I saw a new film the other night at The Academy. A very simple film in which there are good guys and there are bad guys, and the film makes very sure we know which is which. But it seems to me that the film makes the same mistake as the people it criticises -- rather than showing all the facts, it invites us to take somebody else's judgement for our own, which was in part the reason for the catastrophic failure the film portrays.

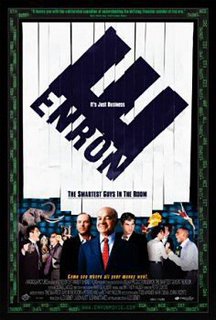

I saw a new film the other night at The Academy. A very simple film in which there are good guys and there are bad guys, and the film makes very sure we know which is which. But it seems to me that the film makes the same mistake as the people it criticises -- rather than showing all the facts, it invites us to take somebody else's judgement for our own, which was in part the reason for the catastrophic failure the film portrays.The film was The Smartest Guys in the Room, portraying the collapse of what was then America's seventh-largest company. The bad guys were not 'baddies' in the usual Saturday matinee fashion of wishing harm on everyone. They were baddies because they had failed to perform a simple human task: they had failed to think about what theywere doing.

I bet they 'brainstormed.' I bet they thought they were 'thinking outside the square.' They sure as hell thought they were 'ahead of the curve,' because they kept telling each other they were. Seemed to me that here was a bunch of people playing at what they thought big shot executives should be like, with all the cliches that go with that. Only problem was, they had no clue what they were doing.

A basic question for every businessman and every investor to keep in the forefront of their mind at all times is this : how are we making money? If they can't answer that, then they shouldn't be in business. Enron's executrives couldn't answer that simple question, and nor, it turned out, could its investors.

Everyone figured that everyone else knew. Turned out no-one did. How are we making money? Somehow! But they weren't, and they didn't even know it. Turned out all of Enron's senior management and all of its backers and investors were complete second-handers who preferred to have others do their thinking for them, and who had all joined the stampede downhill in the hopes that someone else knew what they were doing. They didn't. One simple question asked by a Fortune magazine journalist brought down the whole house of cards: how does Enron actually make money? They didn't know. And they weren't.

The CEOs were not in control at Enron, the traders were, and all the traders were interested in was their own small piece of the action. Without any executive with an overview, Enron was like an engine revving itself to destruction. The billions of borrowings on the back of a huge trading cash flow and a ballooning share price fed the illusion of success, and allowed even more borrowing and an even higher share price. Short-term successes were reified into belief in the success of Enrons's long-term strategy -- except that there was no long-term strategy, just the casting around for the 'next big idea' -- the 'New Economy's' 'new new thing' -- so that like a bunch of dumb old bastards they could hand out backslaps all round and feel like they were all 'ahead of the curve.'

But these people were not dumb by any means. They were clearly highly intelligent, highly ambitious human beings. How had they been so blind? Why had they failed to think? Answer: they had blinded themselves, and they had done it by their bad fundamental ideas. Enron was a house built, not on sand, but on bad philosophy. And as with all bad philosophy that tries to deny or to fake reality, they soon enough found that reality is the ultimate avenger.

These people were complete and utter pragmatists. As philosopher Leonard Peikoff explains, the philosophy of pragmatism can be summed up as the "principle of not being principled":

In the whirling Heraclitean flux which is the pragmatist's universe, there are no absolutes. There are no fact, no fixed laws of logic, no certainty no objectivity. There are no facts, only provisional 'hypotheses' which for the moment facilitate human action. There are no fixed laws of logic, only mutable 'conventions' without any basis in reality...The leitmotif of the pragmatist is short-term thinking, a range-of-the-moment obesssion with the here-and-now that blinds the pragmatist to the longer-term reality. What works now is what concerns the pragmatist, and a fig for the long-term consequences. As Lord Keynes put it on behalf of pragmatists everywhere, "in the long run we're all dead anyway." In the modern world, this is called 'being pragmatic.' Being 'practical.' In the real world it's called making yourself a dumb-arse, and setting yourself up for failure.

At Enron they were nothing if not 'practical' -- they were obsessed with the short-term, and at the real expense of the long-term. Obsession with today's share price; with today's 'strategy'; with screwing California's electricity consumers today, despite the long-term consequences for California and themselves; with whatever seemed to work today, whatever its consequnces for tomorrow . Here at Enron was range-of-the-moment thinking taken to its logical conclusion: selling off the future in favour of the present, just like a farmer chewing up his seed corn and then finding he has nothing to plant next year.

But the future does not stay hostage forever to the present. When the sun does eventually rise tomorrow on the hangover of today, it may be seen that the Emperor is naked. So it was with Enron. The collapse happened quickly, so quickly that many are still trying to work out what went on. Alex Epstein has perhaps the clearest diagnosis:

...to Skilling and other Enron executives, there was no clear distinction between what they felt should succeed, and what the facts indicated would succeed--between reality as they wished it to be and reality as it is. Time and again, Enron executives placed their wishes above the facts. And as they experienced failure after failure, they deluded themselves into believing that any losses would somehow be overcome with massive profits in the future. This mentality led them to eagerly accept CFO Andy Fastow's absurd claims that their losses could be magically taken off the books using Special Purpose Entities; after all, they felt, Enron should have a high stock price. Smaller lies led to bigger lies, until Enron became the biggest corporate failure and fraud in American history. Observe that Enron's problem was not that it was "too concerned" about profit, but that it believed money does not have to be made: it can be had simply by following one's whims. The solution to prevent future Enrons, then, is not to teach (or force) CEOs to curb their profit-seeking; the desire to produce and trade valuable products is the essence of business--and of successful life.Too true. All too true. A lesson all too many in business need to learn.

Instead, we must teach businessmen the profound virtues money-making requires. Above all, we must teach them that one cannot profit by evading facts.

Now, one final point about the film: There are a number of myths about Enron (some of them debunked here), some of which make it into the film. One significant myth that still gets retold is that the California energy market was deregulated. It wasn't. For chapter and verse on that particular myth, I cannot recommend too highly George Reisman's 'California Screaming, Under Government Blows', and Scott Sutton's 'California Power Trips.'

LINKS: The Unlearned Lesson of Enron - 4 Years Later - Alex Epstein (ARI)

Myths about Enron - William Anderson (Mises Institute)

California Screaming, under Government Blows - George Reisman (Mises Institute)

California Power Trips - Scott Sutton (The Free Radical)

TAGS: Films, History-Modern, Philosophy, Economics, Objectivism

5 comments:

OK - I will bite here. I haven't seen the film - I would have liked to, but no one asks me anywhere so I'll wait for the DVD...but I can tell you it is nothing to do with philosophy - when I first read Epstein's essay it read like an ivory tower intellectual's vision of business - and it still does.

Enron was not capitalism, it was greed. Well over 60% of CEO's are morally bankrupt - as in Enron they will do and say whatever is required to keep the SP up there.The traders were the only moral and rational ones in the equation - and interestingly enough Mises, in particular their writer Frank Shostak, and objectivists in general, eschew technical analysis. Maybe that is why most are so poor.

Look out Google shareholders. That is my opinion.

OK, I'll bite back.

You say a) "I can tell you it is nothing to do with philosophy," and b) "Enron was not capitalism, it was greed." So as 'greed' is clearly an ethical judgement, right away you're into philosophy. It's inescapable.

But if it really was greed, and if the long-term share price was truly their concern -- then in that sense, and despite their manifest intelligence, they failed abysmally. The executives ended up poor and in prison, and the SP alost negative. Why did they fail? Well, that's the very question I was answering, weren't I? Answer: the long-term was never 'their thang.' Why not? Read the post again and find out. The answer starts with a 'p.'

"The traders were the only moral and rational ones in the equation..." Oh, we agree on that. But they were left directionless by the lack of a decent compass -- either commercial or moral -- from above.

"Interestingly enough Mises, in particular their writer Frank Shostak, and objectivists in general, eschew technical analysis." I presume you mean the present luminaries at the Mises Institute? And this is relevant because .... ? Eschewing mathematical analysis in economics does not mean one should eschew rational accounting in the field of finance.

Technical analysis is relevant because these people didn't lose their money.

I have been talking to a friend about this and he says:

This stock was in a longterm uptrend, had been for over a decade. EVERYONE made money on it. The only ones who KEPT the money they made were those who sold. So, who sold? Trend-followers who sold when the downtrend began. Those running stoplosses, stopped out after ENE dropped x% from its $90 high. Who was left holding? Those with no plan, no exit strategy. The "Buy and Hold" brigade. Some of these will have held over the course of the entire downtrend while ENE went from $90 to nothing. This was no sudden catastrophic crash. It was a simple, clear downtrend than ran for over a year. There was plenty of warning and plenty of time to get out with some profits intact.

Take a look at this

http://www.thestreet.com/pf/comment/barryritholtz/10250118.html

"Enron's stock gave many signals that it was under "distribution" by large shareholders. You may not have read about it in the paper, but Enron's chart told astute observers that big institutions were quietly unloading millions upon millions of shares."

http://www.turtletrader.com/enron.html

"There was only one key piece of data needed to judge Enron as an investment: the share price"

"Why would anyone hold onto a stock that goes from $90 to 50¢? Even if Enron was the biggest scam ever must we not also take to task the mindless investors who held on down to 50¢ a share? Are they not guilty of something more than simply being lazy?"

Another good take by Gary North, the author of Mises on Money :-

http://www.lewrockwell.com/north/north92.html

"Fund managers should have known something was wrong, just by looking at the chart of Enron's price history."

"The financial press would not believe what the market was telling them. Enron's officials said that what the market was saying had to be wrong, but it was right."

To answer your question "I know many say TA 'predicted' Enron's demise, and traders were well out before the event - I wonder if you agree with that? Did the charts 'predict' it?"

No, the charts didn't predict such a catastrophic on-going slide, but use of the simplest trend-following TA would have got you out of this stock at a good price well before you gave too much of your profit back to the market. Similarly, use of the simplest, crudest stoploss strategy would have saved you. (Just a small point, but this wasn't a sudden "event" - it was an uptrend that ended and became a downtrend, that's all. Happens all the time. As I said above, there was plenty of warning and plenty of time to get out.)

"Read the post again and find out. The answer starts with a 'p.'" Tell me again why libertarian male bloggers are arrogant assholes. Guess you don't REALLY want feedback.

Read the above again - philosophy my ass.

"Tell me again why libertarian male bloggers are arrogant assholes. Guess you don't REALLY want feedback."

...and shes back to philosophy again! ;-)

Ruth, we appear to be talking about different things here.

Post a Comment