The mainstream, “textbook” economics of recent decades is under threat.

to create asset bubbles to fund “growth” during the boom and, once the bubble bursts the growth stops and the pool of real savings has been diminished, to fund the “stimulus” on which politicians and other know-nothings now set their hopes.

Instead of relying on the questionable acumen of a monetary dictator to set interest rates (cue lots of media conversation about how the dictator is feeling this week, and the “semantic nuances” of his carefully chosen words in public), more far-seeing economists are beginning to say the current emperors have no clothes.

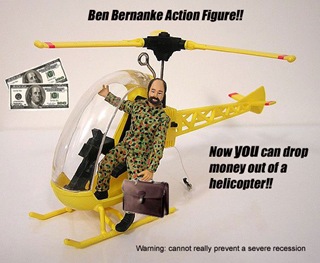

* * The market itself gave the economists a kick in the pants by responding to Bernanke’s openly inflationist cheque book by soaring past $1,400 per troy ounce for the first time.

* * The German Finance Minister helped kick off the head scratching by pouring opprobrium on the acumen of Bernanke and his colleagues (who could not be more mainstream)

“With all due respect, U.S. policy is clueless,” the German Finance Minister Wolfgang Schaeuble told a conference. “(The problem) is not a shortage of liquidity. It’s not that the Americans haven’t pumped enough liquidity into the market, and now to say let’s pump more into the market is not going to solve their problems.”

* * And the Chinese—the Chinese!—told a news briefing at the G20 conference the move “smacked of outmoded central planning.” Which, of course, it does.

* * In the British Parliament, the cradle of modern democracy, two Conservative MPs have introduced a bill to end shut down the spigot of endless credit—every new note of which dilutes the purchasing power of every note in your pocket—and replace the system that produced the boom and bust with a system of honest money and sound banking. Introducing his bill, Douglas Carswell told the parliament:

Since the credit crunch hit us, an endless succession of economists, most of whom did not see it coming, have popped up on our TV screens to explain its causes with great authority. Most have tended to see the lack of credit as the problem, rather than as a symptom. Perhaps we should instead begin to listen to those economists who saw the credit glut that preceded the crash as the problem. The Cobden Centre, the Ludwig von Mises Institute and Huerta de Soto all grasped that the overproduction of bogus candy-floss credit before the crunch gave rise to it. It is time to take seriously their ideas on honest money and sound banking.

The bill is beginning to gather widespread support.

* * Indeed, the bill has been lent support by Britain’s own monetary dictator Mervyn King, the governor of the Bank of England, who told an audience last week it is time to talk about “eliminating fractional reserve banking.”

* * And just yesterday, the head of the World Bank chief Zoellick said the world needs to think seriously about “readopting a modified global gold standard to guide currency movements.” And he’s right, you know, it does. The US Federal Reserve’s insistence on diluting the world’s present “reserve currency” only makes it more urgent to re-adopt that more rational numeraire—the one that underpinned the enormous economic progress of the nineteenth century (not coincidentally, the period which enjoyed the most historically sustained economic progress ever).

So the world’s economists are beginning to turn. They’re beginning to realise their emperors of the last few decades have no clothes, and their their textbook theories so widely held hold no water.

It’s only early days, but as Malcolm Gladwell explains about tipping points, this is how change happens.

Gladwell’s Law of the Few contends that before widespread popularity can be attained, a few key types of people must champion an idea, concept, or product before it can reach the tipping point. Gladwell describes these key types as Connectors, Mavens, and Salesmen. If individuals representing all three of these groups endorse and advocate a new idea, it is much more likely that it will tip into exponential success.

We’re nearly there.

As Ludwig Von Mises, F.A. Hayek, et al. took great pains to explain, what this means is that the seemingly golden age — in reality, a thinly gilded one — during which the first, most favored issuers of cheap credit and artificially boosted equity prices enjoyed almost effortless success, has reached the limit of its ability to postpone the workings of fundamental economic law

And the people who need to are quietly, and not so quietly, realising that over sixty years after John Maynard Keynes died, his gig is finally up, and in the Hayek-Keynes debate (one of the most crucial of the twentieth century) a winner is conclusively being confirmed.

Not before time.

The gold standard was the world standard of the age of capitalism, increasing welfare, liberty, and democracy, both political and economic. In the eyes of the free traders its main eminence was precisely the fact that it was an international standard as required by international trade and the transactions of the international money and capital market. It was the medium of exchange by means of which Western industrialism and Western capital had borne Western civilization into the remotest parts of the earth's surface, everywhere destroying the fetters of age-old prejudices and superstitions, sowing the seeds of new life and new well-being, freeing minds and souls, and creating riches unheard of before. It accompanied the triumphal unprecedented progress of Western liberalism ready to unite all nations into a community of free nations peacefully cooperating with one another.

It is easy to understand why people viewed the gold standard as the symbol of this greatest and most beneficial of all historical changes.

[It is also easy to understand why] all those intent upon sabotaging the evolution toward welfare, peace, freedom, and democracy loathed the gold standard, and not only on account of its economic significance. In their eyes the gold standard was the labarum, the symbol, of all those doctrines and policies they wanted to destroy. In the struggle against the gold standard much more was at stake than commodity prices and foreign exchange rates.

The nationalists [fight] the gold standard because they want to sever their countries from the world market and to establish national autarky as far as possible.

Interventionist governments and pressure groups are fighting the gold standard because they consider it the most serious obstacle to their endeavors to manipulate prices and wage rates.

But the most fanatical attacks against gold are made by those intent upon credit expansion. With them credit expansion is the panacea for all economic ills…. What the expansionists call the defects of the gold standard are indeed its very eminence and usefulness. It checks large-scale inflationary ventures on the part of governments.

The gold standard did not fail. The governments were eager to destroy it, because they were committed to the fallacies that credit expansion is an appropriate means of lowering the rate of interest and of "improving" the balance of trade.

He could have been writing that to Mr Zoellick just yesterday. And Mr Zoellick might very well have been reading it.

12 comments:

Love the Hayek-Keynes video!

PC said...

And the people who need to are quietly, and not so quietly, realising that over sixty years after John Maynard Keynes died, his gig is finally up, and in the Hayek-Keynes debate (one of the most crucial of the twentieth century) a winner is conclusively being confirmed.

Not to the illiterate Labour Party MPs. Look at this comment from Labour MP, Stuart Nash on this blog post of his.

Stuart :

=======

As I have said before, Keynesian economic theory states that in times of economic recession, you don’t give tax cuts to the highest income earners because they will tend to either save or retire debt (i.e. they won’t spend), and this is exactly what has happened.

The man is still stuck in his undergrad economic textbooks. No incentive to upgrade his knowledge and this makes him a moron.

Anon said...

Love the Hayek-Keynes video!

Yes, that's a great vid. At least, PC likes one single rap song.

Thanks Berend and FF for some of those links and stories--and congrats Berend on getting the first comment over at Hickey's on the very point that needed to be made there. Bravo.

Great post Peter. I wonder as the world slowly comes around to acknowledging the only type of economic system that promotes freedom, if they'll also get infected by the philosophy of freedom?

(And NZ has just the dumbest economists in the world I reckon: Kim Jong Hickey seems totally incapable of understanding the constant contradictions he comes out with, and believes economics to be some type of lolly scramble. Pick a bit here a bit there, with the State at the forefront, and a barely concealed loathing of capitalism. How he gets so much air time defeats me.)

"Mangrove appears unaware of what those luminaries cited above have come to realise"

People are inclined to assume that politicians are ignorant, but it seems equally likely to me that they are purposely and maliciously complicit in helping to orchestrate what amounts to large-scale theft from taxpayers. Perhaps they do understand exactly what they are doing, and do it because it helps them and their buddies benefit. David

Has NZ just entered the currency wars where we indicate our intention to join the race to the bottom in terms of what our currency can actually buy?

Seems Dr Bollard has!

Julian

Indeed.

Good characterization of the recent "conversion" of Hickey as well. One wonders when he'll finally come to the truth, but I believe his economics degree is in fact from Massey, the hotbed of NZ communism, so that may be a while.

With a bit of luck there will be more support for a (partial) gold standard, and once that's introduced there's not going be any stopping of that bolting horse, now there is widespread worldwide communication and increased understanding of economics. (As far as one can actually speak of that as a worthwhile discipline).

For NZ the issue is simple, dig, baby dig, get that gold out....

Bez

Massey is the hotbed of communism?

Shit, I've two accountancy degrees from there. I never was struck by that - perhaps only in the economics department (double entry is, after all, pretty a-political).

No, I think that Bernard Hickey is just dumb as stated on this blog many times by other commentators.

Hickey is one of those idiots that this article is talking about, that is , an endless succession of economists, most of whom did not see it coming, have popped up on our TV screens to explain its causes with great authority.

It is a pity that the NZ public listens to dumb idiots like Hickey.

The Labour Party MPs are all illiterate. David Cunliffe is the latest with this blog post.

Currency intervention: Two clips

@FF: Every single nostrum dreamed up by Silent 'T' has been well shot down by everyone he has sought to persuade.

So it would be laughable if not so tragic, that in the face of the worst economic calamity in in eighty years the opposition's finance spokesmen can only scream "for the Govt to get off its butt and use its armies of bureaucrats to get thinking about options."

Which is a frank admission it has no credible options of its own.

Post a Comment