NZ'S TWO MOST POPULAR political parties have leapt into action in the last twenty-four hours in response to the worldwide economic turmoil.

The National Party reconfirmed their pathetic tax cuts based on a decade of government deficits, and also confirmed it will/it won't/it might build "infrastructure" [choose one] paid for from borrowing/not from borrowing/through public-private partnerships [choose one].

And it makes these promises while trumpeting its competence, and whining that Labour hasn't told it what it's doing.

The Labour Party meanwhile has just made the NZ taxpayer, you and I, the guarantor of every banker and every director of nearly every finance company in the country, and of all $150 billion of the deposits on which they earn some pretty impressive commissions. (Oh, and they too want to "bring forward" government spending on "infrastructure," and add lots and lots of "retraining.")

Perhaps it was better when they weren't reacting to the crisis?

Sure, when your neighbouring government promises to "back up" the deposits in its country's banks, you have to do something to stop the inevitable movement from your country's banks -- Germany's Angela Merkel learned that lesson when Ireland started the European rush to backstop depositors in their banks -- but it doesn't change the fact that a short-term promise to backstop deposits itself is utterly unrealistic.

And does being forced into a destructive promise that's impossible to back up alter the fact that it is a destructive error that's impossible to back up.

Just how realistic is the promise can be seen from the amounts involved. How one million taxpayers are going to underwrite a $150 billion contingent liability is a question you just aren't supposed to ask.

The reason they have to make the promise (and John Key has now confirmed it's their "plan" as well) is simple: it's the inherently fragile fractional reserve banking system -- a "leveraged" credit pyramid that balloons rapidly when the small fraction of real reserves increases in value, and plunges just as quickly when the equity base propping it up loses value. The whole fragile system is predicated on important questions about its stability not being asked.

The reason they have to make the promise (and John Key has now confirmed it's their "plan" as well) is simple: it's the inherently fragile fractional reserve banking system -- a "leveraged" credit pyramid that balloons rapidly when the small fraction of real reserves increases in value, and plunges just as quickly when the equity base propping it up loses value. The whole fragile system is predicated on important questions about its stability not being asked.

If you want to know whether your friendly local bank is "sound" then just ask yourself what would happen if every depositor wanted their money out all at once. The answer is: you can't. Modern banks are inherently bankrupt; their promise to pay is based on the assumption that everyone won't turn up at once to ask for their money back.

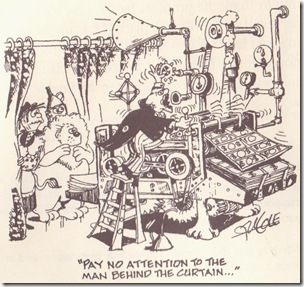

When they do, or they look like they might, then modern banks tend to either fall over like the fraudulent house of cards they are, or they run off to Nanny like a crybaby kid to have their hands stroked and their losses made up by taxpayers. And those few that do act honestly by revaluing their assets and "de-leveraging" the credit pyramid -- the essential prelude to economic recovery -- are punished by Nanny for their diligence by having to watch their less honest colleagues rewarded for failure, and the smoke-and-mirrors concealing the fractional reserve system stay in place to ensure failure on some other day far off in another election cycle altogether.

When they do, or they look like they might, then modern banks tend to either fall over like the fraudulent house of cards they are, or they run off to Nanny like a crybaby kid to have their hands stroked and their losses made up by taxpayers. And those few that do act honestly by revaluing their assets and "de-leveraging" the credit pyramid -- the essential prelude to economic recovery -- are punished by Nanny for their diligence by having to watch their less honest colleagues rewarded for failure, and the smoke-and-mirrors concealing the fractional reserve system stay in place to ensure failure on some other day far off in another election cycle altogether.

NOW, WE HAVEN'T YET SEEN a full "economic plan" from either party to address the crisis -- Labour cunningly promises to deliver one after the election -- National seems to think the mere presence of John Key on the Ninth Floor will automatically cause all stocks to rise and a steak to materialise on every plate -- but the remedies we've seen bandied about are all as destructive as the cause of the crisis, every one of them used by the likes of Hoover and Roosevelt to extend the 1929 correction for another fifteen years.

When markets need to correct, when real savings are being consumed on malinvestments that urgently need to to closed off, then here's what you can do to make sure the necessary correction won't happen:

- Prevent or delay liquidation by propping up shaky businesses and shaky credit positions.

- Further inflate the money supply, creating more malinvestments and delaying the necessary correction.

- Keep wage rates up --or keep money wages constant when prices start falling (which amounts to the same thing) -- which in the face of falling business demand is a sure recipe for unemployment.

- Keep prices up (by means of the likes of green-plated building regulations) or add new costs to struggling businesses (such as the dopey Emissions Tax Scam), delaying the necessary corrections that will make businesses profitable again.

- "Stimulate" demand by spending on "infrastructure" projects just to make it look like the government is doing something -- when what that something actually does is to take money from profitable businesses in order to bid resources away from struggling businesses.

- Discourage saving and investment by increasing government spending (all of which is consumption spending) and maintaining high tax rates.

- Subsidise unemployment with make-work schemes paid out of money from profitable businesses that bid resources away from struggling businesses, delaying the shift of workers to fields where genuine jobs would otherwise be available.

As Murray Rothbard points out in America's Great Depression (from which I draw the above seven points) when you list logically the various ways that government could hamper market adjustments and hobble the adjustment process, you find that you have precisely listed the favourite "anti-depression" arsenal of government policy.

Expect to see them all used here.

UPDATE 1: Bernard Hickey disgracefully called "in March and again last week" for the government to guarantee deposits. As he says today, " I should have been careful what I wished for." This is a scheme with "two big holes to drive trucks through":

Frankfurt School of Finance professor Thorstein Pollett simply explains the importance of "interbank" loans, and why their rapid diminution is a sure sign that confidence is leaving the fiat money system.We now have a scheme that Rod Petricevic could (in theory) use to launch new government-guaranteed finance company to repurchase loans from the receivers for Bridgecorp. It could also be used by Doug Somers-Edgar to fire up the Money Managers empire again. Allan Hawkins could start raising money for his Budget Loans finance company and promise that it was backed by the government.

Yet it may do nothing to solve the fundamental problem facing our major banks — a shortage of wholesale funding between banks. Our banking system could still freeze up in the same way that the European and US systems have and this plan does not stop that.

What I don’t get is… if everything is guaranteed…. will all the rates offered converge? I mean, why should I buy safe NZ government Kiwibonds at 6% if I can get guaranteed deposits at 10% in a finance company? I think everyone will pull their money out of government bonds, out of banks even, and into finance companies. And that just seems entirely backwards, causing the money to move to it’s lowest and worst use.

UPDATE 2: Expect all seven ways of hampering recovery to be used here, I said above. The Standard in all its ignorance not only applauds the use of most of the seven in Labour's "economic plan" -- propping up liquidity, subsidising employment and re-training money, spending on public works -- but delightedly refers to it as

a programme of infrastructure construction, labour up-skilling, and idle capacity utilisation akin to the policies that got the world out of the Great Depression.

Well, no, it's certainly on a smaller scale (at this stage) than anything of the sort done in the depression, but every part of this programme actually made the depression longer by jacking up costs and bidding resources away from where they were most needed.

Readers of The Standard might like to ask themselves why the US, which adopted every single one of the policies above that hamper correction, was one of the last countries out of the depression (not really out until the mid-forties) whereas New Zealand, which actually allowed prices and wages to fall as they needed to, was among the first to emerge from total gloom (by 1935/36 production was nearly back to 1929 levels and next year exceeded it; from its 1933 high of 79,435, about 12%, unemployment had by 1937/38 come back down to 29,899).

NZ still ran public works and make-works programmes however, sucking up resources needed for recovery. In 1932/33 these absorbed 45,000 men, whereas by 1939 the number "employed" was just 77. By contrast, in 1939, one decade after the Wall St crash, Roosevelt's America had virtually the same number unemployed and on relief as they had in 1932, the year Roosevelt was elected.

So much for "policies that got the world out of depression."

6 comments:

Wow...PC said something positive about Murray Rothbard.....must be glitch in the matrix.

If you'd been reading more regularly you'd have seen me say several positive things about Rothbard's economics, in amongst the many negatives about his politics.

You need to check your premises. ;)

As you will see from my IP address, I read almost religiously every day...The subtlety of your differentiation between his politics and economics must have escaped me....and other than your dogmatic dislike for Rothbard, I tend to agree 100% with what you say....In fact, due to your blog, I will now probably vote Libnz rather than not voting at all...

Good man. :-)

PJ, I think that you should vote ACT. ACT's policies are similar to the Libz, but a vote for the Libz is a waste, since they can't make get 1000 people to vote for them in the last election.

Give ACT your party vote.

Rico

A vote for ACT is a waste.

There are plenty of people who voted for them in the last several elections. ACT got seats in parliament and what did they achieve with those? Well, not much change- not much of anything really (although there was some guy who did some dancing and dropped his partner and there was something about losing weight and going swimming and stuff like that- they may have written it up in the Women's Weekly...). Banal and disappointing stuff. No substance. Nothing of principle.

The trouble with your advice to PJ is that if people were to keep voting for the same old BS outfits (with their empty promises, berift of ideas, lacking morality and decent principle), then nothing will alter. Such votes truely are wasted.

Why compromise yourself by voting for a lie? PJ is better off voting for someone who is making a difference- whether in parliament or not. That aint ACT.

LGM

Post a Comment