Specifically, to ignore them and to offer the public a scapegoat.

This is the real point, you see, of the Government-ordered inquiry in petrol pricing: to draw attention from the fact that without excise taxes and GST on petrol, the price would not be the record high of $2.10/litre it is this morning but a highly affordable price of around $1.25/litre. In the words of George Reisman, this will be the guilty interrogating the innocent in order to throw the blame somewhere else.

The reports around the traps this morning and the support for the inquiry from the Automobile Association show that the conjuring trick is working -- the media are too dumb to notice they're being used, and the AA are too keen to curry favour to point out the dishonesty.

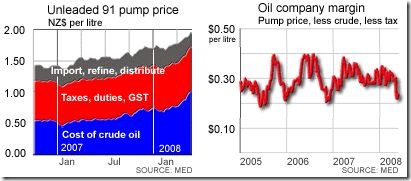

The inquiry has absolutely no other point than to take the focus of the extent of government theft. There is absolutely nothing of any substance an inquiry can achieve. You can compare its theft below, in red, to the margins made by local distributors, in grey, and see for yourself the effect that bullying the local petrol companies could have:

The government takes far more in excise taxes and GST on petrol than the local petrol companies earn for importing, refining and selling the stuff, yet by offering up the spectacle of local oil company executives being harangued by local MPs the government hopes the public will forget the extent that the government is thieving from them, and maintain the illusion that the government is on the side of the motorist.

They know, of course, that can rely on the compliant media and a fawning Automobile Association to back up the lies.

UPDATE 1: Julian summarises the situation, for those of you who Lianne Dalziel hopes haven't kept up. "The reasons that fuel costs are so high are because:

- The cost of crude is high. It is an international commodity. In NZ we are powerless to change that.

- The majority of the local cost is made up of tax. The government can change this - but will not.

- I understand that the return on capital for international oil companies has risen from 22% to 23% - that is an increase of only 1% - since oil was at US$40 a barrel. The costs of refining have risen and they are pouring huge amounts of money into exploration (despite governments trying to prevent them from exploration). The risks they face are enormous and they must be compensated for this.

- Which brings us to the local petrol companies. As the MED graph shows, margins are not high historically speaking. They are powerless in the face of the current environment.

"As you say PC, this is just another exercise in blaming companies - and another attempt to [justify regulating] our lives and business." Don't buy it.

UPDATE 2: The nonsensical idea that international oil prices are being driven up by speculation, and not by basic supply and demand factors, should be given short shrift.I've dealt before with the supply and demand factors, so I won't do that here. Instead, I'll let George Reisman explode the myth that, in the absence of genuine reasons for price movements, 'speculation' is capable of pushing up the price of anything.

Yes, it's true that many investors have been moving into commodities in recent months, but to blame them for the overall rise in prices ignores a number of things (including those supply and demand factors), including the much overlooked fact that in order to gain their profits the speculators or their agents will at some stage have to sell their holdings -- and if the quantities of their purchases are sufficent to shift the market upward (as the braindead say they do), then so too will their sales drive the market down. Explains Reisman:

The fact that speculators must lose in the absence of an independently caused rise in the demand for and price of the commodity in which they speculate is confirmed by the following supply-and-demand diagram.Naturally, this is a problem somewhat helped in the case of oil by the natural tendency of governments to place extensive restrictions on supply.The diagram shows that initially, in the absence of speculators, the price of a commodity is p0, resulting from the demand DD and supply SS. [That is,] the general public buys the entire supply, equal to quantity OA, at the price p0.

Now, speculators appear on the scene, and when their demand is added to that of the general public, the total demand for the commodity rises from DD to D'D'. The result is that the price rises from p0 to p1.

At the higher price, the general public reduces its purchases from the full supply, OA, to the part of the supply represented by OB. The speculators buy up the part of the supply represented by AB. If the speculators bought the quantity AB all at once, they would have to pay a price of p1 for it. In the absence of an increase in demand on the part of the general public, the speculators would then have to sell back their supply at a price of p0, if they sold it back all at once.

The fact that they would probably buy the quantity AB in increments and sell it back in increments changes nothing fundamental, because the purchase and sale of each increment is described by exactly the same analysis.

In addition, there is the further problem of a likely movement of the quantity supplied to somewhere to the right of the line SS, in response to the rise in price.

And just so you know, this is the first, and probably the last, time this blog will play host to a supply-and-demand diagram. It's posted here so all the intelligent Treasury types who read this blog and who do use such diagrams can download it and use it in their submissions to Dalziel's inquiry. (If you want the page reference for your footnotes, you can read the argument in Reisman's book Capitalism, p217-218, and 224-225. You can find a PDF copy of the book online here.)

3 comments:

The reasons that fuel costs are so high are because:

1. The cost of crude is high. It is an international commodity. In NZ we are powerless to change that.

2. As PC says, a majority of the cost is made up of tax. The government can change this - but will not.

3. I understand that the return on capital for international oil companies has risen from 22% to 23% - that is an increase of only 1% - since oil was at US$40 a barrel. The costs of refining have risen and they are pooring huge amounts of money into exploration (despite governments trying to prevent them from exploration). The risks they face are enormous and they must be compensated for this.

4. Which brings us to the local petrol companies. As the MED graph shows, margins are not high historically speaking. They are powerless in the face of the current environment.

As you say PC, this is just another exercise in blaming companies - and another attempt to regulate our lives and business.

Appalling!

Julian

They are doing a similar thing in America, Peter...some idiot Congressman is holding hearings into petrol prices.

However, over there (to find a scapegoat other than the obvious cause being high taxation) they have decided to blame "speculators" (which always plays well with idiots)

Not sure if it's been mentioned already, but someone was reported on National Socialist radio this morning as calling for the oil industry in NZ to be nationalised.

Post a Comment