No, folks, Auckland is no longer unaffordable.

It is now officially a violently, outrageously, horrendously, severely unaffordable city in which to buy a home.

The new 2016 Demographia report, out this morning, confirms that relative to income Auckland is now the fifth-most expensive city on the planet in which to buy a house—or at least, fourth-most expensive out of all the countries and places studied, 367 metropolitan markets in nine countries, which includes many of the places we would have thought would outbid us. Places like London, San Francisco, New York, and even Tokyo … !

The report says Auckland has a house price-wage multiple of 9.7, which is severely unaffordable. Median house prices two to three times median household incomes is regarded as acceptable.

The most affordable major metropolitan markets are in the US, which has a moderately unaffordable rating of 3.7.followed by Japan, with a median multiple of 3.9.

Hong Kong's Median Multiple of 19 is the highest ever recorded in the survey.

Sydney was the second least affordable major market, with a median multiple of 12.2. Sydney’s increase of 2.4 points from its 9.8 median multiple in 2014 is the largest year-to-year deterioration ever indicated.

Vancouver was the third least affordable major market, with a median multiple of 10.8. Auckland, Melbourne and San Jose all had unaffordability multiples of 9.7.

The problems have been well canvassed, and are generational. The problems are not party political, since the problems have grown and festered under the watch of both teams, both Blue and Red, neither of whom wish to puncture the bubble and offend their voters (or would-be voters) who have become paper wealthy, and neither of whom as a consequence propose serious measures to arrest them.

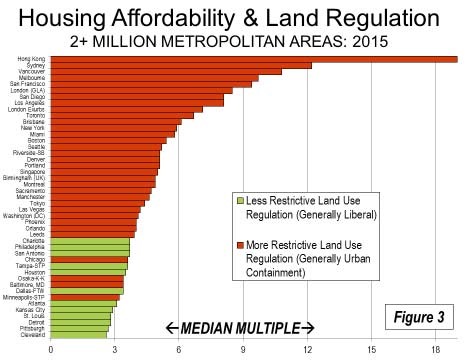

The problem can be simply put: it is due to a planning class being given the power to limit land supply while demand increases as bankers freely lend new mortages into existence at a rate of around 7% more every year—and for year after year after year.

Which means an increasing amount of money chasing housing supply that is struggling to keep up.

No wonder house-price inflation is a thing. A serious thing.

It has killed off spec builders, who once built most of the houses Aucklanders live in – because even as prices have exploded, so have the costs of these builders and all their inputs. Land most of all.

It has favoured wanton and destructive speculation instead of real investment – folk getting rich not by producing more, but simply by selling houses to each other (investing meaning putting money into a productive enterprise to increase production and hence profits; speculating meaning buying an asset in the hope its price will rise*).

It has engendered wanton capital consumption – as folk getting rich on the speculation driven by counterfeit capital turn their real capital into foreign trips, champagne and new en-suites.

And it has encouraged “what me worry” every year as these results are released showing NZ’s major cities (all of them) turning into the most severely unaffordable place in which to buy a house.

The New Zealand housing market as a whole had a median multiple of 5.2, third highest in the world behind Australia and Hong Kong, with six of the eight cities surveyed considered severely unaffordable.

Wellington and Dunedin came in with a house price-wage multiple of 5.2, Christchurch, 6.1, Hamilton, 5.1, Napier-Hastings, 5, and Palmerston North, 4.1.THE WORLD'S LEAST AFFORDABLE CITIES (at least 1 million inhabitants):

1. Hong Kong, China - 19.0

2. Sydney, Australia - 12.2

3. Vancouver, Canada - 10.8

4. Melbourne, Australia - 9.7

4. Auckland , New Zealand - 9.7

4. San Jose, United States - 9.7

7. San Francisco, United States - 9.4

8. London, United Kingdom - 8.5

9. Los Angeles, United States - 8.1

9. San Diego, United States - 8.1

Source: Demographia

* I am grateful to Keith Weiner for the distinction.

UPDATE: So how good are you at spotting a correlation?

No comments:

Post a Comment