A timely guest post by Kel Kelly

[An MP3 audio file of this article, narrated by Keith Hocker, is available for download.]

"A growing economy consists of prices falling, not rising."

"A growing economy consists of prices falling, not rising."

The stock market does not work the way most people think. A commonly-held belief — on Main Street as well as on Wall Street — is that a stock-market boom is the reflection of a progressing economy: as the economy improves, companies make more money, and their stock value rises in accordance with the increase in their intrinsic value. A major assumption underlying this belief is that consumer confidence and consequent consumer spending are drivers of economic growth.

A stock-market bust, on the other hand, is held to result from a drop in consumer and business confidence and spending — due to either inflation, rising oil prices, or high interest rates, etc., or for no real reason at all — that leads to declining business profits and rising unemployment. Whatever the supposed cause, in the common view a weakening economy results in falling company revenues and lower-than-expected future earnings, resulting in falling intrinsic values and falling stock prices.

This understanding of bull and bear markets, while held by academics, investment professionals, and individual investors alike, is technically correct if viewed superficially but because it is based on faulty finance and economic theory, it is substantially misconceived .

Since stock markets can fall — and fall often — to various degrees for numerous reasons (including a decline in the quantity of money and spending), our focus here will be only on why they are able to rise in a sustained fashion over the longer term.

The Fundamental Source of All Rising Prices

For perspective, let's put stock prices aside for a moment and make sure first to understand how aggregate consumer prices rise. In short, overall prices can rise only if the quantity of money in the economy increases faster than the quantity of goods and services. (In economically retrogressing countries, prices can rise when the supply of goods diminishes while the supply of money remains the same, or even rises.)

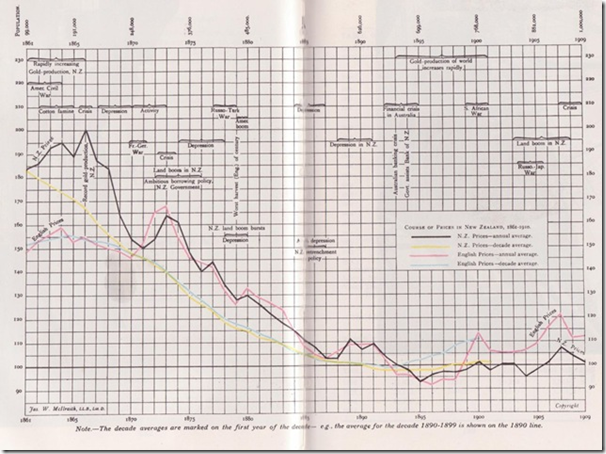

When the supply of goods and services rises faster than the supply of money — as happened during most of the 1800s — the unit price of each good or service falls, since a given supply of money has to buy, or "cover," an increasing supply of goods or services.

Fig 1: NZ & British Price Level, 1860-1910

George Reisman derives the critical formula for the formation of economy-wide prices:1 In this formula, price (P) is determined by monetary demand (D) divided by supply of goods and services (S):

P=D/S

The formula shows us that it is mathematically impossible for aggregate prices to rise by any means other than (1) increasing demand, or (2) decreasing supply; i.e., by either more money being spent to buy goods, or fewer goods being sold in the economy.

In our developed economy, the supply of goods is not decreasing, or at least not at enough of a pace to raise prices at the usual rate of 3–4 percent per year; instead prices are rising due to more money entering the marketplace.

The same price formula noted above can equally be applied to asset prices — stocks, bonds, commodities, houses, oil, fine art, etc. It also pertains to corporate revenues and profits, for as Fritz Machlup states:

It is impossible for the profits of all or of the majority of enterprises to rise without an increase in the effective monetary circulation (through the creation of new credit or dishoarding).2

To return to our focus on the stock market in particular, it should be seen now that the market cannot continually rise on a sustained basis without an increase in money — specifically bank credit — flowing into it.

For example, an increase in net savings involving less money spent on consumer goods and more invested in the stock market (resulting in lower prices of consumer goods) could send stock prices higher, but only by the specific extent of the new savings, assuming all of it is redirected to the stock market.

The same applies to reduced tax rates. These would be temporary effects resulting in a finite and terminal increase in stock prices. Money coming off the "sidelines" could also lift the market, but once all sideline money was inserted into the market, there would be no more funds with which to bid prices higher. The only source of ongoing fuel that could propel the market — any asset market — higher is new and additional bank credit. As Machlup writes,

If it were not for the elasticity of bank credit … [then] a boom in security values could not last for any length of time. In the absence of inflationary credit, the funds available for lending to the public for security purchases would soon be exhausted, since even a large supply is ultimately limited. The supply of funds derived solely from current new savings and current amortisation allowances is fairly inelastic.… Only if the credit organisation of the banks (by means of inflationary credit), or large-scale dishoarding by the public make the supply of loanable funds highly elastic, can a lasting boom develop.… A rise on the securities market cannot last any length of time unless the public is both willing and able to make increased purchases.3 (Emphasis added.)

The last line in the quote helps to reveal that neither population growth nor consumer sentiment alone can drive stock prices higher. Whatever the population, it is using a finite quantity of money; whatever the sentiment, it must be accompanied by the public's ability to add additional funds to the market in order to drive it higher.4

Understanding that the flow of recently created money is the driving force of rising asset markets has numerous implications. The rest of this article addresses some of these implications.

The Link between the Economy and the Stock Market

The primary link between the stock market and the economy — in the aggregate — is that an increase in money and credit pushes up both GDP and the stock market simultaneously.

A progressing economy is one in which more goods are being produced over time. It is real "stuff," not money per se, which represents real wealth. The more cars, refrigerators, food, clothes, medicines, and hammocks we have, the better off our lives. We saw above that if more goods are produced at a faster rate than money then prices will fall. With a constant supply of money, wages would remain the same in money terms while prices fell, because the supply of goods would increase while the supply of workers would not—meaning higher real wages. But even when prices rise due to money being created faster than goods, prices still fall in real terms, because wages rise faster than prices. In either scenario,

This is what rising prosperity looks like.

Obviously, then, a growing economy consists of prices falling, not rising. No matter how many goods are produced, if the quantity of money remains constant then the only money that can be spent in an economy is the particular amount of money existing in it (and velocity, or the number of times each dollar is spent, could not change very much if the money supply remained unchanged).

"Consider that if our rate of inflation were high enough, used cars would rise in price just like new cars, only at a slower rate."

The same concept would apply to the stock market: if there were a constant amount of money in the economy, the sum total of all shares of all stocks taken together (or a stock index) could not increase. Plus, if company profits, in the aggregate, were not increasing, there would be no aggregate increase in earnings per share to be imputed into stock prices.

Under these circumstances, ‘capital gains’ from speculation (the profiting from the buying low and selling high of assets) could be made only by stock picking — by investing in companies that are expanding market share, bringing to market new products, etc., thus truly gaining proportionately more revenues and profits at the expense of those companies that are less innovative and efficient.

The stock prices of the gaining companies would rise while others fell. Since the average stock would not actually increase in value, most of the gains made by investors from stocks would be in the form of dividend payments. By contrast, in our world today, most stocks — good and bad ones — rise during inflationary bull markets and decline during bear markets. The good companies simply rise faster than the bad.

Similarly, housing prices under static money would actually fall slowly — unless their value was significantly increased by renovations and remodelling. Older houses would sell for much less than newer houses. To put this in perspective, consider that if our rate of inflation were high enough, used cars would rise in price just like new cars, only at a slower rate — but just about everything would increase in price, as it does in countries with hyperinflation. The amount by which a home "increases in value" over 30 years really just represents the amount of purchasing power that the dollars we hold have lost: while the dollars lost purchasing power, the house — and other assets more limited in supply growth — kept its purchasing power.

Since we have seen that neither the stock market nor GDP can rise on a sustained basis without more money pushing them higher, we can now clearly understand that an improving economy neither consists of an increasing GDP nor does it cause the overall stock market to rise.

This is not to say that a link does not exist between the money that particular companies earn and their value on the stock exchange in our inflationary world today, but that the parameters of that link — valuation relationships such as earnings ratios and stock-market capitalization as a percent of GDP — are rather flexible, and as we will see below, change over time. Money sometimes flows more into stocks and at other times more into the underlying companies, changing the balance of the valuation relationships.

Forced Investing

As we have seen, the whole concept of rising asset prices and stock investments constantly increasing in value is an economic illusion. What we are really seeing is our currency being devalued by the addition of new currency issued by the central bank. The prices of stocks, houses, gold, etc., do not really rise; they merely do better at keeping their value than do paper bills and digital checking accounts, since their supply is not increasing as fast as are paper bills and digital checking accounts.

"An improving economy neither consists of an increasing GDP nor does it cause the

The fact that we have to save so much for the future is, in fact, an outrage. Were no money printed by the government and the banks, things would get cheaper through time, and we would not need much money for retirement, because it would cost much less to live each day then than it does now. But we are forced to invest in today's government-manipulated inflation-creation world in order to try to keep our purchasing power constant.

The whole system of inflation is solely for the purpose of theft and wealth redistribution. In a world absent of government printing presses and wealth taxes, the armies of investment advisors, pension-fund administrators, estate planners, lawyers, and accountants associated with helping us plan for the future would mostly not exist. These people would instead be employed in other industries producing goods and services that would truly increase our standards of living.

The Fundamentals are Not the Fundamentals

If it is, then, primarily newly-printed money flowing into and pushing up the prices of stocks and other assets, what real importance do the so-called fundamentals — revenues, earnings, cash flow, etc. — have? In the case of the fundamentals, too, it is newly printed money from the central bank, for the most part, that impacts these variables in the aggregate: the financial fundamentals are determined to a large degree by economic changes.

For example, revenues and, particularly, profits, rise and fall with the ebb and flow of money and spending that arises from central-bank credit creation. When the government creates new money and inserts it into the economy, the new money increases sales revenues of companies before it increases their costs; when sales revenues rise faster than costs, profit margins increase.

Specifically, how this comes about is that new money, created electronically by the government and loaned out through banks, is spent by borrowing companies.7 Their expenditures show up as new and additional sales revenues for businesses. But much of the corresponding costs associated with the new revenues lags behind in time because of technical accounting procedures, such as the spreading of asset costs across the useful life of the asset (depreciation) and the postponing of recognition of inventory costs until the product is sold (cost of goods sold). These practices delay the recognition of costs on the profit-and-loss statements (i.e., income statements).

"With more money being created through time, the amount of revenues is always greater than the amount of costs, since most costs are incurred when there is less money existing."

Another way of looking at it is that, with more money being created through time, the amount of revenues is always greater than the amount of costs, since most costs are incurred when there is less money existing. Thus, because of inflation, the total monetary value of business costs in a given time frame is smaller than the total monetary value of the corresponding business revenues. Were there no inflation, costs would more closely equal revenues, even if their recognition were delayed.

In summary, credit expansion increases the spreads between revenue and costs, increasing profit margins. The tremendous amount of money created in 2008 and 2009 is what is responsible for the fantastic profits companies are currently reporting (even though the amount of money loaned out was small, relative to the increase in the monetary base).

A final example of money affecting the fundamentals is interest rates. It is said that when interest rates fall, the common method of discounting future expected cash flows with market interest rates means that the stock market should rise, since future earnings should be valued more highly. This is true both logically and mathematically. But, in the aggregate, if there is no more money with which to bid up stock prices, it is difficult for prices to rise, unless the interest rate declined due to an increase in savings rates.

In reality, the help needed to lift the market comes from the fact that when interest rates are lowered, it is by way of the central bank creating new money that hits the loanable-funds markets. This increases the supply of loanable funds and thus lowers rates. It is this new money being inserted into the market that then helps propel it higher.

(I would personally argue that most of the discounting of future values [PV calculations] demonstrated in finance textbooks and undertaken on Wall Street are misconceived as well. In a world of a constant money supply and falling prices, the future monetary value of the income of the average company would be about the same as the present value. Future values would hardly need to be discounted for time preference [and mathematically, it would not make sense], since lower consumer prices in the future would address this. Though investment analysts believe they should discount future values, I believe that they should not. What they should instead be discounting is earnings inflation and asset inflation, each of which grows at different paces.)9

Asset Inflation versus Consumer Price Inflation

Newly-printed money can affect asset prices more than consumer prices. Most people think that the Federal Reserve and other central banks have done a good job of preventing inflation over the last twenty-plus years. The reality is that it has created a tremendous amount of money, but that the money has disproportionately flowed into financial markets instead of into the real economy, where it would have otherwise created drastically more price inflation.

a diversification of the credit process has shifted the centre of gravity away from conventional bank lending. The ascendancy of financial markets and the proliferation of domestic credit channels outside the [traditional] monetary system have greatly diminished the linkages between … credit expansion and price inflation in the large western economies. The impressive reduction of inflation is a dangerous illusion; it has been obtained largely by substituting one set of serious problems for another.11

And, as bond-fund guru Bill Gross said,

what now appears to be confirmed as a housing bubble, was substantially inflated by nearly $1 trillion of annual reserve flowing back into US Treasury and mortgage markets at subsidised yields.… This foreign repatriation produced artificially low yields.… There is likely near unanimity that it is now responsible for pumping nearly $800 billion of cash flow into our bond and equity markets annually.12

This insight into the explanation for a lack of price inflation in recent decades should also show that the massive amount of reserves the Fed created in 2008 and 2009 — in response to the recession — might not lead to quite the wild consumer-price inflation everyone expects when it eventually leaves the banking system but instead to wild asset price inflation.

That also means that more money — relative to the size of the economy — "leaks" out into asset prices than used to be the case. The result is not only exploding asset prices in the United States, such as the NASDAQ and housing-market bubbles but also in other countries throughout the world, as new money makes its way into asset markets of foreign countries.13

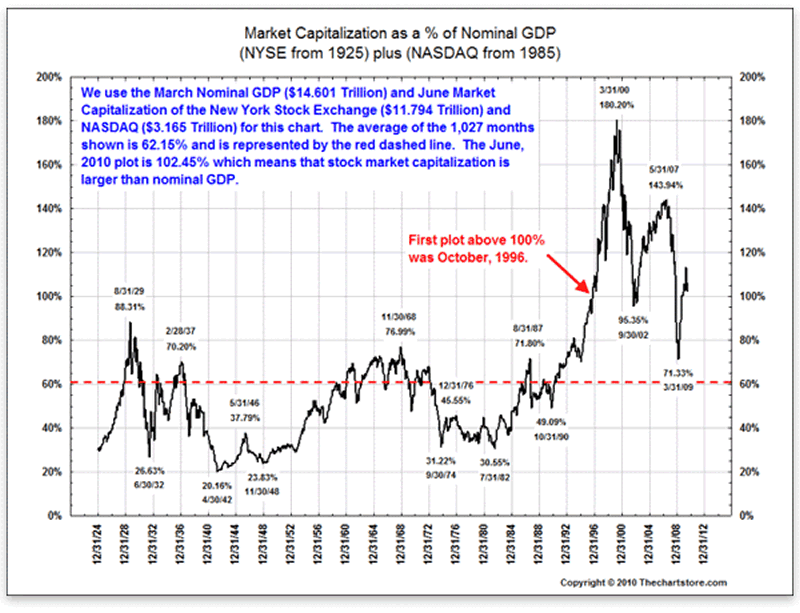

A second effect of more new money being channelled into asset prices is, as hinted above, that it results in the traditional range of stock valuations moving to a higher level. For example, the ratio of stock prices to stock earnings (P/E ratio) now averages about 20, whereas it used to average 10–15. It now bottoms out at a level of 12–16 instead of the historical 5. A similar elevated state applies to Tobin's Q, a measure of the market value of a company's stock relative to its book value. But the change in relative flow of new money to asset prices in recent years is perhaps best seen in the chart below, which shows the stunning increase in total stock-market capitalisation as a percentage of GDP (figure 1).

Figure 2: The Size of the Stock Market Relative to GDP

Figure 2: The Size of the Stock Market Relative to GDP

Source: Thechartstore.com

The changes in these valuation indicators I have shown above reveal that the fundamental links between company earnings and their stock-market valuation can be altered merely by money flows originating from the central bank.

Can Government Spending Revive the Stock Market and the Economy?

So, can government spending revive the stock market and the economy then? The answer is yes and no. Government spending does not restore any real demand, only nominal monetary demand. Monetary demand is completely unrelated to the real economy, i.e., to real production, the creation of goods and services, the rise in real wages, and the ability to consume real things — as opposed to a calculated GDP number.

Government spending harms the economy and forestalls its healing. The thought that stimulus spending, i.e., taking money from the productive sector (a de-accumulation of capital) and using it to consume existing consumer goods or using it to direct capital goods toward unprofitable uses (consuming existing capital), could in turn create new net real wealth — real goods and services — is preposterous.

Given that government spending cannot help the real economy, can it help the specific indicator called GDP? Yes it can. Since GDP is mostly a measure of inflation, if banks are willing to lend and borrowers are willing to borrow, then the newly created money that the government is spending will make its way through the economy. As banks lend the new money once they receive it, the money multiplier will kick in and the money supply will increase, which will raise GDP.

"What is most needed during recessions is for the economy to be allowed to get worse — for it to flush out the excesses and reset itself on firm footing."

As for the idea that government spending helps the stock market, the analysis is a bit more complicated. Government spending per se cannot help the stock market, since little, if any, of the money spent will find its way into financial markets. But the creation of money that occurs when the central bank (indirectly) purchases new government debt can certainly raise the stock market. If new money created by the central bank is loaned out through banks, much of it will end up in the stock market and other financial markets, pushing prices higher.

Summary

The most important economic and financial indicator in today's inflationary world is money supply. Trying to anticipate stock-market and GDP movements by analysing traditional economic and financial indicators can lead to incorrect forecasts. To rely on these "fundamentals" is to largely ignore the specific economic forces that most significantly affect those same fundamentals — most notably the changes in the money supply. Therefore, following monetary indicators would be the best insight into future stock prices and GDP growth.

Kel Kelly has spent over 15 years as a Wall Street trader, a corporate finance analyst, and a research director for a Fortune 500 management consulting firm. Results of his financial analyses have been presented on CNBC Europe and in the online editions of CNN,Forbes, BusinessWeek, and the Wall Street Journal. He is the author of The Case for Legalizing Capitalism. Kel holds a degree in economics from the University of Tennessee, an MBA from the University of Hartford, and an MS in economics from Florida State University. He lives in Atlanta.

Kel Kelly has spent over 15 years as a Wall Street trader, a corporate finance analyst, and a research director for a Fortune 500 management consulting firm. Results of his financial analyses have been presented on CNBC Europe and in the online editions of CNN,Forbes, BusinessWeek, and the Wall Street Journal. He is the author of The Case for Legalizing Capitalism. Kel holds a degree in economics from the University of Tennessee, an MBA from the University of Hartford, and an MS in economics from Florida State University. He lives in Atlanta.

A version of this 2010 article first appeared at the Mises Daily

NOTES

1.See G. Reisman, Capitalism: A Treatise on Economics (1996), p.897, for a fuller demonstration. Most of the insights in this paper are derived from the high-level principles laid out by Reisman. For additional related insights on this topic, see Reisman, "The Stock Market, Profits, and Credit Expansion," "The Anatomy of Deflation," and "Monetary Reform."

2.F. Machlup, The Stock Market, Credit, and Capital Formation (1940), p. 90.

3.Ibid., pp. 92, 78.

4.For a holistic view in simple mathematical terms of how the price of all items in an economy may or may not rise, depending on the quantity of money, see K. Kelly, The Case for Legalizing Capitalism (2010), pp 132–133.

5.Price increases are supposedly adjusted for, but "deflators" don't fully deflate. Proof of this is the very fact that even though rising prices have allegedly been accounted for by a price deflator, prices still rise (real GDP still increases). Without an increase in the quantity of money, such a rise would be mathematically impossible.

6.To gain an understanding of earning interest (dividends in this case) while prices fall, see Thorsten Polleit's "Free Money Against 'Inflation Bias'."

7.Most funds are borrowed from banks for the purpose of business investment; only a small amount is borrowed for the purpose of consumption. Even borrowing for long-term consumer consumption, such as for housing or automobiles, is a minority of total borrowing from banks.

8.The other main reason for this, if the country is poor, is the fact that there is a lack of capital: the more capital, the lower the rate of profit will be, and vice versa (though it can never go to zero).

9.Any reader who is interested in exploring and poking holes in this theory with me should feel free to contact me to discuss.

10.This recycling is what Mises's friend, the French economist Jacques Reuff, called "a childish game in which, after each round, winners return their marbles to the losers" (as cited by Richard Duncan, The Dollar Crisis (2003), p. 23).

11.P. Warburton, Debt and Delusion: Central Bank Follies that Threaten Economic Disaster (2005), p. 35.

12.[12] William H. Gross, "100 Bottles of Beer on the Wall."

13.It's not actually American dollars (both paper bills and bank accounts) that make their way around the world, as most dollars must remain in the United States. But for most dollars received by foreign exporters, foreign central banks create additional local currency in order to maintain exchange rates. This new foreign currency — along with more whose creation stems from "coordinated" monetary policies between countries — pushes up asset prices in foreign countries in unison with domestic asset prices.

No comments:

Post a Comment