I always enjoy reading Rodney Dickens eviscerating the foolishness of economic forecasters,1 and by extension of the fools who buy them and lap them up – both in business and in the media.

His latest report on the forecasters is as entertaining as always. He calls it an Economic Literacy Report. My favourite two sections are the first two, which:

- Expose the consistent failure of the economic forecasters to provide reliable advance warnings of

upturns and downturns in economic growth, residential building, interest rates and the NZD. - Review the track record of the mainstream economic forecasters.

Let’s start with a one-word evaluation of their track record: appalling. When it comes to forecasts, these folk – and you hear them all the time in the media, talking their book – couldn’t hit a barn door with a bowling ball.

Rodney looks at the record of ten forecasters, all of whom sell their shit for big money, on their forecasts for exchange rates, interest rates, GDP growth, consumer spending and residential building activity, all of which clients paying good money for their forecasts would hope would be somewhere in the ballpark, but all of which they persistently get wrong.

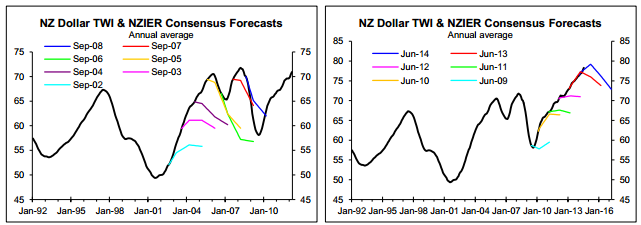

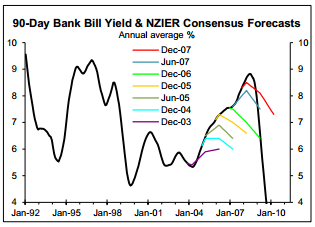

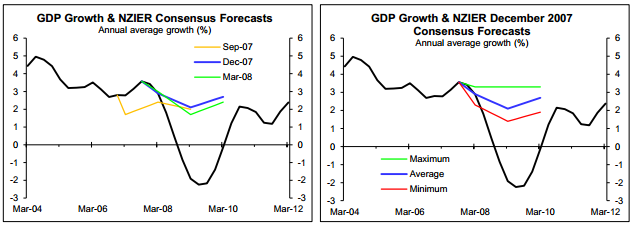

Not just wrong, but dramatically wrong. The black lines in these charts show the actual outcomes; the coloured lines flying in directions unrelated the black lines indicate the “predictions” of the forecasters. I pick out some of the more delightful…

Rodney then rates them on their ability to spot the sort of major event that those buying these forecasts might need to know, such as the 2008 recession, and (what he calls) the 2010 mini-recession. How many of them spotted that? Can you hear the crickets?

Even the most pessimistic of the forecasters surveyed by NZIER in December 2007 predicted 1.4% GDP growth for 2008/09 (red line, right chart). None predicted a recession…

The [2010 mini-recession] recession started before the first major Canterbury earthquake in September… In June 2010, just before the recession was about to start the Reserve Bank predicted that annual GDP growth would remain at over 3% (the blue line, below), which was only slightly lower than what it had predicted in March (the green line)…

The Reserve Bank was one of the 10 forecasters NZIER surveyed in June 2010 as part of a regular

quarterly survey… The blue line in the left chart below shows the March 2010 average or consensus GDP

growth predictions for the 2010/11 and 2011/12 March years. In March 2010 the economic forecasters

were on average predicting that annual average growth would remain a bit above 3%, which they were also predicting in June 2010 (the green line). Even by September 2010, after the mini-recession had started,

the economic forecasters were on average predicting around 3% growth (the orange line, which includes

the predictions for the 2012/13 March year).

Sure, there are times when the economic crystal ball gazers get it right by chance. But you could do that too, and by the same methodology:

By consistently predicting that economic growth will head to around 2.5-3% the economic forecasters will

get it right from time-to-time by chance. For example, prior to the slowdown in economic growth in 2005 the economic forecasters persisted in predicting that growth would slow and eventually they were roughly right. Similarly, by consistently predicting that economic growth would rebound to around 3% after the crisis the economic forecasters eventually got it roughly right.

But this is hardly worth boasting about, and reveals more about the models than their ability: it reveals that, as with global warming models, the expected outcomes are essentially baked into their models.

Now, you might object about now that using the 'average' of the forecasters’ prediction hides those few forecasters who've been successful. But that hypothesis is tested as well, the chart series showing both averages and (as some above do) maxima and minima.

So that hypothesis can be abandoned too.

Now, these charts are hardly a compelling argument for the efficacy of economic forecasting. Of course, Rodney is himself a forecaster -- he has his own methodology radically to that sold by the munters he measures -- but he's at least aware that the public, that is, you, need to be aware not to take forecasters' predictions as gospel.

Why are they so wrong so often?

Now, it’s true as economist Ludwig Von Mises say that “historians and statisticians content themselves with prices of the past,” while “practical man looks at the prices of the future”--and that econometricians pretend to use the prices of the past to predict the prices and conditions of the future. But the fact they can’t, and never can, just reinforces the crucial role of entrepreneurs in driving economic activity: in taking risks on the future with their own money based on their own individual estimations of the future.

It’s not blind crystal-ball readers who move the world, it’s entrepreneurs. And most econometricians wouldn’t even know how to spell the word.

Unlike politicians and central planners, who do take these forecasts as gospel (and central bankers, who think they write the gospel), entrepreneurs who actually act on the basis of forward projections rely in the main not on forecasts like these, but largely on their own independent judgement of what the future holds-- and it's them after all who actually move the economy and drive production.

Entrepreneurs will certainly listen to forecasters, and they definitely don't mind forecasts being taken seriously by the easily led, since it sets up opportunities to take advantage of their poor estimates. ( What entrepreneurs are often looking for is, as Israel Kirzner explains, "unexploited opportunities for reallocating resources from [low-valued] use to another of higher value [which] offers the opportunity of pure entrepreneurial gain. A misallocation of resources occurs because, so far, market participants have not noticed the price discrepancy involved. This price discrepancy presents itself as an opportunity to be exploited by its discoverer. The most impressive aspect of the market system is the tendency for such opportunities to be discovered.")

Entrepreneurs themselves generally recognise the truth stated by Ludwig von Mises, "that the main task of action is to provide for the events of an uncertain future." If, for example, the date of booms and busts and the like could be predicted "with apodictic certainty" according to some formula or other, then everyone would act at the same time to make it so.

In fact, reasonable businessmen are fully aware of the uncertainty of the future. They realize that the economists do not dispense any reliable information about things to come and that all they provide is interpretation of statistical data from the past...

If it were possible to calculate the future state of the market, the future would not be uncertain. There would be neither entrepreneurial loss nor profit. What people expect from the economists is beyond the power of any mortal man.

The greatest danger of 'the forecasting delusion' is the illusion that "the future is predictable, that some formula could be substituted for the specific understanding which is the essence of entrepreneurial activity, and that familiarity with these formulas could make it possible for [bureaucratic management] to take over the conduct of business."

The fact that the term 'speculator' is today used only with an opprobrious connotation clearly shows that our contemporaries do not even suspect in what the fundamental problem of action consists.

Entrepreneurial judgment cannot be bought on the market. The entrepreneurial idea that carries on and brings profit is precisely that idea which did not occur to the majority. It is not correct foresight as such that yields profits, but foresight better than that of the rest.

If you’re relying only on foresight better than that of those who rely on forecasts, that leaves anyone with only half a brain ample opportunity.

1. I hasten to point out that this is my own estimation. Rodney himself has his own forecasting methodology.

No comments:

Post a Comment