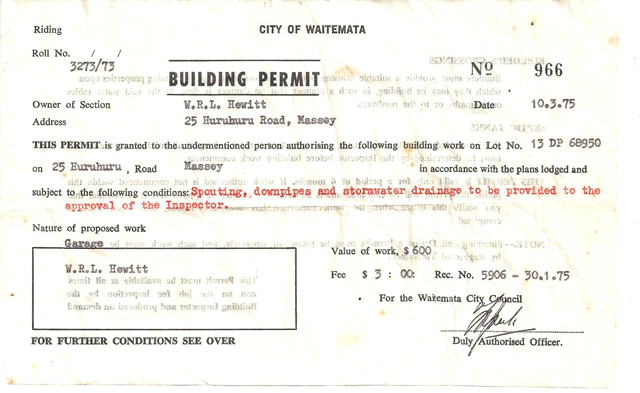

See that bit of paper above? That’s a building permit from 1975.

Cost of the permit: $3.

That is not a misprint. The cost of the building permit in 1975 was three dollars. (That’s thirty dollars in today’s devalued money.)

The most recent permit I received from council cost my clients nearly ten thousand dollars. That, too, is not a misprint. A ten with three zeroes. Sure, it was for more than just a garage, but this might suggest to you one of the reasons house prices are way higher now in terms of what you and I earn than they were in 1975.

Think about it. Could it be that the cost of producing them has been made way higher?

Speculators are always blamed for rising prices. But they’re just a convenient scapegoat. In the absence of other reasons for rising prices, how would speculators gain? If their own purchases are enough to move the market up, then so too would their sales.

Investors in Auckland housing are one of the latest scapegoats, but as president of the Auckland Property Investors' Association Andrew Bruce argues,

Faced with purchasing a property, investors are driven by our own sets of financial criteria whereas home-buyers are more likely to be governed by emotions.

After all, investors are acutely aware that a high purchase price will only have a negative impact on the net return.

What then is the incentive for investors to drive up home prices?

The obvious response, of course, is “capital gain.” But with mortgage payments well above rental returns on most properties (and the higher yielding parts of Auckland offering little in the way of capital gain) that takes some while to pay off, even if the gain is sufficient to outweigh years of payments.

Agree with him or not, he makes a strong argument that one of the main reasons for rising house prices is the rocketing cost to produce houses. And he points to one main culprit: “the skyrocketing cost of doing business with council.” He has examples too:

An APIA member recently completed a basic one lot subdivision of his rental property within the Auckland region.

The project started in July 2012 and took a year to complete, this was after extensive delays throughout the process.

While the actual physical work involved (i.e. installation of the underground infrastructure) took only three weeks, the paperwork took 49.

Most New Zealanders who’ve had dealings with councils will echo that story: long delays that benefit nobody but council employees. And the added cost is significant, adding around 20% to the cost of completing that subdivision.

Another member who has built numerous minor dwelling units throughout Auckland over the past 13 years has also felt the price-pinch.

Back in 2003 he intimated to me that obtaining a consent for a minor dwelling unit cost $2,000.

Recently he received approval for a similar consent which cost $42,000.

This is the equivalent of a 2,000 per cent increase in price over 11 years.

Included in the $2,000 council fee back in 2003 was a $684 charge for a water meter.

Today the price for a water meter and connection from WaterCare is a minimum of $12,770 which is a 1,767 per cent increase over 11 years

The cost increases described above only account for direct council costs.

One must also anticipate the significant pecuniary burden associated with time delays and uncertainties which in many cases spell the demise of a project before it even starts.

For a building project to be economically viable and therefore be green-lighted by financiers, investors, and developers, these costs have to be justified by the final sale

price.

No wonder then that, even with rising house prices the model of speculative building is broken. The model of speculative building is broken not because of investors pushing up the sale price of houses, but because the cost of of producing land and houses is going through the roof.

That won’t be cured until it’s possible once again for builders to buy an inexpensive piece of land, and build and sell at a profit an inexpensive home on it. In other words, not until the model for speculative building is fixed.

If Paul Bennett wants to get rid of loopy rules, if her wish to get rid of them is not just an electioneering gimmick, then let her start there: with all the things that get in the way of that small builder making a profit from a small house.

It could be the best thing she ever did to help New Zealanders.

UPDATE: Rodney Dickens’s latest housing report gives some indication that the hurdles in Auckland are greater than elsewhere – despite the greater demand for Auckland housing, since 1995 supply has been increasing at a rate well below the national average.

Could Auckland learn something from Otago’s councils?

2 comments:

Just for the renovation of our holiday house in Sounds, the cost of consents, plus cost of all engineering & draughting we had done *to get* the consents, came in at $20,000. Left alone with our very competent builder, and his history of well constructed buildings, we would probably have done about $3,000 - $5,000 of engineering work to ensure site was 'safe' (steep hillside), and to design the steel portals around big windows. We received no value at all from the difference, and are not one bit safer for it.

Another under-reported tax is the supply monopoly that Fletchers and others have won for themselves. For example, plumbers have to get taps etc. at multiples of the price of other similar quality ones simply to comply with the consent circle-jerk.

J Cuttance

Post a Comment