I’ve been interested at all this talk of rising house prices—houses, in our little economy, being one of the main reasons for which New Zealanders borrow money.

Or to put it another way, one of the main reasons for which debt is created.

In our system—and in most of the western world—the way new money comes into the system is by means of this new debt; debt organised into currency. An elastic currency:

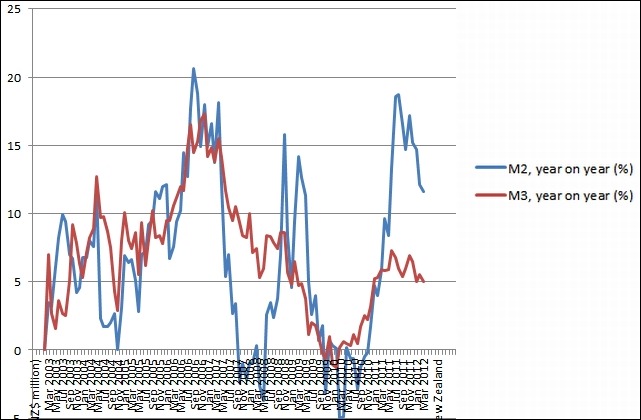

And in New Zealand in recent years, new debt has been coming into the system at an increasing rate in recent years—almost at the pace it was coming in during the 2003-2007 boom. Which is to say, the year-on-year growth in our elastic currency is taking off again:

Growth in M2 and M3 Money Supply, 2003 to March 2012. Source: Reserve Bank: C1, Monetary Aggregates

So no wonder folk expect house prices to keep growing at the rate they were then.

Or to put it another way, no wonder some folks expect to see anther unsustainable “boom” in the housing market. And few, if any, affordable homes for a very long while.

It’s worth noting there is no social benefit whatsoever from attempting to accelerate economic growth by inflating the currency. Never has been; never will be:

The alleged benefit is that monetary inflation through credit expansion builds up the capital structure of the economy more fully than otherwise. Monetary inflation and credit expansion generate the boom-bust cycle, however, not economic growth…

PS: It’s not an ideal graph by which to compare the year-on-year increase in money supply with the year-on-year increase in house prices, but the match between the two over the last decade (with a slight time lag to allow the money to flow from the money spigots into the market and do its inflationary work) is unmistakable.

PPS: Yes folks, this is what inflation always looks like. In fact, this is what inflation is: the organisation of new debt into new currency put into new buyers hands for new purchases--as this study of American inflation across the whole of the last century fairly clearly demonstrates:

Source, http://www.nowandfutures.com/

You want to slow down (house price) inflation? Then slow down the creation of new money.

No comments:

Post a Comment