"Inflation highest in eighteen years," wails Bernard Hickey and many others, but I'm choosing Hickey to complain about simply because he had the nicest graph. See:

"Inflation highest in eighteen years," wails Bernard Hickey and many others, but I'm choosing Hickey to complain about simply because he had the nicest graph. See:

"Frightening," huh?

So what have I got to complain about? Well, despite Hickey's many virtues, he and his mainstream colleagues still don't have their head around what inflation actually is. It's not inflation of prices, stupid, it's the injection of currency or credit into an economy by government. In other words, it's inflation of the money supply.

They're not aware at all of the difference -- the crucial difference between a symptom and its cause -- between the price inflation over which they wring their hands in displeasure, and the monetary inflation* which cause prices to be higher than what they would be otherwise.

Which means they don't even know that monetary inflation exists, or is the real problem. Which means they have no idea that the fundamental cause of the world financial crisis (on which they now comment as if with some expertise) was the rampant monetary inflation and artificial credit expansion. Which means they have no conception that low general price increases in recent years (as measured by the CPI) have obscured the large monetary inflation to which we've been subjected, and are due to real increases in productivity (due in large part to the internet revolution) and the flood of cheaper electronics and ever-cheaper Chinese goods which the monetary inflation has left us unable to enjoy properly.

It was these "deflationary" influences that allowed the rampant monetary inflation of recent years to go unnoticed by all the pundits, even as the huge and destructive credit expansion it represents was out there doing its damage in the wild -- under cover of a phony bureaucratic "price stability" (as I explain here). Instead of enjoying the fruits of these good things, they've instead allowed governments and their central bankers to distort the whole price system and rort the free market on which we all depend.

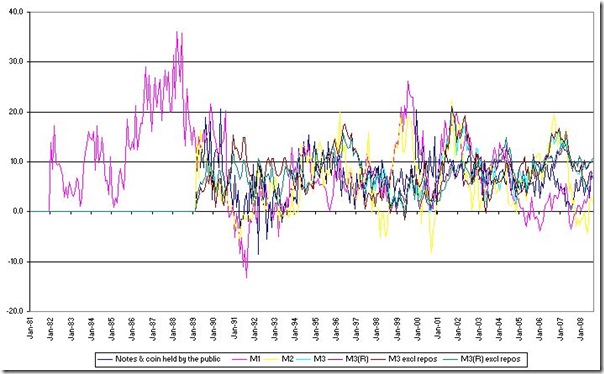

You see, far from inflation being "at an 18-year high thanks to historic price rises" as this Herald numb nut describes it, inflation -- real inflation -- has been high for nearly all of those eighteen years. Take a look at the Reserve Bank's own graph showing the rate of year-on-year expansion of the various measures of the money supply since 1982:

Frightening, huh? That horizontal line all those coloured lines are hugging is not the 5% line, but the 10% line! (See if you can spot some of our major slowdowns when credit contracted, and that period of huge price inflation in the eighties when Guess Who was in charge.)

You might notice while studying the figures that even in April last year M3 was being increased at a year-on-year rate of 14.7%! And even in August this year (the latest figure the Reserve Bank provides) Notes and Coins were increasing at a rate of 6.6%, M1 at 7.0% and M3 at 7.2% on a year-on-year basis.

If you want inflation then, you sure as hell know where to look -- and it's not in Bernard Hickey's pretty-looking charts.

It's not just frightening because this monetary inflation has been so enormous, and so enormously destructive (see for example this story of how the credit bubble caused the housing bubble, or this story showing how our present problems are due to a Fed-induced distortion in the capital structure -- a capital structure that mainstream commentators don't even know exists!) but especially frightening because the monetary inflation has been so widely unnoticed. Instead of being able to enjoy the declining prices due to cheaper electronics and cheaper Chinese goods -- and the increased productivity due to the internet revolution -- the Reserve Bank instead inflated the money supply by injecting currency and credit into the economy, causing the hugely destructive housing bubble and all the various malinvestments around the place that still need to be shaken out.

So let's recap: Put simply, price inflation just measures overall changes in the price of stuff. This is what gets commentators excited. Yet monetary inflation, which is generally the cause of the overall rise of the price of that stuff, and much else much more damaging besides, is the bit the commentators ignore. And for their commentary, which ignores the biggest elephant in the room, they get paid good money.

Go figure.

And capitalism? Where does that fit in? Well, you'll note that the Reserve Bank is a government institution. The country's money supply was nationalised a long time ago -- and the commentators who now blame capitalism for the present crisis never even noticed.

------------------------------------------------------------------------------------------------------------------------

*Explaining monetary inflation, Ludwig von Mises explains it is :

a large increase in the quantity of money in the broader sense that results in a drop in the purchasing power of the monetary unit, falsifies economic calculation and impairs the value of accounting as a means of appraising profits and losses. Inflation affects the various prices, wage rates and interest rates at different times and to different degrees. It thus disarranges consumption, investment, the course of production and the structure of business and industry while increasing the wealth and income of some and decreasing that of others. Inflation does not increase the available consumable wealth. It merely rearranges purchasing power by granting some to those who first receive some of the new quantities of money.

UPDATE: So the take-home message is this:

- if you're a reader of financial journalists and you find them talking about price inflation without talking about monetary inflation, then understand they're not telling you the most important part of the story. Write them a letter and tell them so.

- if you're a financial journalist yourself, then how about you start doing your bleeding job. Distinguish between price inflation and monetary inflation, and start reporting the extent of the more important of the two. (And who knows, you might eventually come to realise why a rise in oil prices isn't actually "inflationary" at all.)

- if you're one of those "economists" whose job is making predictions -- all of which are almost always wrong -- then instead of just "predicting" what Alan Bollard will do with the OCR, how about working out how much extra credit creation will be going on to make that interest rate work, and explaining the damage it will be doing. In other words, start doing your fucking job.

- And if you're Alan Bollard, then get a fucking grip, and stop inflating the damn currency. If you do nothing else (insert obvious jokes here) just do that much. Or that little.

8 comments:

Sorry but this is rubbish. Why?

Instead of being able to enjoy the declining prices due to cheaper electronics and cheaper Chinese goods -- and the increased productivity due to the internet revolution -- the Reserve Bank instead inflated the money

there are three things you mention

1. we have been able to "enjoy cheaper electronics" from China. Just go down to Dick Smith and see.

2. NZ has had on increase in productivity in the last 10 years. The US has a huge increase, Australia some, but NZ has just got worse.

3. If true this would be the Reserve Banks's fault. Your graph still shows huge increases under Brash!

This not the root of the problem

The root of the problem is NZ is rampant expansion of the state over the past 10 years. The US is the same - except the money was spent on a war that is yet to turn a profit.

Whenever government spends more than it gets, or borrows to pay for health, education, interest - or a war - it destroys the economy. That's the simple, take-home message here.

Labour has pissed away the last chance NZ had.

Iceland will be absorbed into the EU.

We won't even be taken on by Australia

(or rather we will: but not as a state, rather as something like Norfolk Island). The Aussies are simply not going to stump up the trillions it would cost to fix NZ (which the EU will be for Iceland).

Sorry, but your comment is anonymous and rubbish, not to say incoherent.

You appear to have missed every point that was made.

You say, for example, we have been able to "enjoy cheaper electronics" from China...

What I said was "enjoy the declining prices" due to cheaper goods and increased productivity -- instead the Reserve Bank has pissed away these boons to allow themselves to ramp prices back up again by inflating the money supply.

Think about it.

"If true this would be the Reserve Banks's fault."

Yes, I believe you have that point.

"The root of the problem is NZ is rampant expansion of the state over the past 10 years."

And those two points are not unconnected. Join the dots and you'll get the whole picture.

What is interesting is if we measure inflation like it used to be measures. For the US, the actual inflation is about 13%.

damn, its enough to make you vote libz.

pc, stop making so much sense!

PC, are the 2 graphs came from the same data source ? If they are, then they're, then Bernard's graph looks like Michael Mann's Hockey stick and your graph looks like Steve McIntyre's Baseball bat, ie, 2 different analysis of the same data which lead to 2 different conclusions.

So, the debate (global warming) is not over yet. Perhaps Bernard will come up with a refine model of his graph at a later time and showed that it fits reality.

Same data sources, essentially, just different time periods.

Bernard H's graph (from Stats Dept data) is for the period 2000-2008. My one below that (from Reserve Bank data) goes all the way back to the time of the Springbok tour. ;^)

As some one that left school at 15

It has been my talking point at work for a number of years..

To much money chasing to few goods.

Where did the money come from ? Credit..

The repayment crisis comes along and the fools throw more money at problem thus causing an even greater problem.

Predicted it almost to the week.

My next prediction is that by March we will really be up the creek

adam2314

Post a Comment