The Herald would like to make it official -- "recession bites: consumer outlook lowest since 1991" says the front-page headline in this morning's Auckland edition -- but at this stage still needs Friday's GDP figures for the March quarter to be negative "as expected" to make the headline a dead cert. Still,

"Consumers are squealing due to the high cost of living," Westpac chief economist Brendan O'Donovan said.

High food and petrol prices were the biggest concerns, though the "litany of woe" also included rising debt servicing costs, falling house prices and job losses.

"It's consistent with what we are hearing from businesses," he said. "It's pretty dire out there. Auckland retailers particularly are struggling."

Also "expected" is that GDP for the June quarter will be even worse -- "the worst of the lot" says Westpacs's Brendan O'Donovan. Figures for the June quarter, by the way, will not be out until September.

Such is the difficulty of determining the present state of the economy by GDP figures alone: as John Clark so insighfully satirises here [scroll down to 'Update 1'].

BARRISTER (in the Royal Commission on What the Hell's Happening to the Australian Economy): So what are the current figures based on?

MR TROUSER (from the Treasury): They're based on the information available at the time the current figures were being prepared.

BARRISTER: Which was when?

TROUSER: 3 months ago. The figures take 3 months to assemble.

BARRISTER: Is it possible for you to tell what's happening now?

TROUSER: Yes, of course it is.

BARRISTER: When could you do that?

TROUSER: In 3 months.

George Reisman offers a more general rule of thumb for measuring whether we're in schtuck.:

A depression is characterized not only by falling prices, but also by a plunge in business profits (which may even become negative in the aggregate) and by a sharply increased difficulty of repaying debt. It is also characterized by mass unemployment.

By Reisman's rule of thumb then we're still only two out of four on the recession scale -- although with dodgy dealing on unemployment figures and and the Reserve Bank creating a phony 'price stability,' how would you really know?

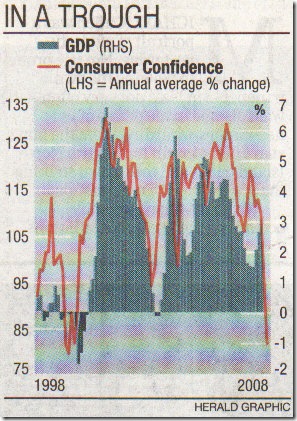

In any case, two things that particularly caught my eye this morning were the graph in the print version of the Herald's article (pictured right) and the many excuses given by the CEOs of collapsing finance companies for being short of the readies, most of which include the phrases "liquidity concerns," the "difficult credit environment," and a failure of clients to "reinvest." These excuses indicate that the growth of many of these finance companies have been built on little more than pyramids formed by new deposits, and on the ability to pull down new tranches of counterfeit capital rather than on making sound investments that are reliably repaid. Bring on the malinvestment!

In any case, two things that particularly caught my eye this morning were the graph in the print version of the Herald's article (pictured right) and the many excuses given by the CEOs of collapsing finance companies for being short of the readies, most of which include the phrases "liquidity concerns," the "difficult credit environment," and a failure of clients to "reinvest." These excuses indicate that the growth of many of these finance companies have been built on little more than pyramids formed by new deposits, and on the ability to pull down new tranches of counterfeit capital rather than on making sound investments that are reliably repaid. Bring on the malinvestment!

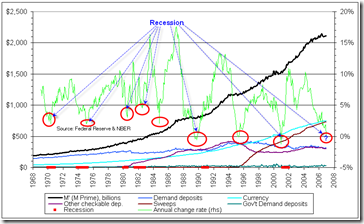

There is a link between these two things (the Herald graphic and the excuses of the finance companies) and how one measures whether or not one is in a recession -- and a graph of the True Money Supply can sort that out.

By 'True Money Supply' I do not mean the figures of M1, M2, M3 or MZM that are commonly used to measure the money supply. As Frank Shostak explains [pdf], each of these measures is flawed:

... M2 double counts some aspects of money and since M3 incorporates M2, it is equally flawed right off the bat. M2 also counts savings accounts which are really credit transactions and MZM is hopelessly flawed as a money definition because it attempts to count things that can easily be converted to money as opposed to money itself.

M1 is flawed by the inclusion of travelers checks and the exclusion of demand deposits with commercial banks and thrift institutions + government deposits with banks and the central bank. M1 also has another huge problem and that problem is 'sweeps', [which are used ] "to lower statutory reserve requirements on demand deposits. In a sweep program, banks “sweep” funds from demand deposits into money market deposit accounts (MMDA), personal savings deposits under the Federal Reserve’s Regulation D, that have a zero statutory reserve requirement ratio. By means of a sweep, banks reduce the required reserves they hold against demand deposits."

What we want is an accurate measure of how much ready money is flushing around the system. courtesy of the central bank. So how do we measure that if the present measures are flawed? Says a student of Shostak who's drawn up the graph on the right: "The definition I am now working with is Cash + demand deposits with commercial banks and thrift institutions + government deposits with banks and the central bank + sweeps + other checkable deposits." He calls this figure M', ie., M Prime. The graph on the right shows M' for the US measured for the last forty years. [See Mike Shedlock's website for a more thorough explanation, especially: Money Supply & Recessions.]

So how do we measure that if the present measures are flawed? Says a student of Shostak who's drawn up the graph on the right: "The definition I am now working with is Cash + demand deposits with commercial banks and thrift institutions + government deposits with banks and the central bank + sweeps + other checkable deposits." He calls this figure M', ie., M Prime. The graph on the right shows M' for the US measured for the last forty years. [See Mike Shedlock's website for a more thorough explanation, especially: Money Supply & Recessions.]

The importance of this measure can be seen by comparing the period 1998 to present to the Herald's graph above (do those peaks and troughs ever match up, do you think?), and by understanding the implications of that match-up for three things:

- this indicates that the booms and inflations of recent years have been driven (at least in part) by expansion of the money supply;

- that finance companies and banks are experiencing a credit crunch largely because the continued expansion of the money supply (and the phony credit on which they rely) has stopped, for the time being anyway; and

- if you want a good way to measure recession (and inflation), look to the money supply as a leading indicator, and in particular to the figure of "M Prime" as adjusted by the CPI. Says Sherlock, using this last figure allows one to see "that there has been a recession on 6 of 7 sustained dips below the zero line of year over year growth in M'."

In other words, it's a reliable way of measuring booms and busts and credit crunches. No surprise really, since the expansion and contraction of the money supply is the single greatest factor in causing booms and busts.

1 comment:

Re retailers: count the stores that aren't offering (big) discounts right now. Not many.

Post a Comment