I wrote yesterday that Labour's housing ministers appear like King Canute, believing that by power of decree alone they're able to repeal the laws of supply and demand -- something for which a second year economics student would be failed.

This morning we learn that the government's foremost economist, on whose shoulders responsibility for what Hayek calls the country's nationalised money rests, has similar aspirations. For some reason, he thinks he is able to repeal the laws of supply and demand that have increased world prices of food and oil and the domestic prices of energy and housing and labour, and somehow fight these price rises by adding another one of his own: the ongoing cost of nationalised money.

It's moronic.

The law of supply and demand is not to be flouted in that way, and the danger of trying to flout price signals as Bollard wants markets to do is that price signals are telling us something we need to know -- and two things we need to know with all those prices at present is that on the one hand there are good reasons to enjoy the prosperity coming from increasing and solid demand causing higher commodity prices; and on the other hand it's government meddling of various sorts that have been raising them (not least government meddling in the name of 'the environment' -- see here, here, here and here for example). But Bollard just doesn't want to know, either about the good reasons or the bad.

Instead, to dampen down wage pressures to keep up with a genuine rising cost of living, he's keeping the cost of housing high by an artificial imposition (and at a time when housing is already one of the highest costs of living ). He's making things worse, not better.

And in the name of an illusory price stability, which in itself leads to instability, he's keeping the cost of borrowing high on all producers -- and this at a time when, as ANZ economist Cameron Bagrie argues, what's driving genuine inflationary pressure is in part NZ's low rate of productivity.

Note that among the chief reasons for NZ's low rate of productivity are the high cost of local capital, government meddling adding to the compliance costs and uncertainties for producers, and a high exchange rate making things tough for exporters. Bollard intends to make all these pressures worse, denying (in the name of an illusory price stability) a chance at genuine prosperity. It's worse than moronic, it's deluded.

The reason that Bollard and other mainstream economists are willing to continue nailing our economy to this deluded cross of price stability is that they look at inflation precisely backwards.

They see price rises that are driven by good market reasons -- for the most part at the moment it's the market reacting to the meddling of governments and growing prosperity in India and China-- and they cry " Inflation!" and let slip the dogs of interest rate doom. Yet at the same time they watch the Reserve Bank, under Bollard's direction, inflating the money supply by around fifteen percent year on year, and they pretend that this currency inflation is part of the inflation fight!

Talk about a vicious and moronic circle.

Let's all remind ourselves once again that inflation is always and everywhere is a monetary phenomenon, and its only as a monetary phenomenon that it should be fought. Sadly, with Bollard and his ilk, inflation as a monetary phenomenon is the inflation that dare not speak it's name. Inflate the currency and he's applauded; let slip the printing presses and he's applauded; stamp on producers and exporters and mortgage-payers ... and he's applauded. Deny prosperity by misunderstanding inflation, and he's applauded.

What on earth does it take to see the light?

And just look who's doing the applauding? Morons who see the fight the same way he does. Other mainstream economists who begin by ignoring inflation as a monetary phenomenon and end up endorsing the Reserve Bank's flight from reality -- Cameron Bagrie for example who endorses it with the unintentionally ironic observation that "common sense needs to prevail." An odd way to characterise a complete flight from common sense, you would think.

Bagrie, who's no doubt representative of his breed, compounds the stupidity by calling for a "growth sacrifice" now [audio] to avoid worse down the track. "We now have a real inflation problem," says Bagrie. "That means there is going to be a sacrifice to get the inflation genie back in the bottle." If we could only get this deluded idea about price stability back in the bottle and silence the Reserve Bank's thundering printing presses, we might well avoid the need for any sacrifice at all.

In fact, strip the Reserve Bank of its monopoly powers, cut the govt's apron strings from the currency altogether, and let the market rip, and that would remove the need for sacrifice altogether. Denationalise money, and at a stroke leave exchange rates, producers and price signals free to operate as they need to.

Can I get a Hallelujah?

UPDATE: Are tax cuts inflationary? Many commentators have focussed on Bollard's apparent green light for the non-inflationary impact of tax cuts, at least within the guidelines set. I've argued before that tax cuts aren't inflationary -- essentially they just change who gets to spend your money-- and as Phil Rennie points out "The important point about tax cuts is that they are actually less inflationary than government spending.". Eric Crampton explains why:

Even if you start from Bollard's premises, his worries about tax cuts seem odd. If the government has the money, it either saves it or spends it. If it spends the money, it tends to hire people. Hiring people also requires buying office space to put them in. What have been the two big components of inflation? Wages and non-traded goods (housing/buildings). When government spends money, it spends it in the areas most likely to push prices up.

If it provides a tax cut, people either save the money or spend it. If individuals spend money, a fair bit of that goes to buying imported goods which have zero inflationary effect. Price inflation in the tradeables sector has been pretty much zilch for the last year: we're a small player in the grand scheme of things, and our importing more stuff has no effect on prices.

I just don't see tax cuts winding up being highly inflationary.

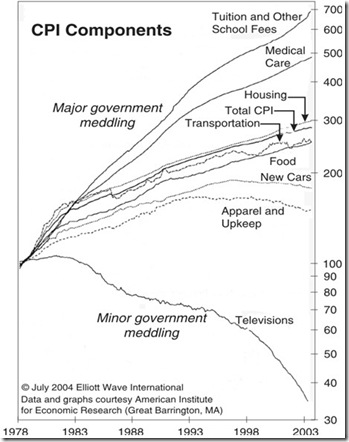

The chaps at The Befuddled Monkey explains these two points graphically (figures are for the USA):

- "When government spends money, it spends it in the areas most likely to push prices up.

- "...a very sizable proportion of New Zealand’s goods are being made in Asian countries (who are essentially exporting deflation).."*

And you don't need to be a genius to note the difference that meddling makes...

3 comments:

Even if you start from Bollard's premises, his worries about tax cuts seem odd. If the government has the money, it either saves it or spends it. If it spends the money, it tends to hire people. Hiring people also requires buying office space to put them in. What have been the two big components of inflation? Wages and non-traded goods (housing/buildings). When government spends money, it spends it in the areas most likely to push prices up.

If it provides a tax cut, people either save the money or spend it. If individuals spend money, a fair bit of that goes to buying imported goods which have zero inflationary effect. Price inflation in the tradeables sector has been pretty much zilch for the last year: we're a small player in the grand scheme of things, and our importing more stuff has no effect on prices.

I just don't see tax cuts winding up being highly inflationary.

Check the latest money supply stats. M1 has been dropping since June; M2 has been low since June. M3's growth rate is way down on last year.

http://www.rbnz.govt.nz/statistics/monfin/c1/data.html gives M1 and M2.

Thanks for that Eric.

** It looks to me that if the government gives us back some of our money, it simply changes who has control of it, so as you say even starting from Bollard's premises there seems to be no reason to expect tax cuts to be inflationary, especially since government spending is in n the areas most likely to push prices up.

PS: Hope you're okay with me using your comment on the front page?

** It's hard for a neophyte like myself to extract competent meaning out of all the Reserve Bank figures, but in the absence of what Frank Shostak and other Misesians call the 'Austrian Money Supply' figure (AMS), it looks like the figure for growth in 'M3 excluding repurchase agreements' is the most relevant, although it specifically excludes central government deposits. [Shostak defines the figure for AMS as: "Cash+demand deposits with commercial banks and thrift institutions + government

deposits with banks and the central bank."

This definition, he says, "shows clearly that any expansion in money supply results solely from central bank injections of cash and commercial banks’ fractional

reserve banking."]

As you say, the M3(R) figure is now down to 7.9% (from a high of 16.7% this time last year, and 13.7% in May). At least it's heading in the right direction.

I found this comment below by Matt Harkerss at Shostak's article on 'The Fallacy of Inflation Targeting,' which I found instructive. It was written back in May:

"The problem being created is that a very sizable proportion of New Zealand’s goods are being made in Asian countries (who are essentially exporting deflation) which means the CPI says 2.7% etc but the currency is debasing itself at 12-15% p.a. So people are asking for lets say 4% pay increases thinking that they are receiving a 1% real wage return but then try saving for a house but can not understand why they are inflating 15% p.a. or that their power bill, thanks to non-renewable resources, keeps going up. Simply the cost of borrowing goes up in an inflation targeting arrangement but there is not necessarily any monetary tightening and if official price statistics are stacked with consumerist high tech gadgets, the scam can go on for a while."

Important point:- the action the Reserve Bank undertakes when it introduces money into the economy IS inflation.

The rising prices that subsequently occur are a RESULT of the inflation undertaken by the Reserve Bank.

This nonsense of setting up a central bank to set interest rates and tell fairy tales about inflation and the economy is yet another example of a failure of socialism. Von Mies pointed this out in the '20s and '30s.

It is impossible for the socialist planner/commissar/bureaucrat to calculate value. "Socialism can't calculate." Given that the government schemes fail everywhere else (health, education, housing, crime, justice, etc. etc. etc.), why would anyone think that such a scam would be successful in diving the correct interest rate while simultaneously stealing wealth and decimating savings? Why indeed?

It was explained to me by an interesting dinner companion last year. He explained that, as with collectivists everywhere, socialists necessarily must lie.

A pox on them.

LGM

Post a Comment