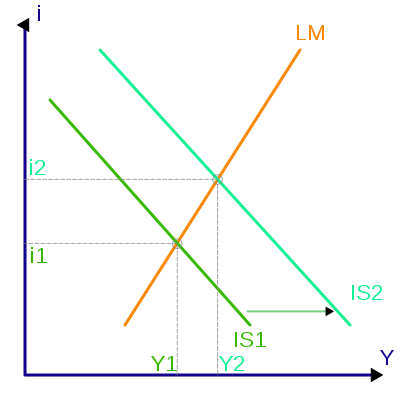

Mainstream macro-economists tend to build hyper-theoretical castles in the air based on very little of real substance. Elegant graphs are constructed like the one on the left, which purport to convey immense quantities of information without ever being sullied by the taint of actual facts.

Mainstream macro-economists tend to build hyper-theoretical castles in the air based on very little of real substance. Elegant graphs are constructed like the one on the left, which purport to convey immense quantities of information without ever being sullied by the taint of actual facts.As Mark Twain used to say, "One gets such wholesale returns of conjecture out of such a trifling investment of fact."

These floating castles only rarely feel the all-too tangible tug of reality to tie them down, and we can spot these times with ease by the frequency with which pensive central bankers appear in the news headlines -- central bankers often unable to explain why the recalcitrant stuff of reality isn't work in the way their elegant models told them it should.

At such times we tend to hear them blaming the inhabitants of the market for not acting the way their models told them "the market" would. Don't we Alan.

At such times we tend to hear them blaming the inhabitants of the market for not acting the way their models told them "the market" would. Don't we Alan.A

ustrian economists by contrast tend to begin with real human action rather than with hyper-theoretical speculation. Here's one example. Austrian economist John Paul Konig noticed that Spider Man comics rose in price from 1963 to now by a whopping 2400%! Much more than what macro-economists would call "the rate of inflation."

ustrian economists by contrast tend to begin with real human action rather than with hyper-theoretical speculation. Here's one example. Austrian economist John Paul Konig noticed that Spider Man comics rose in price from 1963 to now by a whopping 2400%! Much more than what macro-economists would call "the rate of inflation."This interested Mr Konig, and lead to questions such as this:

- Does "the" rate of inflation really mean anything useful?

- Why have Spider Man comics seemingly spurned this rate?

- Why have Spider Man comics increased at a different rate to the rate of increase in the price of Time magazines?

- And to the printing of dollar bills by the central bank?

- What does that say about the relationship between borrowing money and buying comics?

- And how exactly does this simple example help explain the different rates of price increase in different parts of the economy -- differences that are largely overlooked by macro modelists?

In the meantime, enjoy J.P. Konig's piece at the Mises Blog: Spider Man Battles the Inflation Monster.

No comments:

Post a Comment