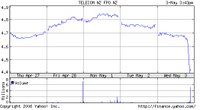

The story in two charts (Telecom on the ASX left, and on the NZSX, right; click to enlarge). As Bernard says in comments below, "It usually takes the Government a week to waste a billion dollars. This act of vandalism against Telecom has destroyed a billion dollars of value in just a few minutes."

The story in two charts (Telecom on the ASX left, and on the NZSX, right; click to enlarge). As Bernard says in comments below, "It usually takes the Government a week to waste a billion dollars. This act of vandalism against Telecom has destroyed a billion dollars of value in just a few minutes."Ruth asks, "I wonder who is buying TEL though? Wouldn't be the Cullen Fund, would it?" Good question. Something's keeping the price 'up.'

LINKS: Basic 5-day chart for TEL.NZ - Yahoo Finance

Basic 5-day chart for TEL.AX - Yahoo Finance

$1.1 billion wiped off Telecom's value as shares plunge - NZ Herald (10:45am)

TAGS: New_Zealand, Economics, Politics-NZ, Property_Rights

10 comments:

Any bets on how much more Slingshot is worth today than is was 24 hours ago?

Still good for a short term punt at this level as it gets oversold IMO. TEL is still a very viable business so I wouldn't get carried away with the sheep over reacting - it isn't Enron just yet ;-)

This move will at least force TEL to become more competitive (not that I agree with the regulation), so long term I'm not worried about the SP. The market needs a good shakeout now and then - gets rid of the rats and mice.

Most people miss the point, Telecom is a private company that has been forced to hand over assets for use by over companys against it's wishes. IT'S THEFT!!!

How did Telecom "aquire" the rights to band width in the first place?

It may be theft Whitehead, but that doesn't mean one cannot make money out of it. That's capitalism.

In fact I look forward to many small ISP's going down the toilet now, as per offshore examples. Just you wait and see. And if karma has anything to do with it the Presley woman will be the first.

Ruth, I'm with you. I predict a 5% return on Telecom shares within 2 weeks...

I'll let you know how I get on.

Good 4U Andrew - I assume you know TEL has been in a downtrend for a year - so chartists won't touch it. Take a look at the 2-3 year chart. It is VERY high risk.

On the other hand Citigroup continue to call this a buy in spite of recent news - fair value NZD5.90. They may well be calling from a proprietary position, but they have been NZ economy bulls for 4 years in the face of much partisan political opposition here - and have not been wrong yet.

Ruth, I think you're right. The tendency will be for there being perhaps 3 other major ISPs in the market (TelstraClear/Paradise, IHUG, Orcon) with the rest only surviving because the owners don't want a proper return on capital.

Ruth, firstly I am talking very short term only. As I said, a 2-week bounce-back.

Secondly (and I am not 100% certain about this) isn't the downward trend due to the problems they encountered in Oz? Are they not currently trying to ditch that problem?

Yes Andrew - Australia was a screw up and I feel that has been factored in to the SP. For the average, less informed Joe Blogg investor TEL is still high risk though, which is why I said that.

Liberty Scott - as u say no other country has as many ISP's as we have - they don't have the capital to invest in the infrastructure now the gloves have come off- so it will all come out in the wash - and it will be all good for TEL.

Post a Comment