Mike Shedlock suggests the worlds various central banks should do three simple things before they do us all a favour and self-destruct. While disagreeing with some of his detailed prescription, the general thrust of his recommendations is worth considering:

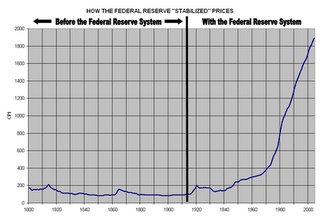

Instead of trying to achieve 'price stability' which ... is something that can neither be achieved nor measured , how about shooting for "money supply stability" instead? a.. Central banks should refuse to monetize government spending and trade deficits; b.. Central banks should let the market set interest rates; c.. Central banks should embark on a campaign of tightening reserves requirements over time to rein in fractional reserve lending Life would be so much simpler if Central Banks everywhere would stop trying to micromanage both prices and economic cycles. Quite simply, they are trying to achieve nirvana when nirvana can not possibly be measured, nor can nirvana be achieved in the first place with the policies they have in place. Of course if they stop doing these things, they will cease to be Central Banks in the modern sense, so perhaps they will get the hint and just close shop.We wish. And as for that graph up top, just see the 'success' the US Central Bank has had in their number one job. Been really useful, huh?

Linked Articles: Inflation monster captured

One graph that says it all

1 comment:

Awesome - I was 5th most popular link.

Post a Comment