This is why the Head of Local Government NZ is paid so much -- to deny the bloody obvious:

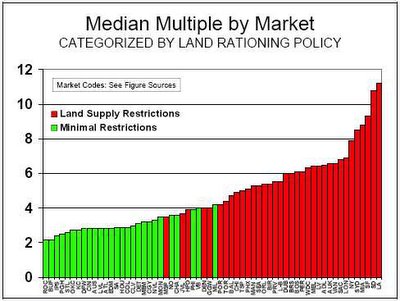

This is why the Head of Local Government NZ is paid so much -- to deny the bloody obvious:RADIO NEW ZEALAND: Local Govt NZ says council regulation not to blame for house price rises The 2nd International Housing Affordability Survey [discussed here yesterday at Not PC] says New Zealand prices increased by around 15% in the last year alone and concludes the principal cause is "excessive land use regulation that strangles housing markets." It blames excessive land use regulation and restrictions on expansion of urban centres... However, Local Government New Zealand President Basil Morrison says house price rises are being driven by other factors...Crap, says one of the authors of the study. "'Loony' policies are responsible for New Zealand houses being among the most unaffordable in the world," he says -- and of course he's right; the RMA itself being the very acme of land-use looniness. The report itself makes clear that it is precisely government policies restricting land supply and land use that are making housing relatively unaffordable in NZ and elsewhere. That graph (above) from the report tells the whole story -- cities with government-created land supply restrictions in red; those with none or few restrictions in green; afforability (measured by how many times more the median house is in that city than the median income) up the scale.

That'd be Auckland, tenth from the right on the graph. Can you see that, Basil, you blind, bloody cretin? At least TVNZ reported it straight, and got an alternative view to bloody Basil.

Linked Articles: NZ Housing affordability "in crisis" says report - Not PC

Local Govt NZ says council regulation not to blame for house price rises - Radio New Zealand

Kiwi houses pricey, survey shows - Dominion

City housing "severely unaffordable" - TVNZ

2nd Annual Demographia International Housing Affordability Survey (2006)

4 comments:

Also my economist acquaintance stationed in Belgium says this:

Nonsense. The affordability measure used in the demographia work (median house price/median house income) is, at best, a partial indicator of affordability and at worst downright misleading. It does not take into account factors such as mortgage interest rates, the tax system for example. If you can stand some simple algebra and economics jargon the journal artice below is worth looking at for a more comprehsive take on affordability -

http://www.ingentaconnect.com/content/aea/jep/2005/00000019/00000004/art00004

Well I see dwelling consents were up 21% in December. So my friend is right and you are just talking your book about the RMA. Oh well - we all do it.

Reserve Bank staff be jumping out da windows soon.

Ruth, you are tilting at the wrong windmill here.

Your friend is talking about housing bubbles in particular markets in which a bubble may or may not be occuring. That has exactly nothing (or at least very little) to do with the purpose of the Demographia study, which applies a standardised methodlology across a range of housing markets and has then compared them to each other.

As such, your comment about a rise in building consent numbers over a month and how this smoehow relates to the RMA is simply a non sequitur - it is not germane at all to the specific issue, I'm afraid.

The Affordability index is very powerful as a means of comparing affordability across markets.

The Belgian economist wants to drag in interest rates etc but these are only useful when comparing affordability over time within a market.

If interest rates were a key factor then most US markets would be similar because they are subject to one interest rate. But they vary hugely and that variation is explained by their degree of land rationing by regulation.Even Paul Krugman now agrees that there is zoneland – where house prices are high - and flatland which house prices are low.

Post a Comment