In this guest post, Don Boudreaux explains how Americans grow a car out of wheat. And how some luddites want to stop them.

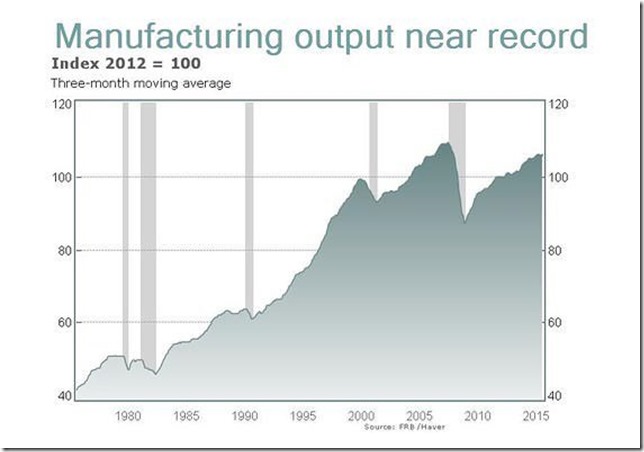

It’s well-known among people who bother to learn the facts that U.S. manufacturing output continues to rise despite the reality that the number of Americans employed in jobs classified as being in the manufacturing sector peaked in June 1977 and has fallen, with very few interruptions, ever since.

Nevertheless, some people – for example, the Economic Policy Institute’s Robert Scott – continue to insist that the loss of manufacturing jobs in the U.S. is largely due to increased American trade with non-Americans. Other studies find empirical evidence that labour-saving innovation rather than trade is overwhelmingly responsible for the loss of manufacturing jobs.

Trade is Innovation

Trade by its very nature is labour-saving. I could bake my own bread with my own hands and my own pans in my own kitchen. But to do so would take more of my own time than is required for me to earn, by teaching economics, enough income to buy bread from a baker. My specialising in teaching economics and then trading for bread saves me some of my labour.

Or I could bake my own bread by using a fancy bread-making machine that sits on my kitchen counter. But I can’t make such a machine myself; I must trade for such a machine, as well as for the inputs – including the electricity – that it requires to produce yummy bread. So it might fairly be said that any bread that I produce in my own home with my incredible bread machine is the result of trade.

Either way – trade with a baker, or my use of the incredible bread machine – I get bread in exchange for less labour than I would have to use to supply myself with bread were I unable to trade with a baker or to use this machine.

What difference does it make if labour is saved by dealing directly with a machine or with another human being?

Recall David Friedman’s report of car production in Iowa (here as related by Steve Landsburg, with emphasis added by Don Boudreaux):

There are two technologies for producing automobiles in America. One is to manufacture them in Detroit, and the other is to grow them in Iowa. Everybody knows about the first technology; let me tell you about the second. First you plant seeds, which are the raw material from which automobiles are constructed. You wait a few months until wheat appears. Then you harvest the wheat, load it onto ships, and sail the ships eastward into the Pacific Ocean. After a few months, the ships reappear with Toyotas on them.

International trade is nothing but a form of technology. The fact that there is a place called Japan, with people and factories, is quite irrelevant to Americans’ well-being. To analyse trade policies, we might as well assume that Japan is a giant machine with mysterious inner workings that convert wheat into cars. Any policy designed to favour the first American technology over the second is a policy designed to favour American auto producers in Detroit over American auto producers in Iowa. A tax or a ban on “imported” automobiles is a tax or a ban on Iowa-grown automobiles. If you protect Detroit carmakers from competition, then you must damage Iowa farmers, because Iowa farmers are the competition.

The task of producing a given fleet of cars can be allocated between Detroit and Iowa in a variety of ways. A competitive price system selects that allocation that minimises the total production cost. It would be unnecessarily expensive to manufacture all cars in Detroit, unnecessarily expensive to grow all cars in Iowa, and unnecessarily expensive to use the two production processes in anything other than the natural ratio that emerges as a result of competition.

That means that protection for Detroit does more than just transfer income from farmers to autoworkers. It also raises the total cost of providing Americans with a given number of automobiles. The efficiency loss comes with no offsetting gain; it impoverishes the nation as a whole.

There is much talk about improving the efficiency of American car manufacturing. When you have two ways to make a car, the road to efficiency is to use both in optimal proportions. The last thing you should want to do is to artificially hobble one of your production technologies. It is sheer superstition to think that an Iowa-grown Camry is any less “American” than a Detroit-built Taurus. Policies rooted in superstition do not frequently bear efficient fruit.

In 1817, David Ricardo—the first economist to think with the precision, though not the language, of pure mathematics—laid the foundation for all future thought about international trade. In the intervening 150 years his theory has been much elaborated but its foundations remain as firmly established as anything in economics.

Trade theory predicts, first, that if you protect American producers in one industry from foreign competition, then you must damage American producers in other industries. It predicts, second, that if you protect American producers in one industry from foreign competition, there must be a net loss in economic efficiency. Ordinarily, textbooks establish these propositions through graphs, equations, and intricate reasoning. The little story above that I learned from David Friedman makes the same propositions blindingly obvious with a single compelling metaphor. That is economics at its best.

To repeat an especially important insight: “International trade is nothing but a form of technology.” That is, trade – intranational and international – itself is an innovation. Finding specialists with whom we can profitably trade requires transportation and communication – both of which today are, as it happens, greatly facilitated by advanced machinery. Yet other, less obvious innovations are involved – for example, the supermarket. The organisational form of the supermarket lowers consumers’ costs of learning about and acquiring groceries. (Superstores, such as Walmart, lower those costs even further.) In international trade, the seemingly simple box that we know today as the shipping container is a labour-saving innovation that dramatically reduced the costs of ordinary men and women from around the globe to trade with each other. Ditto the giant, magnificent modern cargo ship.

The bottom line is that trying to measure what proportion of some number of job losses is due to innovation and what proportion of those job losses is due to trade is rather pointless: from one valid perspective, all of the job losses are due to innovation; from another valid perspective, all of the job losses are due to trade. But from any perspective, the very fact that particular jobs are lost means that labour is saved.

Donald J. Boudreaux is a senior fellow with the F.A. Hayek Program for Advanced Study in Philosophy, Politics, and Economics at the Mercatus Center at George Mason University, a Mercatus Center Board Member, and a professor of economics and former economics-department chair at George Mason University. He holds the Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center. He specializes in globalisation and trade, law and economics, and antitrust economics.

HIs post previously appeared at Cafe Hayek and FEE.

.

No comments:

Post a Comment