Yes friends, the bad news for all those living anywhere between Pokeno and Wellsford (or wanting to) is that the Auckland housing market is now the fourth-most unaffordable in all the places in the world that are measured by the study out this morning. Which is a lot. And Tauranga – Tauranga, with ample land around it on which to spread! -- is not far behind.

Frightening!

What the new study by Demographia confirms is that (as measured by comparing the median house price in a city to the median salary enjoyed by that city’s residents), Aucklanders have the fourth-most expensive city in which to buy a house in all off Australasia, Canada, China & Hong Kong, Ireland, Japan, New Zealand, Singapore, the United Kingdom and the United States (I told you they measure a lot of places).

So that makes Auckland a more expensive place to buy a house, by this median multiple, than every city in this measured world apart from Hong Kong, Sydney and Vancouver. More expensive than Tokyo. More expensive than New York, Osaka-Kobe-Kyoto, and Los Angeles. More expensive than London!

In Auckland, the median multiple (the ratio of the city’s median house price to its median salary) is now 10.0. In London, it is 8.5.

In a normal housing market, in which supply is not constrained unnecessarily, that median multiple is around 3.0 – as it was for most of Auckland’s history until now, and as it still is in very liveable and relatively unconstrained cities in the US like Rochester, Buffalo, Cincinnati, Cleveland, Pittsburgh, Oklahoma City, St. Louis, Grand Rapids, Indianapolis and Kansas City (whose median multiples range from 2.5 to 3.0)

And Auckland continues to grow more unaffordable, not less, every year this study has been performed.

No wonder ACT’s David Seymour has broken ranks with his National partners, saying (accurately) that “the government's housing policy will go down as one of the most cynical pieces of politics in New Zealand's history.”

Here is the full press release and executive summary by the survey’s authors:

PRESS RELEASE:

New Zealand’s housing consensus:

Where is the political leadership ?

Hugh Pavletich, co-author Demographia International Housing Affordability SurveyThe 1st Annual Demographia International Housing Affordabilty Survey was released early 2005.

These annual surveys, as Oliver Hartwich of The New Zealand Initiative within the Introduction to this year's edition makes clear, have proven to be an essential foundation for constructive public discussion of these issues.

By early 2007, the then New Zealand Opposition National Party, under the leadership of the young John Key, started to ‘use’ the housing issue to pressure the then Labour Government in the lead-up to the late 2008 election.

The Key-led National Party won.

Mr Key was extremely clear from 2007 through to the election late 2008, as this interview and speeches at the time illustrate.

Sadly … post- election …the ambitious action man became the can kicker.

In advocacy terms however, the ‘tipping point’ was the October 2012 Government response to housing affordability report ( video - media presentation ), led by then Finance Minister (now Prime Minister) Bill English … with the focus on –

- land supply,

- infrastructure financing,

- process and

- construction costs.

The performance since that time … now over four years ago … could most charitably be described as woeful.

The incompetence of a supposedly centre-right government has been extremely disappointing.

Mr Key had long been disruptive to progress on these issues ... again, as this writer made clear soon after the major October 2012 announcement with … Housing: Mr Key – Get on the Programme .

Since the October 2012 announcement, for example, Auckland housing has further inflated from about 6.7 times household income to 10.

Auckland’s median house price was $427,500 when Mr Key’s Government came to office late 2008 (refer 2009 5th Annual Demographia International Housing Affordability Survey ).

If prices had even been held at this level … with a sound mix of land releases and progressive bond financing of infrastructure … and with Auckland’s current median household income of $83,000, Auckland’s median multiple today would be 5.1 not the current 10.

Median house prices are currently way out of control at around $830,000.

Better still … if prices had been allowed to gently ease since late 2008 (as polling has illustrated most New Zealanders prefer … and currently getting underway in Greater Christchurch, led by easing rentals), then Auckland today would be well on the road to restoring housing affordability.

Auckland’s house prices would now be around 4 times household incomes, not the egregious 10 times incomes they are.

The median house price would be about $330,000 … not the current stratospheric and grossly irresponsible $830,000 !

Political failure of epic proportions !

Thankfully however ... there is now a very broad consensus across the political spectrum.

This is thanks to New Zealand being a dynamic democracy with an engaged and responsible media … as illustrated within the extensive postings within ‘Three Years On … The Great Consensus Emerges’ and the ‘2016’ sections of this writers archival website Performance Urban Planning .

This broad consensus is remarkable. A world first.

By May 2016, polling by Newshub/Reid Research found an unprecedented 76% of the public dissatisfied with the Governments management of the housing crisis.

What had been a housing crisis worsened to become a political crisis as well.

I predicted late August housing would be Mr Key’s Waterloo.

Also during late August, Mr Key had an unfortunate interview with Mark Sainsbury at Newshub.

Labour’s Housing Spokesperson Phil Twyford followed, speaking competently with conviction.

Mr Twyford’s comments reminded one of Labour’s proud history on housing … Restoring the housing that Jack (and Norm) built ... Oliver Chan ... Spinoff.

Late November, the Labour Party leader Andrew Little spoke to the Property Council.

Housing concerns featured very prominently within the September New Zealand Herald’s Mood of the Boardroom 2016 .

Business leaders had lost confidence in Mr Key. And even more so, his Housing Minister Dr Nick Smith.

Mid 2016 Nick Smith welcomed the Labour Party's call to abolish city limits.

Astonishingly, he has made no attempt whatsoever to reach out to other political parties to form a broad coalition on these issues.

The broad consensus is there. The only obstacles are political incompetence and inertia.

In contrast, Labour’s Housing Spokesperson Phil Twyford, with his colleague David Parker, are reaching out to other political parties, as happened with the Housing Accords Extension legislation earlier September … and on other occasions.

In private during September and with an election required by the end of 2017, Mr Key made the decision he was going to exit politics.

He had no intention of facing the music in 2017.

Within the meandering Media Conference on the date of his resignation … Monday 5 December … no mention was made of the housing crisis.

Remarkably, the journalists present failed to ask Mr Key … why ?

2017 is election year, with housing the Number One issue yet again as this pre – Christmas poll result made crystal clear.

Voters will decide who is capable of getting the essential changes in place … an exercise in sorting out the performers from the pretenders .

ENDS

EXECUTIVE SUMMARY:

13th Annual Demographia International Housing Affordability Survey

How does your city rate?

The 2017 13th Annual Edition …

The 13th Annual Demographia International Housing Affordability Survey covers 406 metropolitan housing markets (metropolitan areas) in nine countries (Australia, Canada, China, Ireland, Japan, New Zealand, Singapore, the United Kingdom and the United States). A total of 92 major metropolitan markets (housing markets) --- with more than 1,000,000 population --- are included, including five megacities (Tokyo-Yokohama, New York, Osaka-Kobe-Kyoto, Los Angeles, and London).

Rating Middle-Income Housing Affordability

The Demographia International Housing Affordability Survey rates middle-income housing affordability using the “Median Multiple,” which is the median house price divided by the median household income. The Median Multiple is widely used for evaluating urban markets, and has been recommended by the World Bank and the United Nations and is used by the Joint Center for Housing Studies, Harvard University. The Median Multiple and other price-to-income multiples (housing affordability multiples) are used to compare housing affordability between markets by the Organization for Economic Cooperation and Development, the International Monetary Fund, The Economist, and other organisations.

Historically, liberally regulated markets have exhibited median house prices that are three times or less that of median household incomes, for a Median Multiple of 3.0 or less.

Demographia uses the following housing affordability ratings (Table ES-1).

Housing Affordability in 2016

There are 11 affordable major housing markets, all in the United States. There are 29 severely unaffordable major housing markets, including all in Australia (5), New Zealand (1) and China (1). There are 13 severely unaffordable major markets in the United States, out of 54. Seven of the United Kingdom’s 21 major markets are severely unaffordable and two of Canada’s six.

The most affordable major housing markets in 2015 were in the United States, which had a moderately unaffordable Median Multiple of 3.9, followed by Japan (4.1), the United Kingdom (4.5), Canada (4.7), Ireland (4.7) and Singapore (4.8). Overall, the major housing markets of Australia (6.6), New Zealand (10.0) and China (18.1) were severely unaffordable.(Table ES-2).

There are 11 affordable major housing markets in 2016, all in the United States. Rochester was the most affordable, with a Median Multiple of 2.5, followed by Buffalo (2.6), Cincinnati (2.7), Cleveland (2.7), Pittsburgh (2.7), Oklahoma City (2.9), St. Louis (2.9) and four at 3.0, Detroit, Grand Rapids, Indianapolis and Kansas City.

There are 26 severely unaffordable major housing markets in 2016. Again, Hong Kong is the least affordable, with a Median Multiple of 18.1, down from 19.0 last year. Sydney is again second, at 12.2 (the same Median Multiple as last year). Vancouver is third least affordable, at 11.8, where house prices rose the equivalent of a full year’s household income in only a year. Auckland is fourth least affordable, at 10.0 and San Jose has a Median Multiple of 9.6.

The least affordable 10 also includes Melbourne (9.5), Honolulu (9.4), Los Angeles (9.3), where house prices rose the equivalent of 14 months in household income in only 12 months. San Francisco has a Median Multiple of 9.2 and Bournemouth & Dorsett is 8.9.

San Diego has a Median Multiple of 8.6 and London 8.5, the same as last year. Toronto has a Median Multiple of 7.7, like Vancouver, showing a year-on-year house price increase equal to a year of household income.

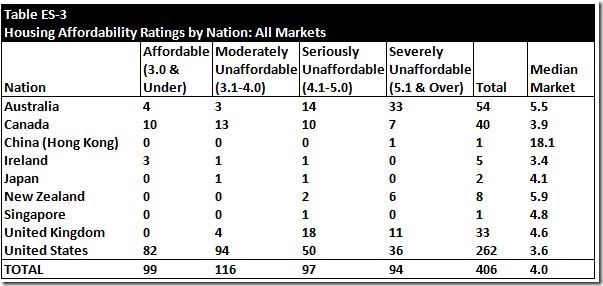

There are 99 affordable housing markets of all sizes including 82 in the United States, 10 in Canada, 4 in Australia and 3 in Ireland (Table ES-3). The most affordable market is Racine (WI) in the United States, with a Median Multiple of 1.8.

There are 94 severely unaffordable markets, with 36 (of 262) in the United States, 33 (of 54) in Australia, 11 (of 33) in the United Kingdom, 7 (of 40) in Canada, 6 (of 8) in New Zealand and the one market in China. Singapore, Japan and Ireland had no severely unaffordable housing markets.

The least affordable among the smaller markets is Santa Cruz (CA) in the United States, with a Median Multiple of 11.6.

“Best Cities” for Middle-Income Households

Every year, “best cities” and “most liveable cities” lists are produced by various organisations. Aimed at the high end of the market, these surveys virtually never evaluate housing affordability. Yet, the media often mischaracterises the findings as relevant to the majority of households.

In fact, a city cannot be liveable, nor can it be a best city to households that cannot afford to live there. Households need adequate housing.

The “best cities” for housing affordability are often better on middle-income urban outcomes that the high-end best cities that attract media attention. This is illustrated by a comparison between Dallas-Fort Worth, where housing affordability is far better than in Toronto, which was rated as the “best city” by The Economist. In addition to better housing affordability, traffic congestion was better and incomes were higher. This is despite the fact that Toronto employs the most favoured urban strategies, which Dallas-Fort Worth does not.

Another comparison shows that Kansas City has better middle-income outcomes that all of The Economist’s top 10 (for which data was available) in housing affordability and traffic congestion and higher incomes than all but three.

Excessive housing regulation has been identified as having significantly reduced economic growth in the United States and inequality internationally. It has complicated the inflation controlling role of central reserve banks.

Economic uncertainty is a substantial concern for households. It is important to keep housing affordable, so that households can live a better standard of living and greater poverty can be avoided. This requires avoiding urban planning policies associated with artificially raising house prices, specifically urban containment. Failing that, housing affordability is likely to worse further.

Paul Cheshire, Max Nathan and Henry Overman of the London School of Economics recently suggested that “… that the ultimate objective of urban policy is to improve outcomes for people rather than places” and that “… improving places is a means to an end, rather than an end in itself.”

Following that policy prescription, a number of cities (such as Dallas-Fort Worth, Kansas City) have achieved the objective of placing people over place For most of society, middle-income households, as well as lower income households, the best cities are where government authorities have overseen local housing markets competently, evidenced by housing that is affordable, all else equal.

The perspective of the Demographia International Housing Affordability Survey is that domestic public policy should, first and foremost be focused on improving the standard of living and reducing poverty.

Survey Introduction

The Introduction to this year’s Survey is by Dr Oliver Hartwich, Executive Director of The New Zealand Initiative, a public policy research organisation based in Wellington. Dr Hartwich has had a long association with the co-authors of this Survey, since his time with Policy Exchange in the United Kingdom.

Wendell Cox, www.demographia.com

Handy Index:

MAJOR MARKETS … RANKINGS: http://www.demographia.com/dhi13-s1.pdf

MAJOR MARKETS … ALPHABETICAL: http://www.demographia.com/dhi13-s2.pdf

ALL MARKETS … RANKINGS: http://www.demographia.com/dhi13-s3.pdf

ALL MARKETS --- ALPHABETICAL: http://www.demographia.com/dhi13-s4.pdf

.

No comments:

Post a Comment