Keynesians and all those modern mainstream economists who still follow his meretricious macroeconomic meanderings maintain that what drives economic growth is not savings but credit growth – and the more credit growth you have, even if it’s credit created not out of real savings but totally out of thin air, the more of that freshly-minted paper you have then the more economic growth you will have.

QED. Or as the Latin scholars say, Quod Erat Demonstrandum.

And yet is never has been demonstrandum.

This is perhaps the single most important thing to understand about economics in the age of paper money: their faith-based conviction that credit growth in and of itself drives economic growth. It is held by modern macro types almost as a religious fixation, immune to criticism ever since postulated by the Master.

It’s what’s behind all the efforts ever since this Great Recession began to “kickstart” economies by lowering, lowering, ever-lowering interest rates --- lower them enough, credit growth will take off, and economic growth will be sure to follow. That’s what wil happen, they assure us.

But it hasn’t. In fact, it never has happened liked that.

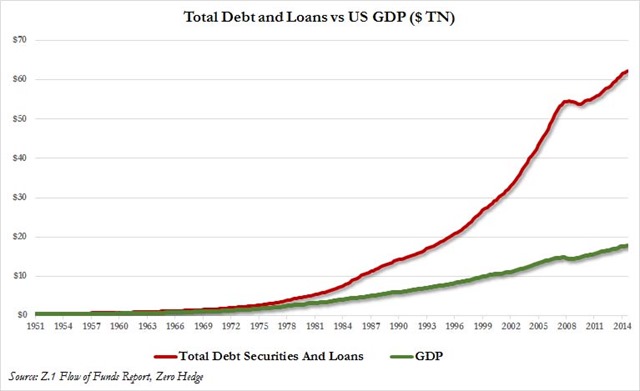

In 1971, in the US, the ratio of total credit to GDP was 150%. Now it is 354%. In other words, credit has been growing much more rapidly than the economy for the past four decades.

You think, maybe, these boys may have ever read about something called diminishing returns? Because even with a measure of growth that juices up spending, which is all that GDP really measures, they still can’t get their gimmick to really achieve take-off. Not in the US. Not in China. Not in Japan. Not in Europe. Not in New Zealand (where credit is growing at a rate of between 6-10% per year, and growth by their measure by something around a quarter of that). And the more they try to juice things up, the more fragile they make the system – and the more that rapidly growing debt bubbles up in all the places that it shouldn’t.

Like our over-heated housing market.

Here’s what a busted theory looks like:

If their creation of counterfeit capital causes anything, then it’s not growth but booms and bubbles and all their inevitable busts (with the credit-to-GDP gap rising significantly before every bust):

Do you think these boys ever read anything about malinvestment?

Frankly, friends, when real sustainable growth really does happen, it happens despite these morons, not because of them.

But as the theory is seen to be holding less and less water, instead of questioning their incantation – more counterfeit credit, more economic growth -- the modern macro types in positions of central-banking power instead have just kept right on lowering interest rates until things pop. Lower, and lower, and lower, impervious to all the damage they’ve been doing, right on down until interest rates in some parts of the world are now negative. Below zero. Past the quantum limit. Out there past the speed of light. Boldly going where not even another central banker had historically gone before.

This really is uncharted economic territory, and we’re out there without even a hard-money lifeboat to save us. Negative interest rates mean that you now pay banks to hold your paper money. Savers now pay them interest to look after it.

But as more and more central bankers take the plunge into negative interest rates, they’re discovering that it’s still not working [listen to AUDIO] and with no other tinking from their tatty textbooks to try, they’re just going to keep doubling, down, down, and ever further down.

What do you think that will do to the rate of saving – out of which comes genuine credit creation?

What do you surmise that will do to savers themselves? and to pension funds dead-set reliant on passive income?

What do you think that will do in the long run, or even the medium run when we’re all still far from dead, to the economic expansion these modern macro morons say their creation of phoney credit is trying to encourage?

Real credit creation comes not from thin air but from the pool of real saving – the saving that Grandmaster Keynes said wasn’t necessary. The saving that sets aside real resources for productive future use, instead of being consumed now.

But that’s the very saving the phony credit-creation discourages – and is ever-more discouraging as interest rates sink ever lower into negative territory.

When do you think these morons will begin questioning their faith? Because you can’t create savings or growth just by printing more money.

.

No comments:

Post a Comment