I see, as you’ve probably seen, that Governor Graham Wheeler issued a new diktat this morning on interest rates. The central planner’s central banker has decreed that the price at the heart of our alleged market economy should be made to drop to the lowest level in all human history.

Why?

In his pursuit of what they allege to be “price stability.” Because, they say, “the general price level” is rising insufficiently to be healthy. Because this price stability demands that the money the central banker has been pumping into the system at around 8% every year is still insufficient to get lift-off in the measure they maintain for money’s inflation. It must go higher they say!

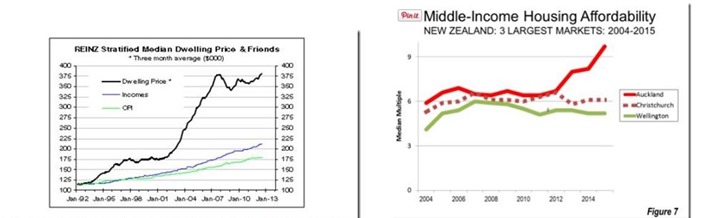

Inflation? Price stability? These bozos can’t even measure inflation – and while they bewail the dangers of “low inflation” (the numbskulls) they’re blind to the phenomenon of rocketing asset prices, and exploding house prices, both caused by their own inflation of the money supply bubbling out to cause havoc. Yet they still purport to believe that the price inflation of their monetary inflation is too low to be healthy, so let us all have some more.

No, folks, this is not inflation. How so? Because Uncle Graham says so.

It’s not because they’re stupid, these smart people. It’s because they’re still in thrall to a Keynesian idea that is.

They do this because they still genuinely believe, via that dead economist, that credit growth causes economic growth—specifically, that bank-created credit growth causes real and sustainable economic growth. This belief lingers despite the gobs of phony credit spewed out worldwide in the form of QE, ZIRP and NIRP returning less and less growth every time the credit spigot is uncorked, and the ever-inceasing amounts uncorked here showing returns only in the ever-inflated prices of houses, shares and other asset classes.

Yet this is not even real capital being lent out. It is counterfeit capital. “Capital in the form of credit is normally and, certainly, properly, extended out of previously accumulated savings,” explains George Reisman. “In sharpest contrast, credit expansion is the creation of new and additional money out of thin air, which money is then lent to business firms and individuals as though it were a supply of new and additional saved up capital funds. Its existence serves to reduce interest rates and to enable loans to be made and debts to be incurred which otherwise would not have been made or incurred.”

The loans are increasing. The debts are ballooning. Asset prices and house prices are exploding. The fragility is mounting. And the Governor blinds himself to the reality, and decrees that we must have more.

It is insane.

RELATED POSTS & STORIES:

- “Cheap money! If you can get it. What we now have is a segregated credit regime in which many – ie younger, poorer people – can’t borrow because the loan-to-value ratios prevent them from doing so, but those who can access it – i.e., those with equity – have never been able to borrow at better rates.”

Low for some – DIM POST - “Moreover, the Reserve Bank's target range for inflation is 1-3 per cent, which implies that very low inflation and deflation are undesirable. The Reserve Bank, therefore, foreshadowed a further cut to the nation's base interest rate, the official cash rate, in an attempt to boost inflation.

“Before trying to solve a problem, though, we need to be sure the problem actually exists. Is inflation actually too low?”

New Zealand does not need more inflation – Fergus Hodgson, NZ HERALD - “’Instead of furthering the inevitable liquidation of the maladjustments brought about by the boom during the last three years, all conceivable means have been used to prevent that readjustment from taking place; and one of these means, which has been repeatedly tried though without success, from the earliest to the most recent stages of depression, has been this deliberate policy of credit expansion. ...

“’To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection--a procedure that can only lead to a much more severe crisis as soon as the credit expansion comes to an end. ...

“’It is probably to this experiment, together with the attempts to prevent liquidation once the crisis had come, that we owe the exceptional severity and duration of the depression.

“’We must not forget that, for the last six or eight years, monetary policy all over the world has followed the advice of the stabilisers. It is high time that their influence, which has already done harm enough, should be overthrown.’”

"Price Stability" is Chaos – NOT PC, 2012 - “So after five years of monetary policy pursuing growth at any cost, the Reserve Bank will again be pursuing price stability, the very policy that helped cause the bust…”

The Fateful Wish for Price Stability – NOT PC, 2014

.

No comments:

Post a Comment