It’s said that houses in Auckland are unaffordable because the city is growing, and higher prices are an inevitable outcome of high growth.

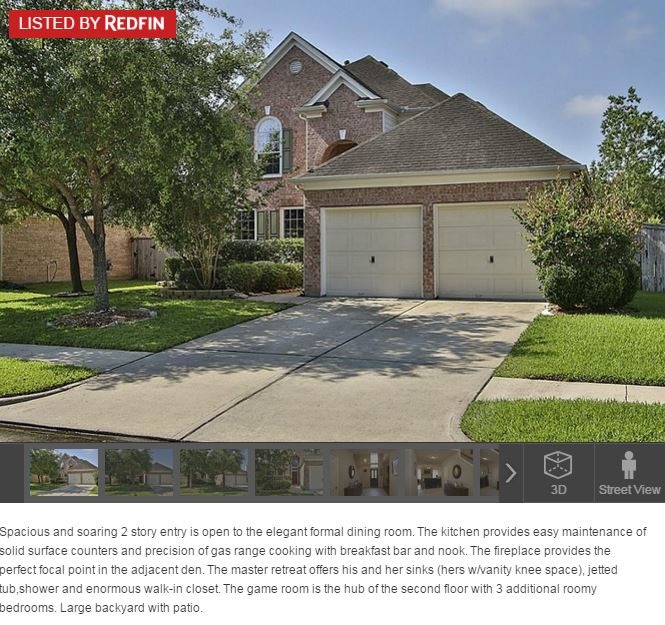

But surely that’s nonsense. Look, if you’re quick you can buy this home for just NZ$320,000:

But there is a catch. The house is in Houston. And while Houston is growing rapidly, and in the last year prices have certainly started to climb as the population grows, they are climbing from a very low peak.

While you'd be hard pressed to find decent building land in Auckland at the minute for under $400,000 a lot, in America at the moment the media section price has just gone up to US$45,000. Gone up! And this is a new record median – prices growing because across the country there is a “scarce supply of developed land.” The story is the same here, but the prices are very, very different. (Just for the record, TradeMe presently has just fifty sections selling for that sort of figure.)

So America’s “new record” median is six to ten times ours. And in several successful and growing North American cities -- cities like Atlanta, Houston, Raleigh,Columbus, Ottawa -- you can still buy an average house for just over three times the average income there, the same affordable median-multiple that New Zealand cities once enjoyed.

Just for reference, in Auckland at the moment, let me remind you, the average house now costs nearly ten times the average income.

Ten times!

There are American cities that have prices as ludicrous as ours. But the difference between these five successful cities and those other cities – and between these five successful cities and us -- is that land supply in the more affordable cities lacks major constraints. When population and monetary demand grows, so too does the land supply. The difference in Auckland is that it hasn't.

So the story is not that growing cities are unaffordable cities.

The story is that unaffordable cities are generally cities that are constrained from expanding.

.

.

2 comments:

Could you please clarify for me why the above USA cities aren't experiencing the effect of oodles of printed money sloshing about, that are having an effect in NZ. {Asked in the most pleasantist voice}

Peter

They probably are, but I'd wager a guess that the money sloshing around is being spent on building new housing, rather than "flipping" existing housing, thereby increasing the housing stock and maintaining a fairly low rates of price increases.

Just a guess though, and happy to be proven wrong.

Post a Comment