So the supposedly politically independent Reserve Bank has clamped down on lending to investors in the housing market “after [says the Herald] Prime Minister John Key expressed frustration about the Reserve Bank's response to rising house prices, saying that it should not need any more time to investigate stricter rules for property investors and should ‘just get on with it’.”

This is allegedly to fix rampant house-price inflation caused by these out-of-control property investors flooding the market. The bastards.

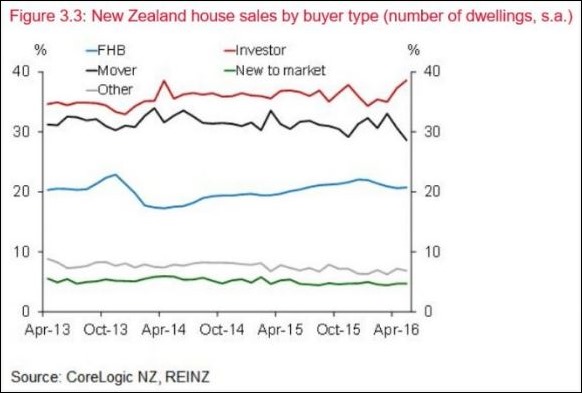

And yet, over the last two years, as house prices climbed by arund 8 to 10 percent per year and the total paper value of NZ housing stock rose from 3.2 time GDP (in 2014) to over four times GDP (as reported just this week), the Reserve Bank’s own figures shows the percentage of property investors has … remained almost exactly the same:

Graph from the Reserve Bank Deputy Governor’s speech on 7 July this year

So someone’s telling fibs here.

And not just about the political independence of the Bank.

.

4 comments:

Croaking Cassandra

"Reserve Bank on housing – still all over the place"

You've most likely read this blog [linked above] by ex Reserve Bank employee. Pretty unflattering.

He comments that the RB is interfering outside their allotted tasks, and doing so poorly. Also gives a graph that shows that "In fact, plenty of places in New Zealand have real house prices today materially lower in real terms (and sometimes in nominal terms) than they were in 2007. { Here is an illustrative chart from the QV data} "

Peter

What arrangements that people make with their banks is their business ,no one else's. When gov't dictate the terms of engagement between private entities,then that is the the heavy hand of gov't dictating to the people how they are to live their lives, riding roughshod over individual and property rights.Communism in drag. This 40% minimum deposit is a round about way of price fixing, trying to effect an outcome they think is desirable. Will this help the housing crisis.? Can't see it, but wait for the unforeseen and unintended consequences. How long will it be before gov't meddling will turn the Auckland housing boom into a crash

Until you stop welfare, super, and the accomodation benefit - this problem will never be solved.

Stop that and the problem will go away overnight.

Morgan finds his housing scapegoat, or one of them:

"The second policy-induced distortion to the property market is the lack of tax on the full return that property owners enjoy. Yes they are taxed if they rent their property out. But they are not taxed on the benefit they get from enjoying the use of the property themselves – and that is a massive benefit that becomes even more massive if part of it manifests in long-term (also tax free) capital gain. The Government Statistician recognises (as all Government Statisticians do) that the benefit you enjoy from owning your own property is income – as much as income you enjoy from earning interest on a bank account is income. The latter is taxed, the former is not. Which is why some of us have been pushing for the imputed rent on owner occupied assets to be taxed – each and every year."

Correct me if I'm wrong, but is he saying that people should be taxed simply for living in their own house?

Post a Comment