After Gareth Morgan managed to sell his failing Kiwisaver to scheme to a government department, he graduated to generally telling lies for a living – and employing others to tell them on his behalf.

One such entity burst into print yesterday, telling the country on his employer’s behalf that

German house prices have been flat (in real terms) for the past 30 years, while over the same time ours have increased by 150%. This despite the fact that Germany is the one of the most successful economies in the world and their per capita incomes have risen faster than those of New Zealanders.

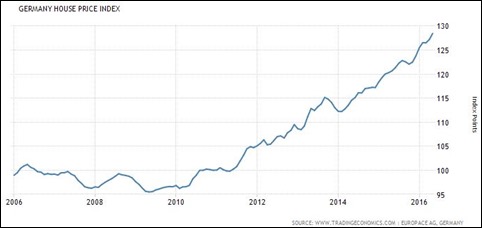

Unfortunately, the graph is a lie. Certainly, it shows the New Zealand housing bubble fairly faithfully. But consulting this German house-price index, instead of Gareth’s lapdog’s, shows that real house prices in German cities have not been flat at all in recent years – rather, they have increased by 46% since 2007, rising faster than rents and incomes. [“The quantitative easing programme by the European Central Bank, worth about US$65 billion per month, is fuelling fears of housing price bubbles in several European countries – with Germany, Norway and the U.K. most at risk….”]

Does that look flat to you?

Sure, it’s not as precipitate as our own local bubble (just check that scale), but it does not tell the story Gaweth’s minion would like it to (which is essentially that government should meddle more in the market, rather than less—which is to say, Gaweth’s own preferred policy settings.) And rather than the flat line showed by the minion, if we extend the story out a few more years, back to German reunification in 1990 (which the minion doesn’t mention) we see both decline and increase.

So the story is nothing like the one the minion makes known. (Just file that knowledge away next time you hear Captain Morgan bellowing his strandard bullshit around the usual channels.)

This is not to say that house prices should not be either flat or gently declining over time (they should), nor that there is nothing to learn from German housing. There is: They are still generally cheaper to buy than many other places in the west (“on figures cited in 2012 by the British housing consultant Colin Wiles, one-bedroom apartments in Berlin were then selling for as little as US$55,000, and four-bedroom detached houses in the Rhineland for just US$80,000. Broadly equivalent properties in New York City and Silicon Valley were selling for as much as ten times higher.”)

One of the reasons for the decline certainly is political: It followed the reunification in 1990 of the socialist East- with the semi-capitalist west Germany.

During the time of the socialist GDR housing was part of dictatorship government. They built the so called "Plattenbauten", large flat houses with hundreds of small flats, while the old housing inside the cities couldn't be renovated because of governmental price control on the rents. The rent income couldn't cover the costs for repairs nor paint. After the fall of the wall, there was a time when they adapted the governmental controlled rents to reasonable rents. A lot of people of the western part of Germany bought properties in the eastern part and got subsidies for renovating all the degenerated extremely cheap houses. But because of the people's migration to the west, a lot of houses couldn't be rented out, prices decreased and a lot of property owner got broke. But this applies only for the eastern part of Germany.

During the last years the property prices increased by 46%, esp. in cities like Munich, Hamburg, Berlin, Stuttgart...

Left-state governments try to keep the rents low by governmental price control. But it is easy to see to where it will lead.

And “a prominent critic of America’s latter-day enthusiasm for doctrinaire free-market solutions” is still forced to conclude that

a key to the story [of generally cheaper housing] is that German municipal authorities consistently increase housing supply by releasing land for development on a regular basis… housebuilders [as a result] rarely accumulate the huge large land banks that are such a dangerous distraction for U.S. housebuilders like Pulte Homes, D. R. Horton, Lennar, and Toll Brothers. German housebuilders just focus on building good-quality homes cheaply, secure in the knowledge that additional land will become available at reasonable cost when needed.

Mind you, that critic actually bothered to research his story properly.

Because if you do, you do find in the critic’s account at least two real lessons for reducing rocketing New Zealand house prices: the first (as mentioned above) is to to allow land onto the market rather than restrict it; the other has been promoted here by the NZ Initiative, that local councils (as long as they hold the whip hand) need to share in the economic benefits of new housing. Both encourage supply, rather than restrict it.

That, really, is the “ultimate driver.”

.

No comments:

Post a Comment