There are plenty of reasons to reject the consensus that Brexit will be costly to the UK’s economy, says Isaac Tabner.

The shock and horror at the Brexit vote has been loud and vociferous. Some seem to be revelling in the uncertainty that the referendum result has provoked. The pound falling in value, a downturn in markets – it lends credence to the establishment’s claims before the referendum that a Leave vote would lead to economic Armageddon.

We were told that the consensus of economic experts were overwhelmingly opposed to a Brexit. Lauded institutions – from the IMF, OECD to the Treasury and London School of Economics – produced damning forecasts that ranged from economic hardship to total disaster if the UK leaves the EU. Yet 52% percent of the British electorate clearly rejected their warnings.

Something that my professional experience has taught me is that when an “accepted consensus” is presented as overwhelming, it is a good time to consider the opposite. Prime examples of this are the millennium bug, the internet stock frenzy, the housing bubble, Britain exiting the European exchange rate mechanism (ERM) and Britain not joining the euro. In each of these examples, the overwhelming establishment consensus of the time turned out to be wrong. I believe Brexit is a similar situation.

Downright Dangerous

The economic models used to predict the harsh consequences of a Brexit are the tools of my profession’s trade. Used properly, they can help us to better understand how systems work. In the wrong hands they are always downright dangerous. The collapse of the hedge fund Long-Term Capital Management in 1998 and the mispricing of mortgage-backed securities leading up to the 2008 financial crisis are just two of many examples of harmful consequences arising from the abuse of such models.

The output of these often highly sophisticated models depends entirely upon the competence and integrity of the user. With miniscule adjustment, they can be tweaked to support or contradict more or less any argument that you want.

The barrage of dire economic forecasts that were delivered before the referendum were flawed for two main reasons. First, they failed to acknowledge the risks of remaining in the EU. And second, the independence of the forecasters is open to question.

Let’s start with the supposed independence of the forecasting institutions. While economists should in theory strive to be independent and objective, Luigi Zingales from the University of Chicago provides a compelling argument that, in reality, economists are just as susceptible to the influence of the institutions paying for their services as in other industries such as financial regulators.

Peer Pressure

Another challenge faced by economists is presented by the nature of the subject matter. Economics is a social science which, at its heart, is about the psychology of human social interactions. Many models try to resolve the difficulties that human subjectivity causes by imposing assumptions of formal rationality on their models. But what is and is not rational is subjective. In further recognition of this difficulty the sub-discipline of behavioural economics has evolved.

When you put the current level of volatility in context of other shocks, market conditions are not as bad as they might seem.

Herding is a concept that has been used to rationalise financial market bubbles and various other behaviour. It describes situations in which it seems rational for individuals to follow the perceived consensus. Anyone who has found themselves in a position where the majority of their company has a radically different view to their own will have experienced the difficulty of standing out from the crowd.

In 2005-06, various people (including myself) presented the view that UK house prices would crash. While some audiences were sympathetic, the majority view at the time was both hostile and derisory. Challenging the received wisdom exposes you to feelings of isolation.

Received wisdom among academia has been that the EU is a force for good that should be defended at all costs. Respected colleagues are incredulous that anyone with their education and professional insights could think otherwise and remain part of the academic “in” crowd. In such an environment, it is very difficult to challenge this orthodoxy.

I – and the bulk of the UK population – might have been convinced by the pro-Remain economists if they had been a little more honest about the limitations of their models, and the risks of remaining inside the EU.

Market Reactions

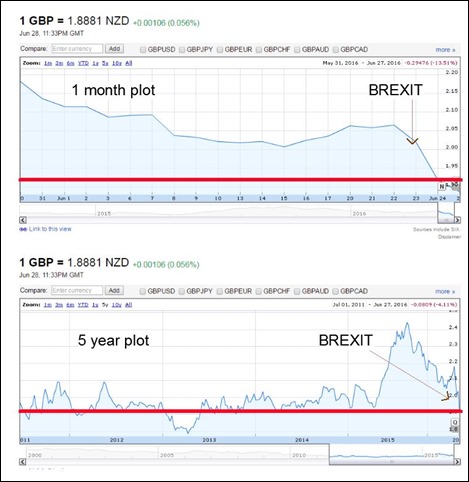

Despite reports of markets crashing following the Brexit result, when you put the current level of volatility in the context of a wider time period (above) and of other shocks, market conditions are not as bad as they might seem. The FTSE 100 is still higher than it was barely two weeks ago and the more UK-focused FTSE 250 is currently higher than it was in late 2014. This is the kind of volatility that markets see two or three times a year.

The volatility index for the US S&P, known as the VIX or the “fear gauge”, is what is widely used to measure how uncertain global financial market participants are about the outlook for stocks. When the Brexit result was first announced, the VIX moved sharply, but has since settled in the mid-20s. To put this in context, the all-time average is 20.7, the all-time closing low is 8.5 and the all-time closing high on Black Monday in 1987 was 150. More recently during the financial crisis, it reached a closing high of 87.2 in November 2008.

VIX volatility chart. CBOE

VIX volatility chart. CBOE

Other financial indicators also moved rapidly as the referendum results came through. On the face of it, the Japanese market suffered a severe shock falling almost 8%. However, the 8% fall in the Japanese stock market is almost exactly matched by an 8% gain of the Japanese yen relative to the pound. Therefore, the net effect for UK-based investors in Japanese equities is close to zero.

The fall in the value of the pound following the Brexit result is also not as bad as it may first appear, not when seen in a wider context. The size of the fall was exacerbated especially by the previous day’s assumption that Remain would win, by the scare-mongering that was put about by the Remain team before the vote – and by the six-month high the pound hit in the week before the vote…

There is also precedent for a dramatic fall – after the ERM crisis – which proved beneficial for many British exporting companies and arguably helped sustain the economic recovery of the 1990s.

A lower pound benefits companies that add most of the value to their products inside the UK, and companies that sell their produce on international markets. This includes exporters like pharmaceutical company GlaxoSmithKline, drinks company Diageo and technology company ARM – all of which saw stock price gains on the morning after the vote. Companies that rely on imports or who add little value within the UK will be hardest hit in the short term as they adapt to the exchange-rate volatility.

There will undoubtedly be winners and losers from the UK’s decision to leave the EU. [Winners and losers who would not be so in a system of fixed-exchange rates* – Ed.] But indexes for volatility are already lower than they were in February this year, suggesting that (unlike those who comment upon it) these markets are not abnormally worried about the outlook, and UK government borrowing costs are at an all time low. This is further reason to reject the pre-referendum consensus that Brexit would bring economic doom.

Isaac Tabner is a Senior Lecturer in Finance at the University of Stirling.

This post previously appeared at FEE, where it was reprinted from The Conversation.

* F.A. Hayek: “[F]lexible exchange rates preclude an efficient allocation of resources on an international level, as they immediately hinder and distort real flows of consumption and investment. Moreover, they make it inevitable that the necessary real downward adjustments in costs take place…in a chaotic environment of competitive devaluations, credit expansion, and inflation…

“I do not believe we shall regain a system of international stability without returning to a system of fixed exchange rates, which imposes on the national central banks the restraint essential for successfully resisting the pressure of the advocates of inflation in their countries — usually including ministers of finance.”

RELATED POSTS:

- "The political and financial establishments of Europe and the United States were taken by almost total surprise and sent into apparent shock when 52 percent of the voters in the United Kingdom chose for their country to leave the European Union (EU). But it is not the end of the world as we know it, and can be a positive sign and example of opposition to unrepresentative and centralized bureaucratic control over people’s lives."

The Future of the UK After Leaving The EU: Capitalism or Socialism? – CAPITALISM MAGAZINE - “The EU grew out of attempts that began in the 1950s to establish a free-trade zone among a number of western European countries. But soon the free-trade idea was superseded by various interventionist programs for intergovernmental planning of agriculture and industry, and for a welfare-state social safety net.”

The European Union and the Interventionist State – Richard Ebeling, FEE - “Rather than engaging with those who voted to leave the EU, young people, and their sad cheerleaders among middle-aged Remain journalists, have sought to demean and degrade a large section of the voting public not just for disagreeing with them, but also for being old.”

After the referendum, the ugly scourge of ageism – Ella Whelan, SPIKED - “The Brexit vote was not ‘anti-immigrant,’ racist, or xenophobic, the Brexit vote was all about: ‘an internationalist, global Britain, a more deregulated Britain, a freer Britain, and a more Democratic Britain, one that is interested and engaged with the affairs every continent, including Europe.’”

Brexit: Prelude to A Freer, More Democratic, More Internationalist Britain – Roger KImball, PJ MEDIA - “So the debate is between a cuddly "soft exit" and a bracing "hard exit" from the EU. I'm hoping for the former. It's entirely doable given the will. In the meantime, I'd like the UK to adopt unilateral free trade and get deals in place with the likes of Canada, Australia, NZ, US, etc. Time to crack on, be confident. Also, the divisions are opening between those (like me) who want the UK to adjust its relationship for genuinely liberal, pro-enterprise reasons, and those who did so for nationanlistic, protectionist ("keep out those foreigners and save `our NHS'" types). This is arguably the fault-line in UK politics that will be the main one to watch in the years ahead. We may even see new political coalitions and parties. It reminds of when the Corn Laws were abolished in the 1840s, paving the way for the eventual rise of the Liberal Party under Gladstone.”

~ Tom Burrroughes - “"The first is the press’s peculiar belief that the “Leave” side won because its voters are stupid and impetuous, and because they don’t know what’s good for themselves – an attitude that has been well illustrated by the insistence that British voters took “frantically” to googling “what is the EU?” once the results had become clear. From the start, the implication of the coverage has been that, devastated by the news that they had actually prevailed, the moronic advocates of Brexit elected finally to do some reading.

"In truth, this whole line is nonsense. As 538’s Ben Casselman has pointed out, people also googled “who is Mitt Romney” after he lost to Barack Obama in 2012. Should that be taken as a sign of regret? Hardly, no. Not only do we not know who is doing the googling (it could be Remain voters, it could be Leave voters, it could be non-voters; nobody knows), but, as Gedalyah Reback of Geektime notes, this is what voters do in the wake of momentous political events. Moreover, it turns out that the supposed “frantic” “spike” in interest was caused by just 1,000 people.”

The Media’s Disgraceful Brexit Meltdown – NRO - "To people who think that the sky is falling for Britain, consider this from George Friedman of Geopolitical Futures:

"The EU, Not Britain, Is the Weaker Player.’

“Obviously, nothing will happen in the immediate future. But it is not clear to me that there will be any real economic blowback. The UK is not Greece. Attempting to shun the British carries heavy potential consequences. Anything imposed on the British will resonate on the Continent. And Germany—which gets almost 50% of its GDP from exports—is not likely to let anyone hinder that trade."

This week in geopolitics – MAULDIN ECONOMICS - “The message is that the EU promise of a unified collection of states, under one market and one currency, has morphed into a failed centralized bureaucratic political system, mired in red tape and red ink. If Britain goes, the power base of the EU might follow.”

Don’t be bamboozled, Brexit creates huge opportunities for the U.K. – Terence Corcoran, FINANCIAL POST - “The BBC’s desperate shilling for Remain will come under increasing scrutiny as we exclusively reveal that the supposed ‘popular petition’ for a second referendum – wholly illegal and unworkable, and unprecedented in British history – is a prank by notorious sh*tposters 4 Chan.”

Brexit ‘2nd Referendum Petition’ A 4 Chan Prank: BBC Report It As Real – HEATSTREET - “The leftist media (which is 95% of the so-called mainstream media), and their crony politicians and intellectuals are whining that Britain’s decision to leave EU is a massive disaster for the entire human race. These supercilious know-alls are completely wrong.

“On the day of #Brexit news, I had predicted in a comment in this group that Britain leaving the EU is actually very good development for the markets, and that the markets will recover in less than 15 days.

“Well, the markets seem to have recovered already from the so-called #Brexit results. So my prediction was spot-on. :-)

“#Brexit is not a disaster. How can freedom from a socialist organisation like EU, which is full of climate change charlatans and is being led by an expansionist Germany, be a disaster?

“The ‘real’ investors understand that Brexit is a good thing for the markets, because now that Britain is free from EU, it has better chances of reforming its economy. Hopefully Britain’s exit will inspire other EU countries to set themselves free, and the final unravelling of the EU will put an end to the proposal for creation of such entities in other parts of the world.

“Stock markets can fall again, but they will never fall due to #Brexit.”

~ Anoop Verma, post to FOR NEW INTELLECTUALS

1 comment:

All that really matters is whether the EU permits the city to keep their "passports" that permit trading in Euro financial instruments. This decision will not be made rationally, but politically - depending on whether the EU wishes to regulate to drag that business back to the continent.

I find it hard to believe that a communist country will offshore so much of its economy to a capitalist subsidiary state that has just left. The EU will cancel the "passports" and that shuts down the city, and that's something like 10% of the economy, so 10% of jobs and 10% of tax receipts.

Post a Comment