Economic activity versus economic growth

Guest post by Steven Horwitz

Even the smartest of economists can make the simplest of mistakes. Two recent books (Violence and Social Orders by Douglass North, John Wallis & Barry Weingast, and Why Nations Fail by Daron Acemoglu & James Robinson) both suffer from misunderstanding the concept of economic growth. Both books speak of the high growth rates in the Soviet economy in the mid-20th century. Even if the authors rightly note that such rates could not be sustained, they are still assuming that the aggregate measures they rely on as evidence of growth, such as GDP, really did reflect improvements in the lives of Soviet citizens. It is not clear that such aggregates are good indicators of genuine economic growth.

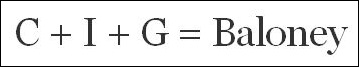

These misunderstandings of economic growth take two forms. One form is to assume that the traditional measurements we use to track economic activity also describe economic growth, and the other form is to mistake the production of material things for economic growth.

What GDP does not distinguish, however, is whether the exchanges that are taking place — even the total quantity of final goods — actually improve human lives.

That improvement is what we should be counting as economic growth. Two quick examples can illustrate this point.

First, nations that devote a great deal of resources to building enormous monuments to their leaders will see their GDP rise as a result. The purchase of the final goods and labour services to make such monuments will add to GDP, but whether they improve human lives and should genuinely constitute “economic growth” is much less obvious. GDP tells us nothing about whether the uses of the final goods and services that it measures are better than their alternative uses.

Second, consider how often people point to the supposed silver lining of natural disasters: all the jobs that will be created in the recovery process. I am writing this column at the airport in New Orleans, where, after Katrina, unemployment was very low and GDP measures were high. All of that clean-up activity counted as part of GDP, but I don’t think we want to say that rebuilding a devastated city is “economic growth” — or even that it’s any kind of silver lining. At best, such activity just returns us to where we were before the disaster, having used up in the process resources that could have been devoted to improving lives.

GDP measures economic activity, which may or may not constitute economic growth. In this way, it is like body weight. We can imagine two men who both weigh 250 pounds. One could be a muscular, fit professional athlete with very low body fat, and the other might be on the all-Cheetos diet. Knowing what someone weighs doesn’t tell us if it’s fat or muscle. GDP tells us that people are producing things but says nothing about whether those things are genuinely improving people’s lives.

The Soviet Union could indeed produce “stuff,” but when you look at the actual lives of the typical citizen, the stuff being produced did not translate into meaningful improvements in those lives.

Improving lives is what we really care about when we talk about economic growth.

The second confusion is a particular version of the first one. Too often, we think that economic growth is all about the production of material goods. We see this in discussions of the US economy, where the (supposed) decline of manufacturing is pointed to as a symptom of a poorly growing economy. But if economic growth is really about the accumulation of wealth — which is, in turn, about people acquiring things they value more — then material goods alone aren’t the issue. More physical stuff doesn’t mean that the stuff is improving lives.

More important, though, is that what really matters is subjective value. The purchase of a service is no less able to improve our lives, and thereby be a source of economic growth, than are the production and purchase of material goods. In fact, what we really care about when we purchase a material good is not the thing itself, but the stream of services it can provide us. The laptop I’m working on is valuable because it provides me with a whole bunch of services (word processing, games, Internet access, etc.) that I value highly. It is the subjective satisfaction of wants that we really care about, and whether that comes from a physical good or from human labour does not matter.

This point is particularly obvious in the digital and sharing economies, where so much value is created not through the production of stuff, but by using the things we have more efficiently and precisely. Uber doesn’t require the production of more cars, and Airbnb doesn’t require the production of more dwellings. But by using existing resources better, we create value — and that is what we mean by economic growth.

So what should we look at instead of GDP as we try to ascertain whether we are experiencing economic growth?

- Look at living standards: of average people, and especially of poor people.

- How easily can they obtain the basics of life?

- How many hours do they have to work to do so?

- Look at the division of labour.

- How fine is it?

- Are people able to specialise in narrow areas and still find demand for their products and services?

Economic growth is not the same as economic activity. It’s not about just making more exchanges or producing more stuff. It’s ultimately about getting people the things they want at progressively lower cost, and thereby improving their well-being. That’s what markets have done for the last two centuries. For those of us who understand this point, it’s important not to assume that higher rates of GDP growth or the increased production of physical stuff automatically means we are seeing growth.

Real economic growth is about improving people’s subjective well-being, and that is sometimes harder to see even as the evidence for it is all around us.

Steven Horwitz is the Charles A. Dana Professor of Economics at St. Lawrence University and the author ofMicrofoundations and Macroeconomics: An Austrian Perspective, now in paperback.

A version of this article appeared at FEE.

2 comments:

Perhaps instead of talking about "economic growth" -- because what exactly is growing? -- it would be better to talk about economic *progress*, as Ludwig Von Mises did:

'We call a progressing economy an economy in which the per capita quota of capital invested is increasing. In using this term we do not imply value judgments. We adopt neither the "materialistic" view that such a progression is good nor the "idealistic" view that it is bad or at least irrelevant from a "higher point of view."

'Of course, it is a well-known fact that the immense majority of people consider the consequences of progress in this sense as the most desirable state of affairs and yearn for conditions which can be realized only in a progressing economy.'

Where I live are legions of bureaucrats administering largess to an equal quantity receivers. Out of a population of around 2000, I'd guess only 10% are producing something (out of the ground). I hear people here say that the town has never enjoyed so much business activity since the height of the mining boom round 2 years ago when the population was 4000. Millions of (tax & borrowed) dollars + bureaurats + beneficiaries = what must be brilliant GDP numbers. All is well, for ever and ever, Amen. Suzuki

Post a Comment