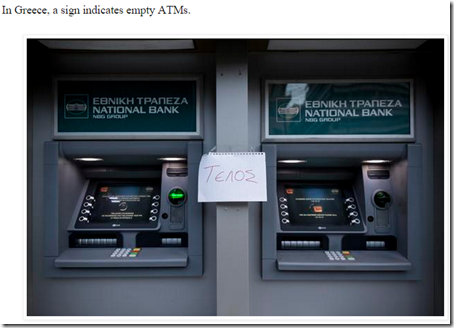

How was your weekend, people? This is how Greeks ‘spent’ theirs (ho ho): Queuing for currency:

Why?

And all that excrement is finally hitting the fan.

And even a paper Euro looks like hard currency compared to the softness of paper drachmas. Not to mention the feel of real hard assets – even if you have to queue to get your hands on them.

Take note: This is not just a run on a single bank. This is a run on all of them. This is a run on a whole future currency.

And the time-honoured response to a run on a currency based only on debt? A “bank holiday.” Right on cue, after a week of denail, Greek Prime Minister Alexis Tsipras announced that he was closing all banks “as a way to stemming the tide.”

“In real life, a holiday means to have time off work and have fun. In the world of banking, a holiday means to rob the customer as a way of keeping a bankrupt system afloat.”

No coincidence it’s happening on the weekend before the Greek gov is suppose to pay back $1.7B to the IMF, possible only by another bailout to pay back those extended previously, and Prime Minister Alexis Tsipras announced a surprise referendum on terms for future bailouts.

Advice to Tourists: If You Go To Greece, Bring Plenty Of Cash.

Advice to Greeks: Stop borrowing just to repay previous borrowing. Stop borrowing for consumption. Start producing value.

***The story with most economic crises is similar: everything looks fine until it isn’t.***

RELATED, AROUND THE TRAPS …

- “Our lens suggests that the very low interest rates that have prevailed for so long may not be “equilibrium” ones, which would be conducive to sustainable and balanced global expansion. Rather than just reflecting the current weakness, low rates may in part have contributed to it … “

Bank For International Settlements (BIS) Slams Keynesian Money Printers…….Again! - “Angela Merkel … drives the rickety machinery of the misbegotten eurozone superstate toward “a solution before the markets open on Monday.” Those eight words are the heart of the statist catastrophe which is now engulfing the world economy.”

Message To Merkel: Shut-Up Und Setzen Sie Sich! - “Because if indeed the ECB were to pull the carpet from under Greece as it hinted it would do on Tuesday when the Greek program runs out, when it froze the Greek ELA despite the ongoing Greek bank run, it would promptly set off a chain of events that would not only crush the Greek banking system but destroy any credibility Greek sovereign collateral had as a state, impairing all Greek national and corporate collateral, including bonds and loans currently held by the ECB, to zero.”

The ECB Suddenly Has A Huge Headache On Its Hands - “So why worry about a little turmoil at the foot of Olympus?”

The Test Of Central Bank Omnipotence May Be Upon Us - “While seen by some observers as end-point to a failed crisis resolution, I will argue that it should be the beginning of a new dialogue, building on the difficult lessons of the past years and using the new institutions and possibilities in place within the Eurozone. Whether Greece stays in the Eurozone or leaves it, is only one of several important decisions to be taken in Athens … “

Greece – the day after: Time for a fresh start? - “The goings on in Greece should be the last of any Aussie investor’s worries. Because at home, things look set to get a whole lot worse…”

The Aussie Crisis That’s Bigger Than Greece… - “These stories are related in a number of ways, the most important being that they’re examples of governments messing with markets that they don’t understand and therefore have no business trying to manipulate.”

On Monday, It’s China Versus Greece - “While Greece has understandably been the focal news event over the weekend - after all it has been 5 years in the making - let's not forget that in another massive move, one geared squarely to prevent a market collapse and to avoid even further panic, the Chinese central bank cut both its policy rate and the reserve rate in a dramatic push to calm down markets after a 10% crash in just two trading days.

“Which, incidentally, shows that after the Fed, the BOE, the SNB, the BOJ and the ECB, the PBOC is the latest bank to have cornered itself in a world where it must inflate the bubble at all costs or face the dire consequences. What consequences? Nomura explains … “

A Helpless China Tips Its Hand: A Market Crash "Poses Great Danger To Social Stability" - “1. GDP growth of 7% w/profit growth of 0.6%=really bad managers or 2. GDP growth not really 7%. Choose 1 or 2

#China … Let’s not forget that the Greece story may end up as relatively small by comparison.”

China comparison of the day

1 comment:

And all that excrement is finally hitting the fan.

Post a Comment