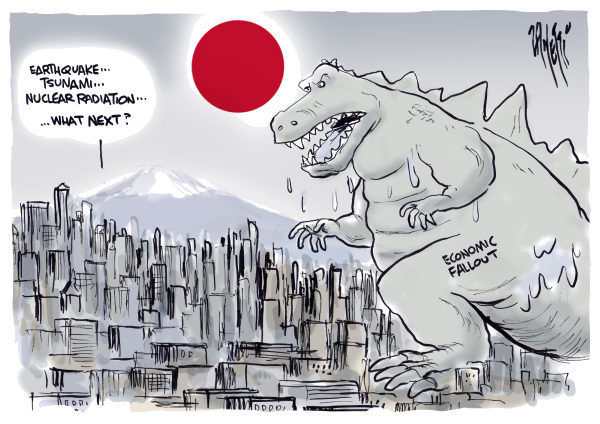

The Berlin Wall hasn’t been the only near-scientific experiment in recent decades testing political and economic ideologies to destruction. As Peter Schiff writes in this Guest Post, in recent years Japanese Prime Minster Shinzo Abe (pronounced Ar-Bay) has turned his country into a virtual petri dish of Keynesian ideas. The result, as even he has now had to concede -- and as has been reported many times here at NOT PC -- is a rolling economic disaster.

As Japanese Prime Minster Shinzo Abe has turned his country into a petri dish of Keynesian ideas, the trajectory of Japan's economy has much to teach us about the wisdom of those policies. And although the warning sirens are blasting at the highest volumes imaginable, few economists can hear the alarm.

Data out this week shows the Japanese economy returning to recession by contracting for the second straight quarter (and three out of the last four quarters). The conclusion reached by the Keynesian apologists is that the benefits of inflation caused by the monetary stimulus have been counteracted, temporarily, by the negative effects of inflation caused by taxes. This tortured logic should be a clear indication that the policies were flawed from the start.

Although the Japanese economy has been in paralysis for more than 20 years, things have gotten worse since December 2012 when Abe began his radical surgery. From the start, his primary goal has been to weaken the yen and create inflation. On that front, he has been a success…

The yen has fallen 23% against the dollar, and core inflation, running slightly negative in 2012, has now been "successfully" pushed up to 3.1% according to the Statistics Bureau of Japan.

But there is no great mystery or difficulty in creating inflation or cheapening currency. All that is needed is the ability to debase coined currency, print paper money or, as is the case of our modern age, create credit electronically. These "successes" should not come as a surprise when one considers the relative size of Abe's QE program. For much of the past two years the Bank of Japan (BoJ) has purchased about 7 trillion yen per month of Japanese government bonds, which is the equivalent of about $65 billion U.S. [ref: Forbes 9/24/14, Charles Sizemore] While this is smaller than the $85 billion per month that the Federal Reserve purchased during the 12-month peak of our QE program, it is much larger in relative terms.

The U.S. has roughly 2.5 times more people than Japan. Based on this multiplier, the Japanese QE program equates to $162.5 billion, or 91% larger than the Fed's program at its height. But, according to IMF estimates, the U.S. GDP is 3.3 times larger than Japan. Based on that multiplier, Japanese QE equates to $214.5 billion per month, or 152% larger. And unlike the Federal Reserve, the Bank of Japan hasn't even paid any lip service to the idea that its QE program will be scaled back any time soon, let alone wound down. (As Charles Sizemore says on examining the data, "If you want a 'risk free' trade for the remainder of this decade, it would be this: short the yen.")

In fact, Abe's promises to do more were spectacularly realized in a surprise move on October 31 when the BoJ, claiming "a critical moment" in its fight against deflation, announced a major expansion of its stimulus campaign. (The fact that official inflation is currently north of 3% - a multi-year high, seems to not matter at all.)

At the same time the BoJ also announced its intention to roughly triple its pace of its equity and property purchases on Japan's stock market. According to Nikkei's Asian Review (9/23/14), the BoJ now holds an estimated 7 trillion yen portfolio of Japanese stock and real estate ETFs. Even Janet Yellen has yet to cross that Rubicon.

And what has this financial shock and awe actually achieved, other than 3% inflation, a weaker yen, a stock market rally, and continued international praise for Abe? Well, unfortunately nothing other than a bona fide recession and a growing threat of stagflation.

The weaker yen was supposed to help Japan's trade balance by boosting exports. That didn't happen. In September, the country reported a trade deficit of 958 billion yen ($9 billion), the 27th consecutive month of trade deficits. The deterioration occurred despite the fact that import prices rose steeply, which should have reduced imports and boosted exports. And while some large Japanese exporters credited the weak yen for easier sales overseas, small and mid-sized Japanese businesses that primarily sell domestically have seen flat sales against rising fuel and material costs.

But price inflation is not pushing up wages as the Keynesians would have expected. In August, Japan reported real wages (adjusted for inflation) fell 2.6% from the year earlier, the 14th straight monthly decline. This simply means that Japanese consumers can buy far less than what they could have before Abenomics. This is not a recipe for happy citizens.

Japanese consumers must also deal with Abe's highly unpopular increase of the national consumption tax from 5% to 8% (with a planned increase to 10% next year). The sales tax was largely put in place to keep the government's debt from spiraling out of control as a result of the fiscal stimulus baked into Abenomics. And while economists agree nearly universally that the price increases that have resulted from the sales tax have caused a sharp drop in consumer spending, they fail to apply the same logic that price increases due to inflation will deliver the same result.

Despite the bleak prospects for Japan, Abe continues to bask in the love of western investors and alleged economists. In an October 6 interview with the The Daily Princetonian, Paul Krugman, who has emerged as Abe's chief champion and apologist, responded to a question about the European economic crisis by saying "Europe need something like Abenomics only Abenomics, I think, is falling short, so they need something really aggressive in Europe." A Bloomberg article ran on November 18 under the headline "Abe's $1 Trillion Gift to Stock Market Shields Recession Gloom." So according to Bloomberg, Abenomics is not responsible for the country's fall back into recession, which hurts everyone, but it is responsible for the surging stock market, which primarily benefits the wealthy.

One wonders how much more bad news must come out of the Japanese experiment in mega-stimulus before the Keynesians reassess their assumptions? Oh wait...I'm sorry, for a second there I thought they were susceptible to logic. But those who are not blinded by left-wing dogma should take a good look at where the road of permanent stimulus ultimately leads.

Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author of six books, including How an Economy Grows and Why It Crashes, Crash Proof 2.0: How to Profit From the Economic Collapse, and The Real Crash: America's Coming Bankruptcy---How to Save Yourself and Your Country, and host of the syndicated Peter Schiff Show—and one of the few who famously predicted the collapse of the American housing bubble.

Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author of six books, including How an Economy Grows and Why It Crashes, Crash Proof 2.0: How to Profit From the Economic Collapse, and The Real Crash: America's Coming Bankruptcy---How to Save Yourself and Your Country, and host of the syndicated Peter Schiff Show—and one of the few who famously predicted the collapse of the American housing bubble. A longer version of this post can be found in Euro Pacific Capital's Global Investor Newsletter.

20 comments:

What is wrong with deflation? I keep asking but nobody can give me an answer beyond a collectivist notion that it is somehow a bad thing.

If prices fell to where they were 20 years ago surely that would be a good thing - especially for me!

Mr Lineberry you're a dumbass if you think deflation is a good thing. It's not as simple as things just getting cheaper. Basically the whole economy goes into a downward spiral. You have the internet, go see if you can find a period of historical deflation that worked out well for the country concerned.

Barry - this morning I was at Countdown and spent $137-40 on groceries; if that suddenly fell to, say, $90 due to an outbreak of deflation I am at a loss as to how that is bad! haha!

Call me all the names under the sun if you want, but because $90 is less than $137 this deflation lark seems an ideal system to me.

So many of these economist chappies seem to assume everyone knows what they are talking about, whereas I am not entirely clear on the whole deflation thing - unclear on why paying less is bad and paying more is good.

It is rather like the collectivist gasping whenever the words "Gold" and "Standard" are uttered - nobody can actually explain why a gold standard is bad (it isn't, by the way) - yet they trot out the mantra that it is.

Barry:

You are half right: Deflation punishes borrowers. But then it rewards savers. Inflation does the exact opposite. The same, but different: Some win, some lose, whichever way it goes.

It hardly creates a downward spiral, as we already see deflation in many fields (the price of Hi Def LCD TV's for a quick example) This hardly puts Harvey Norman out of business.

No, the sector that bleeds during times of deflation is the Financial sector, mostly because they have been fostering the "Borrow yourself up to your eyeballs" mentality, and have been very loose with credit.

Now, as Mr Lineberry pointed out, a gold standard is a good thing, as it prevents the extreme swings in inflation and deflation thereby never favouring one part of society over the other for any extended period of time, or in any extreme way. Savers (or more appropriately investors), are rewarded insofar as they manage risk, and borrowers are rewarded insofar they spend the money on productive assets.

Dolf is correct, and - all jokes aside - I will give you a perfect example of deflation not being a bad thing to anyone who has invested productively and isn't borrowing to the hilt with wam-pum.

When I was starting out in the publishing business some 2 decades ago my biggest competitor was charging advertisers a certain amount of money....and they charge exactly the same amount today.

I don't like this company very much, and I cannot stand being in the same room as the dickhead who owns it - but I will give credit where it is due, and that dickhead has spent a great deal of time and money re-investing his profits (rather than borrowing) to create a "lean mean machine"...(ironically the sort of 'lean mean machine' I pioneered in about 1996 and other have copied haha!)

It may surprise everyone to learn this company makes larger profits today than it did back then and carries no debt on its balance sheet (beyond the usual monthly bills).

These people have a 'proper' company, providing 'proper' customers with 'proper' products, for which they are paid 'proper' money, and make 'proper' profits.

Such people have nothing to fear from deflation - in contrast to the average property investor or Merchant Bank which is mortgaged beyond the hilt and wants a large dose of inflation to keep them afloat.

Barry

Deflation was evident for large portions of the 19th Century in Gt Britain, much of Europe and the USA. It was a result of the industrial revolution making things easier and easier to manufacture and hence more plentiful. Everything did not spiral down the drain. Another example of deflation is in computer and other IT products. That certainly did not lead to an economic death spiral for the consumer or the producers concerned. You've spent too much time sipping the Kool Aid of court economists and financial clowns.

Amit

mnnn.. are you sure that is what is meant by "deflation", in this context?

I suspect that rather than things just getting cheaper, on account of them being easier to produce, "deflation" in the context in which it is being bandied around by the pundits today, as being somehting to be terribly afraid of, it means that there is less money wanting to be spent - for some reason, like perhaps everyone loses their job and their income, or a money supply goes negative or something.

I think flat screen TV's might be a naive example to use, in the context of the Japanese problem.

Can we stick with a the price of products which still take the same amount of effort to produce?

Deflation is not just a mainstream economics bogey man. Even Hayek thought it was a no-brainer that deflation is undesirable.

Anon is right: price depreciation of certain products due to technology is not deflation. Rather it is a broad cycle that effects an entire economy or region. And since it would hit the financial sector the hardest it's incredibly naive to think that all the rest of us would notice would be lower prices at the supermarket.

"Can we stick with a the price of products which still take the same amount of effort to produce?"

You mean like producing new paper money?

Amit

Barry

Ah so now you are on about the good deflation and the bad deflation. Sounds like a bigot I met who spent an hour telling me how there are good Maoris and bad Maoris.

Amit

jesus christ , I spent four years to find out that global climate was a UN hoax, another few years to check Quantitative Easing, another hoax , only one month to see President Xi is a warlord.

Give me mercy , where can a poor man go.

I love how the left wingers misquote and misrepresent Hayek about deflation.

Hayek wasn't experiencing, or talking about, the current situation whereby several trillion dollars of wampum has been created out of thin air in 6 years.

I think anybody 50 years ago would see little need or desire for deflation - but quite a different story today; I doubt Mr Schiff would have written such an article at the time Hayek was alive.

It is akin to 100 years ago today - November 21st 1914 - asking Harry Truman, as he ploughed fields on his family farm, whether he thought it a good idea to drop a bomb and kill several hundred thousand people in the blink of an eye; Truman (assuming he could even comprehend such a thing) would have said "no, of course not"

Ahem, I wonder if readers realise there are a truckload of posts at this very blog on deflation, and falling prices -- which are not necessarily the same thing (indeed, the latter is the cure for the former).

And allow me to recommend two excellent books: Jorg Guido Hulsmann's 'Deflation and Liberty,' arguing that deflation and falling prices are a bad thing only for those of a particular political class; and George Selgin's 'Less Than Zero: The Case for a Falling Price Level in a Growing Economy.' The title tells you the argument.

Oh good stuff - that is what I was saying yesterday, this assumption that everyone knows what you are talking about when I was getting a bit confuzzled (and I am sure other folk were too) as to what is meant by deflation.

(someone actually named a child "Jorg"? hahaha!)

I wonder if know-it-all Dolf has read PC's comments, and re-educated himself?

Next step - he acknowledges that he got it hopelessly and naively wrong :)

Except he didn't get it wrong. Nor did he write anything that contradicts what PC wrote. You, Ms Anonymous and little Barry got nothing correct- not even your dishonest attempt to smear Dolf.

Amit

Yes he did get it wrong Amit. Anony and I tried to point out that falling prices of any given product aren't necessarily deflation, and you thought I was talking about good deflation vs bad deflation.

And in a subsequent article PC used photos of an iPhone 5 launch to make his point about falling prices. So his grasp of deflation seems to be sketchy as well despite reading books on the subject.

Hey mark-amit-dolf do they pay you by the hour or the post buddy???

Barry

When I referred to good inflation and bad inflation I was making fun of you and your ideas. That does not mean I believe in good inflation, bad inflation, good deflation and bad deflation. It does mean that I consider your economics (such that they appear to be) as foolish and worthy for some mild ridicule.

For the record, the term "inflation" is (perhaps unfortunately) most commonly used by people to refer to "price rise" or "price increase". In reality the price increases are merely a symptom of the disease and that disease is inflation of the supply of currency. To be accurate and strictly correct the term "inflation" refers to the increasing of the currency supply, usually by the government and/or central bank and/or commerical banks working in some kind of legalised arrangement to convert the wealth of others people (as in steal or otherwise acquire it from its owners involuntarily). Likewise common employment of the term "deflation" refers to prices going lower or falling. Strictly speaking what is being referenced when the word "deflation" is being used can be one of two things. The first is a mythical bogey-man that mainstream economists and Keynesians hyperventilate about. What they are scared about is people not over-spending, not consuming beyond what they can afford and not going into debt but preferring instead to save and live within their means. There is a lot of mainstream hysteria about the alleged badness of people living within their means and failing to go into debt to consume. A reason for this is that when such a situation persists the purveyors of debt struggle to live in the manner to which they belive they are entitled. Their access to to power, wealth or status is diminshed. They are scared. The second strictly directed use of "deflation" refers to the necessary decline in the currency supply when debt is devalued, renegged, restructured, retired or, best one of all, defaulted and it is no longer possible to record it on the books or treat it as an "asset". The nature of fractional reserve banking means that when any of those things happen then there is a decline in the amount of currency. The decline is in multiples of the loss of the face value of the "asset". Pop enough economic bubbles and the deflation becomes overwhelming and has the power to liquidate many (most, perhaps all) schonky financial organisations, banks etc. This is because such are insolvent (always have been) and would then be no longer use sleight of hand bookkeeping and legalised special arrangements to hide their status. It is what ought to have occurred in the first GFC. Had that been so then a recovery would have been allowed well and truly by now. Instead we await the inevitable second GFC (which is going to be much more serious than the first one- that was just a taster). Meanwhile most working people are experiencing their personal circumstances falling already and have done for decades. Frankly, I'd rather enjoy the deflation followed by the elimination of the present fiat currency and fractional reserve regime. Then we could go to inflation-proof specie-based money.

Amit

Must be by the word...

Post a Comment