Since the last two posts here encompassed the twin topics of money-printing and housing—and since Gareth “Captain” Morgan has emerged from his quarter deck today to berate the Reserve Bank for “a long history now of Reserve Bank prudential policy combining with selective tax policy to provide a toxic little no brainer for property investors”—I figured I’d link up all three topics in one hit, so to speak, by pointing out how the Reserve Bank is busy buggering up the demand supply of the affordable housing equation just as successfully as councils are buggering up its supply.

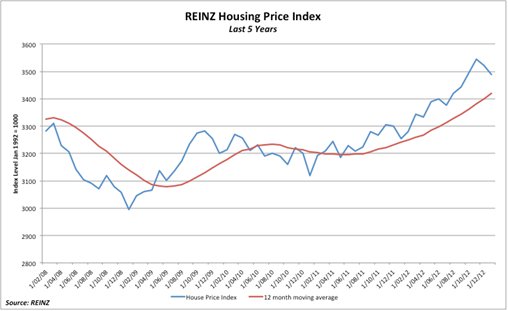

New Zealand housing is undeniably in another bubble right now—a bubble desperately in need of a pin.

The constraints on the supply of land on which housing cab be built affordably have ben well canvassed here—and need just the destruction of District Plans to be fixed.

But the monetary demand for housing just keeps on heading right up into the stratosphere, even while all about are busy praising the Reserve Bank’s diligence, and talking loudly about how insane Russel Norman’s now-abandoned plan for money-pointing was.

However.

Guess who’s been printing money? Or, to be more accurate, who’s been quietly doing a little monetary easing of their own?

Year–on-year monetary inflation in M2 money supply (blue),

and M3 money supply (red), from July 2010 to April 2013

(Source: Reserve Bank Monetary Aggregates)

That’s what inflation looks like pure and simple.

Not pretty, is it.

So if you’re wondering why house prices and the share market have been hovering well up above reality for the last year(s), it’s not because NZ houses and NZ companies have become between five to fifteen percent more profitable.

It’s because the Reserve Bank has been helping inflating the money supply by around that amount, year on year, and almost all that inflated counterfeit capital they’ve helped issue has ended up in housing and shares.

Over to you, Reserve Bank apologists.

In the meantime, if you want to slow down (house price) inflation, then slow down the creation of new money.

RELATED POSTS:

- More money, higher house prices… (2012)

- Unaffordable housing? No wonder!

- House price inflation on the rise again? (2009)

- Houses are homes, not investments

- No, Dr Brash, inflation targeting has not "worked well." Not ever.

- The Reserve Bank: Lock the doors and leave the building to the four-legged rats

1 comment:

Nolan over at TVHE has replied.

I would note that a fair bit of capital for loans for NZ houses comes from overseas rather than from here. Were RBNZ to tighten, I'd expect greater inflows of foreign money funding our mortgages. Fundamental problem is land supply, not monetary policy.

Post a Comment