A blogger at the Labour blog The Sub-Standard has found time between posts eviscerating the Labour leader to criticise John Key’s criticism of KiwiBuild, the Labour leader’s plan for his government to build 100,000 new houses around the country costing $300,000 or less and to give everybody a new pony. (How? Somehow.)

At least we have a plan for affordable housing (says the rebel in the Red Team), pointing the finger at the Blue Team who he says only have arm waving and rhetoric and plans to build 2,000 to 2,500 new homes in Hobsonville costing more than $485,000 each!

Which is a point, albeit not an entirely valid one, because while the National Government’s plans to fix a market the government's planners themselves have broken do amount to little more than rhetoric and arm waving, it’s worth noticing that in a market that isn’t broken it’s not entirely unhelpful to build houses costing more than $485,000 each if you want to free up houses of a lesser more affordable value.

This seemingly contradictory point can be understood only when you learn about the concept of “churn.”

“Churn” in this context refers to the chain of purchasers who “trade up” after a new house is bought and folk move into that house and out of their old one—leaving their old house empty for someone else to move into, which leaves their house empty for someone else to move into, which leaves their house empty for someone else to move into, and so on and so on right on down the line.

In a healthy housing market, one house purchase by one family can start off a chain reaction of up to ten, twelve or even twenty moves further down the line as each family moves out of their old and up to their new home.

Why do I say “move up”? Because this is the housing equivalent of the weird double-thank-you moment we talk about in economics:

How many times have you paid $1 for a cup of coffee and after the clerk said, "thank you," you responded, "thank you"?

There’s a wealth of economics wisdom in the weird double thank-you moment. Why does it happen? Because you want the coffee more than the buck, and the store wants the buck more than the coffee. Both of you win.

Equally, when you decide to sell what you’ve got now to move into a new place, it’s because you want the new place more than the old place—and your new buyer wants your old place more than their old place, and so on down the chain. You each want the new place because in your minds your new housing situation is going to be better for you than your existing housing situation.

It’s just the same for every buyer in the chain.

So every time a new house is built and purchased, of whatever value, that opens up opportunity for many other families to make their situation better.

So while the buyer of the $300,000 may not know it, that new $485,000 house is what just made his own life better. He’s at the end of a chain of churn created by that first purchaser and his vendor saying “Thank you!”

This is what happens when the housing market is not broken by regulation, as it is now.

If that idea makes your head hurt, then consider this question: is it better in general to build better houses or lesser houses? Wouldn’t we all agree that better quality is far better than lesser? So as better houses costing more are built and folk move up to what in their own view are better houses, the overall housing stock for everybody is improved.

The real answer to affordable housing then has been provided neither by the Blue Team nor the Red Team.

The answer is to fix the broken market.

And how do they do that? They stop pretending they know what they're doing and get the hell out of the way.

* * * * *

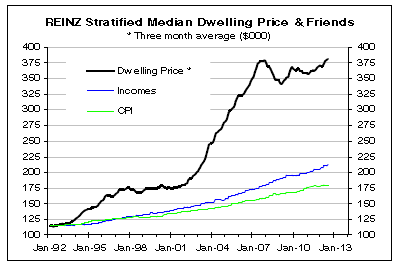

* Of course, in a healthy market, housing prices don’t bubble up like New Zealand’s have in recent years.

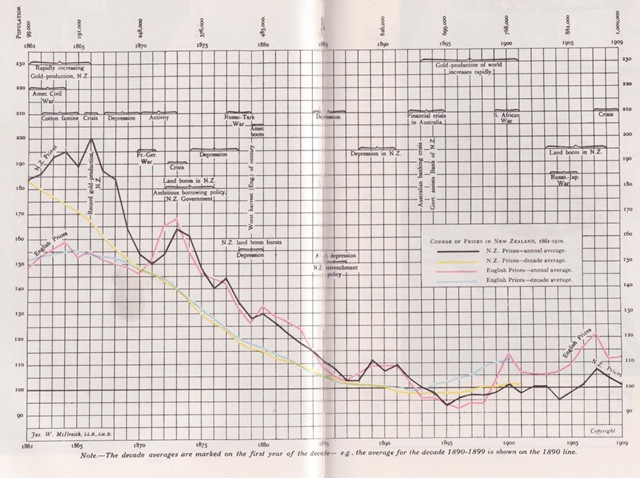

Instead, they decline gently, just as all commodities do in healthy markets enjoying stable, un-inflated currencies. Just like New Zealand & Britain were in the late 1800s…

“Course of Prices in New Zealand, 1860-1910,” from Muriel Prichard’s book An Economic History of New Zealand

“Course of Prices in New Zealand, 1860-1910,” from Muriel Prichard’s book An Economic History of New Zealand

No comments:

Post a Comment