NEW ZEALANDERS ARE GETTING “screwed” on housing. Let’s compare Christchurch and Auckland with, let’s say, the housing markets of Houston, Dallas, Fort Worth,and Atlanta--using a simple "mixed measure" reflecting the cost of money and housing, current interest rates, and median house prices and gross annual median household incomes; in other words, the methodology employed by Demographia, the World Bank, United Nations and Harvard University.

What we find is astonishing, especially when correlated with the level of regulations on land.

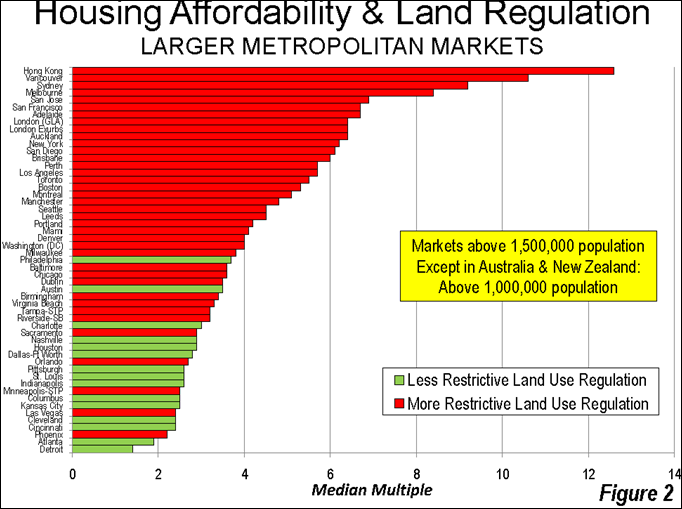

By this measure, with a multiple of 6.4, Auckland is the tenth-least affordable large metropolitan market in the English-speaking world.

This is not the sort of prize we want to win.

Not appearing on this chart because it’s not large enough, poor destroyed Christchurch is however not far behind, with a house price/income multiple of 6.3. Houston(1) however has a multiple of just 2.9; Fort Worth and Atlanta and 2.8 and 1.9 respectively.

Readers may like to check out the listings and latest Monthly Report of the Houston Assn of Realtors to get a sense of what a normal affordable housing market looks like. Our major markets in contrast are severely unaffordable....and therefore abnormal.

They may like to ponder why the Houston economy grew by 8.5% last year and is expected to do so again this year... perhaps because without spending so much on their houses there are more savings available for business.

They might also like to learn about those American cities where the paycheck stretches furthest, and why their disposable household incomes look so pretty.(2)

In first place is Houston, where the average annual wage in 2011 was $59,838, eighth highest in the nation. What puts Houston at the top of the list is the region’s relatively low cost of living, which includes such things as consumer prices and services, utilities and transportation costs and, most importantly, housing prices: The ratio of the median home price to median annual household income in Houston is only 2.9, remarkably low for such a dynamic urban region; in San Francisco a house goes for 6.7 times the median local household income. Adjusted for cost of living, the average Houston wage of $59,838 is worth $66,933, tops in the nation.

THE LESSON OF MODERN AFFORDABLE housing begins in the US with the great entrepreneurs of the residential construction industry Bill and Alfred Levitt, who created the modern affordable housing industry we know today. There were massive material shortages following WWII, and Bill and Alfred bought forests, nail factories etc. to overcome these problems. These remarkable guys set up housing on a production line, supplying 80 square metre homes on 700 square metre sections for $US8,000, selling to single-earner young families with an average annual income of $US3,800 (US median gross household incomes at the time overall were about $US2,500). That’s around 2.1 times gross annual household earnings. The mortgage loads were 18% of gross annual single-earner household incomes.

The Levitts were reputed to have made about a 17% gross margin on these houses – about $US1,300 each.

The Levitt’s housing revolution took place in an era with enormous social pressures on blokes to financially support partner and children. If blokes failed to do this, forcing their partners out in to the workforce to supplement the family income, the bloke was considered a "loser." Now however housing prices force most young couples both out to work, like it or not.

So the 30% of household incomes that the finance industry peddles as an “affordability threshold” is complete rubbish. Self serving rubbish.

I spelt out the problems with the mixed measures in the Sydney Morning Herald early last year.

THANKS TO THE GENIUS of the Levitts, affordable housing provision today should be a very formulaic business indeed – and a clear Definition of an Affordable Housing Market is provided on the front page of my archival website Performance Urban Planning.For metropolitan areas to rate as 'affordable' and ensure that housing bubbles are not triggered, housing prices should not exceed three times gross annual household earnings. To allow this to occur, new starter housing of an acceptable quality to the purchasers, with associated commercial and industrial development, must be allowed to be provided on the urban fringes at 2.5 times the gross annual median household income of that urban market.

The critically important Development Ratios (4) for this new fringe starter housing, should be 17 - 23% serviced section cost - the balance being the actual housing construction.

Ideally through a normal building cycle, the Median Multiple should move from a Floor Multiple of 2.3, through a Swing Multiple of 2.5 to a Ceiling Multiple of 2.7 - to ensure maximum stability and optimal medium and long term performance of the residential construction sector.

Square-metre costs are important. With new homes at $US8,000 each, in the early 1950s, these pioneering Levitt residential developments worked out at $US100 per square metre all up. Today, in 2012, on the fringes of the affordable US markets, fringe area “starter stock” sells for around $US600 per square metre all up and a little north of it – as I explained here on Interest Co NZ 2 1/2 years ago.

Here in New Zealand however the political and planning clowns have blown housing construction costs up through the roof to $NZ2,500 per square metre all up, and well north of it.

Put another way – Kiwis are paying about $NZ2,500 plus all up for fringe starter stock when they should be paying about $NZ1,000.

The rest (about $NZ1,500 per square metre) should be called “Government Stuff Up Costs” ... raw land costs grossly inflated by planning restrictions keeping land off the market; totally unjustified Development Levies; the process circus and a welfare scheme for consultant troughers, inappropriate infrastructure financing (after 8 long years the political clowns still haven’t learnt about infrastructure bonds financed through Municipal Utility Districts). These costs and impositions are destroying home-owners’ dreams and wrecking the housing industry— bludgeoning it bureaucratically back to the cottage-industry Stone Age.

On the fringes of our urban markets, you should be able to buy a new starter home of 200 square metres on a 600 square metre section / lot for $200,000 ALL UP - $160,000 for the actual house construction and about $40,000 for the serviced section(3). Sound Development Ratios are critically important to ensure appropriate development - not over development or under development.

In social and economic terms it is enormously important that housing can be purchased at or below 3 times gross annual household earnings. There is nothing "clever" about excessively loading households up with 6 to 7 times annual household earnings and beyond with unnecessary mortgage debt.

The big question is, will this Government finally do with its October announcement what it promised at the 2008 election?

Or will it just continue to watch the burden get higher.

WHAT’S REQUIRED? WHAT CAN the government do? Alex Tarrant reported on this late July, saying he expected to see a change from a demand to a supply focus, which would “reduce pressure on the government's balance sheet by taking pressure off the accommodation supplement rental subsidy, and also schemes like Working for Families, which is viewed as effectively a rent/mortgage subsidy for the middle class.” Few specifics are extant, but he reports,

Wholesale changes are coming to how the government approaches housing affordability, with the focus turning to influencing the supply side of the market.

A response to the Productivity Commission's recommendations on improving housing affordability is being tied in with the government's local government and Resource Management Act reforms.

See the Commission's recommendations here: Productivity Commission recommends immediate release of land for residential development in Auckland, Christchurch, in final housing affordability report.

The size of the policy work programme means a large package may still be some months off. But it is likely to set benchmarks to be hit over the next three to five years aimed at improving the ability of the market to supply much more affordable, lower quartile housing.

I made it clear a few months ago what is required within Christchurch.

It is well past time we got some elementary disciplines in to our Local Government sector. Focus (yes - focus) on the essential changes to open up land supply and require them to finance infrastructure properly - and Local Government will start on the path of performing to an acceptable level.

The current system simply encourages councils incentivizing them to behave like lunatics on infantile bureaucratic power trips. And the larger they are the worse they are.

Local Government inflation leads to housing inflation which in turn leads to general inflation. It is so stupid that in Auckland for example (where home buyers face a 6.4 Median Multiple between housing prices and income), that families on $120,000 are in struggle street—or on middle-class welfare.

We need to reverse that fast, so that New Zealand can become increasingly internationally competitive. And as the late Sir Paul Callaghan put it – “A place where talent wants to live.”

* * * * *

1. Some ask why I quote Houston so much as an example of an affordable North American market....Here are a few of the reasons....

(1) It has a very open land market, with a mix of zoning, no zoning and deed restrictions.

(2) The infrastructure financing arranges for new subdivision with their highly refined Municipal Utility Districts are the world leaders.

(3) Its housing is consistently rated “affordable” i.e. at or below 3 times annual household incomes.

(4) With its 6.1 million people it is one of the fastest growing major metros in the United States.

(5) Its economy is very diversified and huge with a Gross Metropolitan Product of about $US384 billion (in contrast NZ about $US130 billion for a population of 4.4 million), that is currently growing at a truly massive rate of about 8.5% a year. And its real growth – unlike the artificial and opaque Chinese variety.

(6) Politically Houston is “Democrat” and all its Mayors over many years now have been Democrat. The current Mayor Annise Parker is the first openly lesbian Mayor of a major US metro. It is a very diverse and tolerant place where over 90 languages are spoken. When I was there in 2008 on a study trip (and as a Conference speaker) I was surprised just how relaxed and helpful people are there.

If it was badly governed, nobody would want to live there because of the climate – with the suffocating humid summers. There is great rivalry with Dallas Fort Worth (where the climate is more congenial). So there is pressure on them in Houston to do things properly and not let those Dallasites beat them ! Nothing like rivalry / competition in lifting performance. Here in Christchurch we should be aiming to make Auckland New Zealand’s second major City! There is no reason why we cant head off those guys !

2. In case you are wondering what they are paying for new housing within the affordable housing markets of North America, here is the Houston page of the magazine “NEW HOMES SOURCE.” Bear in mind when leafing through that Americans do notinclude garage space when stating the area of their house. Therefore add 36 square metres - say 6 x 6 m ( 388 square feet ) to the square feet quoted. Note the Americans still use "feet." To bring this back to square metres divide by 10.764.

Unfortunately, our housing construction market current pricing & performance is a shambles that needs to be sorted out with urgency.

3. Read also Dale Smith, Affordable Land Convenor of Cantabrians Unite article ACHIEVING $50,000 SECTIONS . Over recent months Dale has been doing a great deal of work working with people inside and outside of Government on these issues. I am very grateful to Dale for the great work he is doing. His long "hands on" industry experience is essential and invaluable ..http://www.cantabriansunite.co.nz/resources/file/Achieve-$50,000-sections2.pdf

4. The hugely important issue of sound Development Ratios is poorly understood - and it is well past time the (so called) professionals within the property industry stepped up to the plate and explained this issue in the public arena.

2 comments:

PC I am not convinced that availability and cost of land is the only factor in the afordability of housing. If land cost is the reason houses are unafordable then appartments, where land is an insignifant component of the price, would be significantly cheaper than standalone houses of the same floor area. However they are not, they are generally much more expensive.

There are two factors in the afordability of housing, the desirability of the location, I note in the chart Detroit is considered highly afordable and the manner in which the houses are built. In New Zealand little has changed in the last 100 years and houses are still built by laboriously nailing together pieces of 4x2. A process that usually takes several months.

Section sizes are a quarter of the size they used to be, the days of the quarter acre section are long gone and houses are also much bigger and more complex.

These factors should also be taken into consideration.

Before blaming the Government the building industry and architects should look to themselves and ask whether they are contributing to the high cost of housing.

Mark, no one is saying "availability and cost of land is the only factor in the affordability of housing."

TO that you can add costs of materials, costs of reduced levels of skilled labour, development levies and consent fees.

But land costs are significant, and land costgs for housing will have a commensurate effect on prices for apartments (that's how prices for "substitute goods" work). Take a look at the pie charts and so on in this post, for example, which suggests that costs associated with land accounted for around 50% of the dollar increase in housing from 2002 to 2007.

Post a Comment