Jeffrey Tucker ably crystallises both the error of Keynesian “rescues” of the economy and the economic implications of the zombie apocalypse. “Rescues” first, zombies later:

Apocalyptic themes are everywhere. The glorified European currency union that was to fix all that was wrong with Europe is falling apart. The patchwork bailout schemes introduced month by month delay the collapse. But the time between fixes is growing shorter and shorter…

In the United States, the combination of stagnant labor markets and struggling stock markets has cast a spell of doom over nearly everyone…

For those of us who have been watching the unfolding folly since 2008, it’s very difficult to take any of the current panic too seriously. What else should we expect from Keynesian policies after half a century of failure?

And you don’t even have to know the history to know that the path of spending, money growth and interest-rate manipulation is going to prove fruitless. You need to know only that government has no power to create bread from stones.

It’s a tossup as to which aspect of Keynesian policy is silliest. Maybe it is this idea that government can ramp up spending and that this spending can be a viable proxy for private-sector investment. Where does government get its money? From the private sector. Draining resources by force from one sector to be spent by another creates no new wealth. It destroys wealth, because you are throwing good money after bad.

Or maybe it is this idea that a sector can be rescued from deleveraging pressures with enough infusions of newly created government money. In this case, it was mainly the housing sector that was the target. If the bust were the correction of the error, why would you want to throw resources at re-creating the error? In any case, it didn’t work. The tailspin continued, despite the interventions.

Or maybe it is this idea that we can push interest rates to zero and thereby inspire people to stop saving and go out and borrow and spend. But interest rates are prices that imply a meeting of minds. Subsidizing one side of the transaction, the borrowers, penalizes the other side of the transaction, namely the lenders. And even if people can make deals under these conditions, they won’t be economically wise.

Even aside from the goofy logic of this policy, didn’t Japan already try this approach all throughout the 1990s? Yes, this very thing happened. Interest rates were pushed to zero in an effort to give the economy a jolt after the asset bubble collapsed. Now these years are typically referred to as “the lost decade.” One might suppose that if a decade is lost, people might blame the bad policies that caused it to happen.

But that’s just the problem. It is a matter of establishing cause and effect…

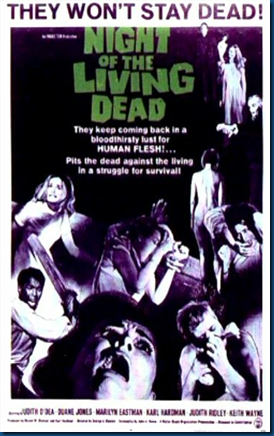

Fast forward to today and there’s now a rash of movies, comics, stories and fanzines about zombies, about the “zombie apocalypse; about walking corpses we can’t kill eating out our brains; about the flesh-hungry undead slowly taking over the world. Which they are. Metaphorically. Because the feeling is afoot today that something dreadful is happening to the world, some drooling beast is stalking us, and no amount of reasoned argument can avert it.

And when you read the likes of Paul Krugman and realise the undead flesh-eating theories of John Maynard Keynes have risen from the grave and are destroying the world all over again—and no amount of reasoned argument appears able to avert the tragedy—you understand precisely what they mean.

Keynes just won’t stay dead.

UPDATE: For Genuine Economic Recovery, Ask “What Would Mises Do?”

Mises’s advice is as timely now as it was then:

To these people [who say follow the United States] one should answer first of all: “One of the privileges of a rich man is that he can afford to be foolish much longer than a poor man.” And this is the situation of the United States. The financial policy of the United States is very bad and is getting worse. Perhaps the United States can afford to be foolish a bit longer than some other countries.

Mises noted that the usual alternative to financing government spending through taxation is to finance it through inflation (government fabrication of fiat money). Such a policy, he explained, is disastrous, the economic chicanery of Lord Keynes notwithstanding, for it enables the government to go further into debt while devaluing the currency in the marketplace. Fortunately, he argued, it is a policy that can be reversed:

Inflation is a policy. And a policy can be changed. Therefore, there is no reason to give in to inflation. If one regards inflation as an evil, then one has to stop inflating. One has to balance the budget of the government. Of course, public opinion must support this; the intellectuals must help the people to understand. Given the support of public opinion, it is certainly possible for the people’s elected representatives to abandon the policy of inflation.

Obviously most of today’s Argentines have forgotten or ignored Mises’s warnings; annual inflation in that nation proceeds at around 25 percent… [And so too have local morons like Bernard Hickey, for whom print, baby, print is their new mantra.]

If [we] want genuine economic recovery, rather than mountains of government debt and dollars worth dimes, they would do well to ask “What Would Mises Do?”

1 comment:

Steve forbes has written a column reviewing a book which talks about how the return to a Gold Standard is inevitable:

http://www.forbes.com/sites/steveforbes/2012/06/06/golden-rule-for-prosperity/

Post a Comment