“Keynesian macroeconomics is literally playing with half a deck. It purports to be a study of

the economic system as a whole, yet in ignoring productive expenditure it totally ignores

most of the actual spending that takes place in the production of goods and services. It is

an economics almost exclusively of consumer spending, not an economics of total

spending in the production of goods and services.”

- George Reisman

If GDP measurements were a good measure of economic health, then the US economy (and, by extension, the world economy) would be in fine fettle.

But who are we kidding? Bill English and Tim Geithner might think things are growing, but it’s not, and we aren’t.

In fact, GDP Is Useless and Deceptive: There Was No Recovery—and probably won’t be until this barbarous Keynesian relic has been thoroughly discredited.

The GDP figure is next to useless, unless you want to trumpet government’s good works.

The measurement of so-called Gross Domestic Product doesn’t measure production at all, it measures spending.

And it doesn’t even measure all the spending in an economy: Sure, it measures all the govt’s spending—every cent of it, all of which attracts the big tick from the statisticians—and it measures every cent ever spent on big screen TVs, small screen smartphones and Little Lucy’s little pony, but it only measures the tiniest fraction of business-to-business spending, i.e., the stuff that actually is the economy.

Nice ruse, wouldn’t you say, especially since it allows the govt to posture as a saviour when it uses its own extra spending to “top up” that fraction of business-to-business spending that’s dropped—spending that comes either by borrowing from investment markets, printing new money or taxing the hell out of business folk—al of which hinder rather than help production, and all just to help fake the figures for the next quarter.

So GDP doesn’t measure production at all, it measures spending. Mostly consumption spending. Spending that doesn’t last. Which means, when you think about it, that the more money there is in the system to spend (and after Quantitative Easing I and II, there’s an awful lot of it sloshing around the globe) the more you can pump up your GDP figures.

See how the smoke and mirrors work? See how you can be “not in recession” according to the figures, while all around you is a sea of losses, unemployment and general business-to-business misery. All you have to do is pump out new money, pump up your spending and WHAMMO! everybody’s happy!

Except they’re not. Reality can’t be so easily faked. Because as James Mill pointed out almost two-hundred years ago:

“The whole annual produce of every county is distributed into two great parts; that which is destined to be employed for the purpose of reproduction, and that which is destined to be consumed. That part which is destined to serve for reproduction, naturally, appears again next year, with its profit. This reproduction, with the profit, is naturally the whole produce of the country for that year.”

But this is not what is being measured by the GDP. Instead, this “seed corn” is stolen to pump up a fake figure.

Fact is, the figures themselves are fake:

We have not recovered from the Great Recession and thus our current economic stagnation is less a new event than a continuation of the original collapse. The basis for the so-called "recovery" was a rise in GDP, that measure of what we have spent in the economy. It's a fairly useless bit of data…

Economic growth doesn't start with spending: it starts with saving and production and ends with spending. And that is why we should not rely on GDP to measure the health of the economy…

So when the conventional wisdom says that the economy recovered in June 2009, it didn't.

In fact, we’re all still kneck-deep in the pooh. Just as we were this time last year.

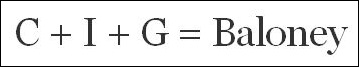

And the GDP equation? Here’s how it really looks:

Read:

- Why GDP Is Useless and Deceptive: There Was No Recovery – Z E R O H E D G E

- QUIZ: Test your economic knowledge – N O T P C

No comments:

Post a Comment