The recovery has stalled.

Obvious enough to anyone actually on the ground trying to do business, this news would be a surprise only to a mainstream economist, or to anyone who listens to one. Like NZIER’s Principal Economist Shamubeel Eaqub, for example, who is surprised to have to announce that, “The recovery may be stalling. The outlook is still fragile.”

No kidding.

So why are the mainstreamers (and those who take their advice) so surprised? Because, according to their lights, throwing out all those trillions to “increase aggregate demand” must have had some effect. And of course, they’re right, it did. It lit up some fireworks for a while, but at the cost of delaying any real recovery.

“The problems are not over [summarises Jim Rogers]. If you pump lots of money into an economy, it looks better but essentially it’s artificial. We are going to see more problems in the US over the next year or two.”

Nobel Prize winner and stimulus loon Paul Krugman reckons however that the problem is not too much stimulus, but too little. If we’re going to raise world demand properly, says this modern reincarnation of the Great Idiot Keynes, then Obama and The Fed (and, by extension, everyone else in the G-20 and beyond) needs to be thinking—not about austerity packages—but in terms of trillions of dollars more stimulus. If we’re going to successfully “raise demand,” then the world’s governments needs higher deficits, he says, not lower.

That he says this in the face of the near bankruptcy of several European governments for running the very deficits he applauds should tell you one thing about his favourite nostrum: that it’s really the height of irresponsibility.

But what it won’t tell you is why he wants governments to be so irresponsible.

The answer to that, however, is very simple. At least, I’ll try to make it simple. The reason he wants to boost government spending is because he thinks that will boost demand; and by boosting demand he thinks we can all boost GDP. It’s a simple idea, but it’s wrong as hell. (“If you pump lots of money into an economy, it looks better but essentially it’s artificial.”)

Let me explain why.

So there’s your basic economy. 80 people devoted to making and drinking beer, and 20 devoted to getting the hell in their way. (Oh, did I mention that the first sixty get the pleasure of paying the credit card bill for the annoying bastards consuming the mini-bar?)

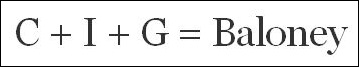

Now in the way of conventional economics, the formula for GDP has been cunningly contrived to measure only what the drinkers do, and not what the other sixty get up to. Here’s the formula for GDP (which has here been given the title of ‘Baloney.’)

C is Consumption, i.e., all the drinking done by all your twenty drinking partners.

G is Government, i.e., all the drinking done by all the twenty grey ones from the mini-bar.

And I … now that’s “Investment.” And that’s a bit trickier, because it’s not total investment but only nett investment. Essentially this figure measures the difference between the six-packs of beer we sixty producers pay out to get things done, and the six-packs of beer we get back when we do things for others. So (to oversimplify a great deal) if our profit is ten percent, then only the work of six of us are measured in the GDP/Baloney figure.

If that sounds ridiculous, it’s because it is—yet that’s how ridiculous the GDP delusion is. It doesn’t measure production, it measures consumption. Rather than measure economic activity, what it does is bury the bulk of economic activity (i.e., the production of those other fifty-five folk) under this contrived figure of I, and then it contrives to ignore all fifty-five. (As a measure of just how much it ignores, US GDP in 2006 was $13.4 trillion, whereas total business spending was $31 trillion, meaning businesses were spending $4.30 for every $1 spent on personal consumption. Policy-makers take note.)

It’s by this utterly contrived means then that alleged economists like Mr Krugman can talk about “raising GDP” through the “stimulus” of shopping subsidies (or as his mentor Keynes did, by the “stimulus” of building pyramids)—it’s because all that GDP really measures is what gets spent in the shops, and not hardly at all what goes on in the mines, factories and warehouses that makes all that spending possible.

And it’s the homage paid to this ridiculous economic equation that allows him to get away with it, and is so economically destructive--as you’ll see when we take another look at our simplified economy in recovery mode.

Let’s imagine our simplified consumers have all just had a party. A big blow-out. A boom. And now it’s the morning after. (What a bust.) There’s still hops a’pickin’ and still beer a-brewin’ in the vats, but your packaging and production cycle has got a bit out of whack, and the livers of your drinking partners are all feeling a bit tender. Demand has gone down (and they’re starting to beg for the invention of some basic pain-killers), but in a short time production will be back on track and things ticking along again.

Then along comes Mr Krugman, and all he sees is calamity! “Look!” he cries. “Your “C” is way down. And your GDP/Baloney/Spending figure is flat! We’ve got to boost demand!” And of course, he’s right. It is. But it wouldn’t be right simply to print drinking vouchers so the twenty parliamentarians can raise “G” at the mini-bar, while ignoring the sixty producers who were trying to get things back on track, and whose production would have to pay for it (but whose total production has been “netted out,” i.e., minimised, in that figure for “I”.

Because their spending has to be paid for. That demand must come from production. And if you start “stimulating” the economy simply by overstocking the mini-bar, without ever getting anything back for it, then you’ll wake up one day soon and find you’ve got no more six-packs set aside to pay for more hops and more barley. Which means no more beer at all.

And just because that bogus GDP equation allows alleged economists like Paul Krugman to ignore that, it doesn’t mean that you should.

Because as the great economist Ludwig Von Mises used to say, it’s not just the next generation who pays for deficits, it’s this one. And the way we pay is by having our resources diverted today from all the good productive activity that the GDP equation ignores, into all the unproductive consumption that it picks up.

Which helps explain why the Paul Krugmans of this world (and their sophistic, simplistic equations) have helped make the recovery less likely, rather than more.

So to end this wee post, here’s economist Bob Murphy’s tribute to his favourite Keynesian moron, Paul Krugman (sung very badly to the tune of The Buckinghams’s Susan).

UPDATE 1: More good, related reading at The Cobden Centre: “Short sharp shock –'the Irish Route' or Keynesian Malaise?”

UPDATE 2: I’ve rewritten an old Q&A (from January ‘09) to help explain the point:

Stimulus: Because all economies have performance issues

Q: What is the point of running deficits?

A: Because it’s demand that drives an economy, and we have to keep demand up to keep the economy going. So when consumer demand drops, the government has to pick up the slack. That’s it’s job.

Q: By borrowing?

A: By borrowing, by printing money, by any way you can do it.

Q: But aren’t most business-to-business payments paid for out of real savings, not faked up demand?

A: Well, yes…but we can try to fool them for a while.

Q: For how long?

A: Long enough. Another three years if we need to.

Q: Until we turn into Greece?

A: Um…

Q: So does borrowing or printing money bring any new resources into existence?

A: Well, no. In the first case it transfers existing resources, and in the second it just dilutes existing savings. But it does create new demand.

Q: But doesn’t your demand have to be paid for with real resources?

A: Well …

Q: So what you’re relying on is using your new bits of paper to redistribute existing resources in ways the original owners wouldn’t have otherwise agreed to.

A: They need to spend!!

Q: And at the same time you’re denuding the existing pool of real savings.

A: They need to stop saving and start spending!! We need to run deficits to make up for the money that savers have withdrawn from the economy by their hoarding.

Q: But how can you say savings are being hoarded when most business-to-business payments are paid for out of real savings?

A: Well…

Q: How is running deficits going to rebuild that shattered pool of real savings?

A: Um…

Q. Okay, let’s move on. What is an Economic Stimulus Payment?

A. It is money the government distributes to some taxpayers to boost demand, and stimulate economic activity.

Q. Where will the government get this money?

A. From taxpayers.

Q. So the government is giving me back my own money?

A. Only a smidgen.

Q. What is the purpose of this payment?

A. The plan is that you will use the money to purchase a High definition TV set or a new computer, thus stimulating the economy.

Q. But isn't that stimulating the economy of China?

A. Um.

Q: Well, how on earth does it stimulate the one whose taxpayers are paying to be stimulated?

A: It's all about the "multiplier."

Q: The "multiplier"?

A: Yes, the "multiplier." Every dollar the government "injects" into the economy creates an even larger increase in national output -- a multiple up to one-and-a-half times the original spend-up. The money the government is giving away goes to retailers, which then goes to producers, which then goes to other producers and so on. The net result of the spend-up, as the theory goes, will be new jobs and an overall increase in the nation's income.

Q: So the government is giving me back a smidgen of my own money, and this smidgen is multiplied several times to create a "stimulus?

A. You've got it.

Q: And it keeps prices up?

A: We hope so.

Q: But don't the prices that producers pay need to fall in a recession to get real production going again?

A: Well, yes.

Q: And it's not even backed by real demand, is it?

A: Well, no.

Q: So how long can such an artificial stimulus last, then?

A: Um, the theory is that it's only temporary at best.

Q: But you’ve been advocating running deficits and printing shopping subsidies to fix the economy now for nearly three years!

A: They haven’t been over-spending enough!!

Q: Well, what sort of stimulus would it have created if you hadn’t taken it off me, abd I'd been able to keep that money myself, and either spend it or save it?

A: Well . . .

Q: Or if producers had been able to keep their own money?

A: Um . . .

Q: So it would be fair to argue that "not only does the increase in government outlays not raise overall output by a positive multiple; but, on the contrary, [it actually] leads to the weakening in the process of wealth generation in general.”

A: But . . .

Q: And this is the whole theory? This is all you economists can come up with?

A: Well, that's about it, yes.

Q: So it's a bit like when "a carnival magician produces a quarter from behind a child's ear," isn't it. "The 'magic' of the multiplier is mere illusion."

A: Hush your mouth. People are listening.

Q: No answer?

A: Sorry, we're a bit busy right now shovelling money out the door.

* * * * Stimulus: Because all economies have performance issues * * * *

10 comments:

Good post.

Did you see Krugman on CNN Sunday morning? Frightening piece. I put a very quick blog up here.

Key has put out a release this afternoon saying he's happy to follow the leadership of the G20 on matter concerning 'the recovery under way' - yeah right. I've - well, a guy called Tribeless - has put a comment about that up on the NBR. My final paragraph on that realease was:

"So, disputing Key's use of the term 'following' the economic crisis, as I don't think he can say we're out of it, I wonder which camp he puts himself in? The spenders and Big Staters, or the State dieters. Who knows: as your 'negative politics' editorial pointed out this morning, he doesn't actually say anything - what are 'NZ's policy objectives'? On the face of it, all we have to go on is via the State appropriations in this years budget, Bill English grew the size of our obese old Nanny State by another 9%, while Mr Dunne unleashed his IRD on the innocents to the degree of $120 million, without even enough empathy with the electorate to make the property tax rules clear, so they could have something solid to guide them."

I feel righteous now - I've certainly been doing my fair share of production and consumption in the beer economy.

The green shoots are flooded in sodden land

"...Great Idiot Keynes..."

By what authority, what qualification, from what experience, do you derive the right to abuse one of the greatest economists of the 20th century in this way? An insult such as calling someone a "great idiot" must surely come from a writer with, perhaps, a Nobel prize in economics? Or do you have some great experience in running a bank or some such institution of major importance? I would like to know the credentials by which you derive the confidence to dismiss a man who by any ordinary measure of achievement towers about the author of this piece, a man who by influence and impact would make the writer of this post unfit to even shine his shoes? Tell me, what are you credentials to say such a thing? I am curious, I tremble in anticipation of revealed genius! Or am I to be sorely disappointed, and the writer to be revealed as a know nothing of no stature or reputation or achievement to speak of in the field of economics, a repeater equipped with nothing more than an accurate memory and a meaness of spirit?

It's amazing the intelligent people who think that the economy will recover just as soon as the stimulus kicks in.

What no one has yet been able to answer for me is this: if stimulus packages worked, how come we have recessions in the first place?

Bill O'Reilly stick it to Krugman here on this youtube vid:

Clip of Tim Russert - Paul Krugman vs O'reilly

Look at Krugman, mumble & fumble.

@Sacntuary: "... a repeater equipped with nothing more than an accurate memory and a meaness of spirit..."

Yeah, that's me. Someone who remembers that no Keynesian solution has been successful anywhere (only destructive)--"The results of their Keynesian economics [have wrecked] every industrial country, but they refuse to question their basic assumptions."

And who's aware that the Great Idiot Himself had enough meannes of spirit and sharpness of tongue himself against his opponents to justify feeling he deserves anything he gets.

Yet frankly, while his suppposed acumen is just bullshit, Mises is right when he says, "There is no use in arguing with people who are driven by 'an almost religious fervor' and believe that their master [Keynes] 'had the Revelation.' It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion."

@Pro-Capitalist: "Bill O'Reilly sticks it to Krugman here on this youtube vid..."

Unfortunately O'Reilly wouldn't know a fact from a raccoon.

Pro-capitalist, watching that video of Krugman vs O'Reilly, I thought that O'Reilly was going to punch Krugman at some stage. I watched it till the end and O'Reilly acted in a restraint manner in which he didn't punch Krugman.

Yep, I think that leftist idiot like Krugman should be thrown in for a TV round with Mr O'Reilly, because O'Reilly knows how to rattle these leftist idiots like Krugman.

Santuary gets owned....couldn't happen to a nicer shit. ;-)

Post a Comment