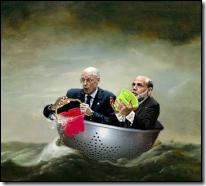

When Federal Chairman Ben Bernanke sees a problem, he always has the same solution: Bailout, stimulus, liquidity, injection of credit, stimulus, stimulus, stimulus...

When Federal Chairman Ben Bernanke sees a problem, he always has the same solution: Bailout, stimulus, liquidity, injection of credit, stimulus, stimulus, stimulus...

You see a pattern there? He's like a cheap quack -- a doctor whose quick fix for all his patients, whatever their ailment, is a handful of steroids to keep them going in the short term, regardless of the long-term damage he causes.

His latest call for more billions for yet another stimulus package -- billions of dollars "to help improve access to credit by consumers, home buyers, businesses and other borrowers" -- which follows Congress's first multi-billion dollar "stimulus package" in the American spring that is supposed to have "kept the economy afloat through the summer" -- which was followed by trillions of dollars in bailouts, buy-outs, credit injections and the partial-nationalisation of the American banking system ...

Ben is a Pollyanna with a printing press, and he's banking on it, quite literally, to fix everything.

Is anyone else starting to think this guy hasn't got even the beginning of a fucking clue? How many shots of fiscal bloody stimulus are enough, for Galt's sake, before you realise you're a busted flush! How long before someone with a brain says to him, "put down the printing press, Ben, and move away from the patient."

How long before the son of a worthless banker leads the whole bloody world into a fully fledged crack-up boom.

The economy is now on life-support from years of steroid abuse -- the collapse of the inflationary housing bubble caused by years of easy credit; the consequent flight into liquid assets that's caused the credit crunch, presaging the beginning of an inflationary depression; the desperate need to flush out the malinvestments that years of monetary inflation have produced -- and he wants to keep feeding this zombie economy the same steroids that caused it to lose its brain, and to keep feeding the economy's remaining resources to the malinvestments.

But the economy faces risk of "protracted slowdown," the Fed chairman says, oblivious to the reasons for the slowdown (years of steroid abuse by the Fed). "Another shot of fiscal stimulus may be needed now to help the U.S. economy recover from what could be a drawn-out slowdown," says the Fed failure. He hasn't even the first idea of what caused the slowdown, he has no conception that the slowdown represents the market trying to recover from years of steroid abuse, but he has one tool in his kit-bag to fix the "problem" that is the only sign of health.

It's insane. What's needed now is not to keep consumption up -- especially not if it's paid for with truck-loads of printed money -- but correction. Markets need to correct. Prices need to change to reflect what things are worth now. Misallocations of resources need to be corrected. Businesses with failing lines need to trim them and put their resources instead into things more profitable.

More and more billions of dollars of printed money will only prop up the bad way things are now, and prevent things changing to the way they need to be -- and to make it worse, the money Bernanke prints and prints and prints will be paid for out of the real resources businesses could have used to fund a real recovery.

It's time to shoot the doctor.

UPDATE: Jeffrey Tucker points to the collapse of oil prices as an example of one of the benefits of the collapse of the inflationary credit bubble that Bernanke is desperately trying to stop.

UPDATE: Jeffrey Tucker points to the collapse of oil prices as an example of one of the benefits of the collapse of the inflationary credit bubble that Bernanke is desperately trying to stop.

In a saving grace of productivity downturns, gas prices are falling dramatically, as much as $1 lower than a month ago. Fabulous news! This eases the tremendous pressure on airlines faced with declining ticketing, car dealerships with tight credit standards, and consumers who confront a recessionary environment. Everyone these days is cheering the lower prices...

In general, ..., most people are happy about low prices for gasoline. This is a model we should use for understanding price trends in the economy at large. Gloriously, the prices of oil reflect commodity prices in general, which continue on a downward trend that began in July. Yes, the price declines probably reflect a slowing economy. No, there is nothing wrong with this, contrary to Bernanke. Falling prices are a boon for consumers, a port in a storm. The worst mistake the government could make today would be to attempt to reverse this.

11 comments:

It's like pumping morphine......its very addictive. At some point we have to realise we can't consume more debt based goods and services.

yes the economy will slow down...but its a necessary withdrawal from years of overdoing it.

no one wants to be the grown up and stand up and say the party is over.

PC, calm down, for the real capitalist, every downturn has an upside. Such as betting in the intrade market that the DOW will be below 7,800 points before 1 January 2009. There's not much volume people, so please start trading!

Only slightly off topic, PC I'm sure you have already seen the 'death of libertarianism' article on Slate, I'm looking forward to your principled and cliche avoiding deconstruction of the article.

Sometimes we just need reminding that libertarians are always correct.

CRAIG: Only slightly off-topic, but Weinberg's argument is no different in reality than Matt McCartens', that it's all the fault of capitalism - and I thought Roger Kerr among others thoroughly demolished McCarten.

So I hadn't planned to address Weinberg's schtick, although I did like the responses of Matt Welch at 'Reason' (even if he doesn't read Ayn Rand, the bastard), and Thomas Woods at the Mises Blog, particularly this point:

"Yes, yes, I know we've heard this all before [how stupid and ideologically blinkered libertarians are for not recognizing the meltdown as a failure of "unregulated markets], but it's almost kind of funny how someone can write a whole article about this and never once -- as in not one time -- mention central banking.

"Jake, buddy, central banks are an intervention into the economy. They also have a teensy weensy bit to do with the financial situation right now..."

"So here's my question: is Weisberg a moron who thinks monetary central planning is the only brand of free-market thinking that exists, or is he more sinister, deliberately portraying phony free-market thinking as the real thing in order to make a better case for interventionism? Seems unlikely, though not impossible, that the editor of Slate could be just an ignorant blockhead, so I'm not sure where I come down on this."

Where do you come down?

Gloriously, the prices of oil reflect commodity prices in general, which continue on a downward trend that began in July.

Hell yeah! Good for the US, good for China - absolutely shit for NZ

Q: how much longer do you think the NZ dollar will remain a liquid currency?

A: about 6 weeks

Craig

A wee point you might like to consider.

In the USA the Federal Register (that's the list of regulations and laws and imposts and tributes government controls business and the markets with) comes to some 70,000 pages. The Federal Government controls every aspect of financial activity- money, banking all of it. There is no free market- never has been. It's been restricted, limited- always encumbered by arbitrary fiat. For anyone to claim otherwise they'd need to be a liar at best or an imbecile with severe mental retardation at worst.

It would be excellent to at least let Libertarianz have an honest try at sorting the mess out. Hell! Every form of collectivist bullshit (ibncluding several forms of socialism) have been tried already. Time for to try someting better.

LGM

I thought the upside was the falling prices, that Bernanke et al are now trying to inflate -- just like Hoover did.

Which makes me think we need a wrist-band for the politicians with a catchy acronym on it as a constant reminder: not WWJD, but WWHD -- What Would Hoover Do?

They could look at that, check the history, and remind themselves to make damn sure they did precisely the opposite of what he did.

It would be a good start. :-)

PC

I think you made a typo. Surely you meant to type,

"This disaster is not a failure of capitalism, as I say above, it's a failure to have capitalism."

What we have is a socialised, nationalised funny money system with insolvent banks propped up by arbitrary fiat. It is incredibly unstable and takes enormous infusions of wealth (overtly and covertly) to keep it operating. While that may suit insiders and certain interests, it does not benefit anyone else.

Seriously, how can anyone claim that such a statist system is capitalist? It is an absence of capitalism. Once again, statist intervention has been proved to be a failure.

LGM

Hi Raf,

No, not everyone wants to say so, and it's not even evident they know so.

And let's note, of course, that if we successfully produce more debt-based goods and services, we get to consume whatever we like commensurate with that production.

This disaster is not a failure of capitalism, as I say above, it's a failure to have capitalism.

But you say that "no one wants to be the grown up and stand up and say the party is over"?

Well, at At least there's the Libertarianz, eh. See here and here.

Yes, you're right LGM. Oops.

Re-posted the offensive post,with the correction. :-)

Post a Comment