The Clark Government is keeping us all poorer than we need to be. In a recent NBR column, Owen McShane compared notes between ourselves and our wealthier Australian cousins: "Australian GDP per capita is now A$47,181. That’s about 40% higher than New Zealand’s A$33,682, at present market exchange rates. Even Tasmanians, their “Clean and Green” poor cousins, at only $35,253, are richer than New Zealanders. Western Australians, are the richest at $58,688, which makes them about 75% better off than New Zealanders."

We're poorer than we should be. We're poorer than we need to be. As I explained yesterday, in keeping our own money out of our own hands the Clark Government restricts private saving and private investment, and that severely restricts productivity. (The Govt's Kiwisaver just can't be taken seriously as a real investment vehicle, can it. It's just spin.)

We're poorer than we should be. We're poorer than we need to be. As I explained yesterday, in keeping our own money out of our own hands the Clark Government restricts private saving and private investment, and that severely restricts productivity. (The Govt's Kiwisaver just can't be taken seriously as a real investment vehicle, can it. It's just spin.)Saving, by the way, is a good thing. Private saving, that is, since in a very real sense it's saving that fuels wealth. Here's how: You see, saving doesn't just reduce demand. Savings don't go into a hole in the ground. In fact, as all non-Keynesian's understand, saving is simply the flip-side of investment. Saving is not hoarding: saving one's income does not take it out of production; rather, it makes 'seed capital' available to build and grow productivity in areas in which entrepreneurs see opportunity. Savings don't just go into a hole in the ground, savings is where capital comes from, and it's capital that makes us all more productive.It's that necessary capital of which we're short,meaning we're becoming of necessity more and more reliant on the foreign capital coming here as a result of our over-inflated exchange rate. We're short of capital because we're too poor to save. In fact, NZ's private savings have now fallen well behind countries that we were ahead of in absolute terms in 2000 -- former Soviet Bloc countries, former dictatorships, and even currently Islamic countries (where investing money for profit -- ie., earning interest -- is actually considered illegal)... That's how poor this Government has made us.

- Turkey*, for example, which in 2002 had US$6 billion in investment funds, now has over US$15 billion -- that's about two-and-a-half times the amount. Not bad going.

- Then there's Chile, which in 2000 had just US$4.6 billion in investment funds. Now, the Chileans have $16.7, just over three-and-a-half times what they had then.

- Or Poland, which had a derisory US$1.6 billion in investment funds in 2000 now has over $23 billion worth of investments -- nearly fifteen times the 2000 figure.

That's how quickly the effect of pathetic economic management piles up.

While other countries' savings and investments have leaped ahead since 2000 -- countries such as Ireland (whose wealth and investments have increased by over five times in that period), Australia (by 2.2 times), Denmark (2.7 times), Norway (2.8 times), Mexico (3.1 times), Hungary (3.2 times), India (3.9 times), Finland (4.6 times) -- even a European Union awash in EU regulation has managed to double the figure -- even a South Africa enmired in violence has increased their global savings and investments by nearly four times!

But not us.

In this place that's slowly returning to the Polish shipyard David Lange promised to deliver us from in 1984, we've barely increased our wealth at all in the last two-and-a-bit-electoral cycles (which is all Cullen's fiscal settings are aimed at). Rather than climbing up the wealth ladder by virtue of investing and reinvestingwhat little wealth we have, as others have been doing with their own resources, here we are denied the use of vast amounts of our own money, the Government is running a $ billion surplus ... and we're falling behind.

There is no tax paradise on the face of this earth, unfortunately, but there are places which are far, far wealthier than we are, and unless we are allowed the means to make ourselves wealthier -- our own means that have been taken from us by force -- then this small paradise at the bottom of the South Pacific will just slip further and further behind, and more and more good New Zealanders will leave.

Meanwhile the Government's surplus is about NZ$7B and we're still not allowed tax cuts at all; not allowed them because those would be "inflationary" [bullshit] or -- worse -- because they might be saved and invested in new businesses, new machinery, or new economic projects, (thereby reducing demand, which would reduce infla… umm, don't worry -- spot the Keynesian contradiction).

Meanwhile the Government's surplus is about NZ$6B and we're still not allowed tax cuts at all. We're not allowed them because:

1) Labour's Keynesians tell us those would be "inflationary" [see yesterday's post for a thorough debunking of that horse shit]; and

2) Or -- worse -- because they might be saved and invested in new businesses, new machinery, or new economic projects, reducing the sacred aggregate demand, which would reduce economic activity and thus infla... umm ... nevermind. Contradictions like that never bother Keynesians. Or power lusters. (Stumble upon a situation of "full employment," and Keynesians like Cullen become lost.)

We are falling behind ... and the man most responsible .... the man who has taxed and taxed and taxed and spent and spent and spent our money, leaving us unable to save and invest and grow ....well, he will be delivering tomorrow's Budget.

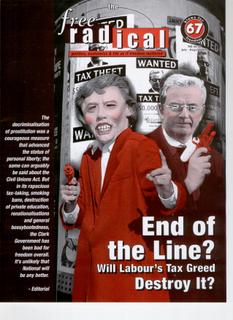

What an ignorant, destructive prick. As the Free Radical cover asked way back in issue 67, will Labour's tax greed destroy it? Probably. Eventually. But whatever the answer to that question, it's clear it's destroying us.

_ _ _ _ _

* Figures from Australian Fund Management, Annual Review, 2007, Credit Suisse (Australia)

6 comments:

I have a friend who left NZ in 2004 with half the proceeds of his house sale (after a divorce) and who went to work and live in Victoria. He has been away for three years, and is now completely back on his feet, owning property, investing and doing well. He said the biggest difference between Australia and New Zealand was the attitude of "getting on with it" and making something for yourself. I have to say that attitude is looking more attractive all the time - especailly when I am funding people I know with familes larger than mine and with more income than I have to get welfare.

Brian Smaller

Phil Rennie is at the CIS, Not the CEI

:-)

Note on the Islamic states.

Islamic Shia economics is based on "no interest" not "no profit". "No profit", ah, you would be thinking of the NZ economy.

Instead of interest on investment a round-about profit sharing/shareholding is used by lenders.

When you talk about all these countries that are doing so well you conveniently leave out crucial points.

Ireland - Only doing well because of the solidarity it is being shown by the EU with subsidies.

Australia - Full of abundant natural resources because remember its natural resources that make people rich not knowledge and entrepreneurs.

Denmark & Norway & Finland - These are great countries that have taken the Third Way and invested substantially in human capital. They take care of the poor and in that sense everyone does better.

Mexico - Despite being plundered by western societies this lovely little culture has still managed to keep their quaint tradition of social cohesion and socialism. Really, the native peoples of Mexico are actually prospering because of their socialist culture.

India - Huge levels of centralized direction and courageous investment in planned growth has been the source of success here. Look at the technology and IT sectors in India - the Government has marked that industry for success. If it had just been left to silly little greed lusting individuals India would still be going backwards.

Hungary - I'm hungary.

"Australia - Full of abundant natural resources because remember its natural resources that make people rich not knowledge and entrepreneurs."

Yeah, I guess that's why Nigeria is so rich. And Singapore and Hong Kong so poor. Idiot.

"Phil Rennie is at the CIS, Not the CEI."

Oops. Bloody acronyms. Fixed. Ta.

"Note on the Islamic states.

Islamic Shia economics is based on "no interest" not "no profit"."

Yes, I hadn't exactly made it clear.

""No profit", ah, you would be thinking of the NZ economy."

Well said. :-)

Brian: I think you'll find that Willy was being tongue in cheek. At least, I hope he was being tongue in cheek!

Post a Comment