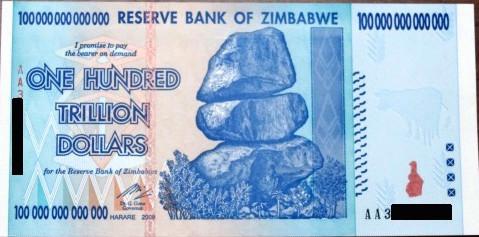

Weird factoid: US$1 = Zimbabwe $250,000,000,000,000 (i.e., 250 trillion).

So apparently quantity does matter, n’est ce pas.

Some folk think money or credit conjured out of thin air somehow has no effect on prices. They explicitly repudiate what’s called “the Quantity Theory of Money.”

The basic idea of the Quantity Theory of Money is that more money chasing the same number of goods leads to higher prices. Or, conversely, that every new dollar that enters the economic system devalues the purchasing power of every existing dollar. And, in truth to destroy that basic notion you would have to destroy or repeal the law of supply and demand—and, despite the best efforts of Keynesians and neo-Keynesians, that hasn’t happened just yet. And nor is it ever likely to.

This is not news. It was observed nearly 500 years ago by astronomer Nicholas Copernicus, who maintained

This is not news. It was observed nearly 500 years ago by astronomer Nicholas Copernicus, who maintained

We in our sluggishness do not realise that the dearness of everything is the result of the cheapness of money. For prices increase and decrease according to the condition of the money.1

Of course, this is not the only reason that prices increase and decrease. You might have a bad harvest, or an aging product. These tend to increase and decrease these prices respectively. But what the astute Copernicus observed was prices increasing and decreasing en masse. For everything to becoming dear, you need money to becoming cheap.

Philosopher David Hume couldn’t reason his way to connect the sound of his servant on the stairs with his study door opening moments later (strike one for those who think philosophers are a waste of space), but he did set up a thought experiment to show that the quantity of money does affect prices.

Let us assume that a money producer increases the individual cash balances of every person in society through an act of magic by exactly 10 percent overnight. If a person had $1,000 in money the evening before, that person will now have $1,100 in money holdings. A person who had $50 in money will now have $55. The overall amount of money in the economy thereby increases by 10 percent but, importantly, this happens instantaneously, with everybody affected at the same time and in exactly the same way. This is a one-off event; no additional money injections follow. We will make one additional assumption: Every person, as he wakes up and goes about his business, not only knows immediately that he magically received an additional 10 percent of cash, but he also knows that everybody else has received an additional 10 percent of their previous money holdings, too. This is, of course, a most unrealistic example of money injections. However, we can quickly see that this fantastical scenario is the only one imaginable in which the increased supply of money affects the price level only and does so in a way that is exactly proportional to the change in the money supply.2

You see two things immediately: Prices rise because of new money; and the the only way in which all prices can change in precise proportion to that new money is this: by magic.

So a few hundred years ago, the understanding existed that a change in money tends to change prices, and the way change happens matters. Another few hundred years and new names for silliness doesn’t change things. Just consider, for example, the effect of QE:

If you put three-and-a-half trillion of demand into the fixed income market at points along the yield curve all the way from two years to thirty years, that is an enormous fat sum on the scale. That is an enormous distortion of pricing, because you can’t have that much demand without affecting the price.

True. The price in this case appears in the price of things like bonds and fixed-income assets rather than the things measured by the NZ Statistics Department that appear in their Consumer Price Index. If however those trillions were to be released into the retail sector, as they were in Weimar Germany and revolutionary France, then they would appear very quickly in the prices of consumer goods which, in both those tragic cases, rose very quickly indeed upon their back. (And if they are issued in gross through a government-sponsored fractional reserve system, as first devised by a fellow like John Law about three centuries ago, then they will inevitably end up in disaster, as he did.)

SO THIS IS WHERE OUR hero Ludwig Von Mises begins, with the observation that any amount of money is sufficient in an economic system. The quantity becomes sufficient by prices. Building on the observations of Copernicus:

SO THIS IS WHERE OUR hero Ludwig Von Mises begins, with the observation that any amount of money is sufficient in an economic system. The quantity becomes sufficient by prices. Building on the observations of Copernicus:

We imagine two systems of an evenly rotating economy A and B. The two systems are independent and in no way connected with one another. The two systems differ from one another only in the fact that to each amount of money m in A there corresponds an amount n m in B, n being greater or smaller than 1; we assume that there are no deferred payments and that the money used in both systems serves only monetary purposes and does not allow of any nonmonetary use. Consequently the prices in the two systems are in the ratio 1 : n. (Ludwig Von Mises, Human Action, Ch. XVII: ‘Direct Exchange,’ s. 5: ‘The Problem of Hume & Mill & the Driving Force of Money’)

So that’s the idea behind the basic Quantity Theory of Money. And some theorists never got beyond that – or never realised there was more to it than that . They understand by it what we might call the naive version of this doctrine, one favoured by monetarists from Milton Friedman to his mentor Irving Fisher: the so-called “linear” Quantity Theory of Money. They didn’t talk about magic. But they did talk about money being dropped out of helicopters.

This linear Quantity Theory of Money holds that the total money supply (a stock) multiplied by the “velocity” at which it is spent (a flow) equals “the average price level” (as estimated by a govt bureau) multiplied by total spending (a flow, as measured by GDP). In other words:

MV = PT

(This of course reflects a simple truism of supply and demand, that “price” in the abstract is the sum of aggregate demand divided by aggregate supply, i.e., P=Dc/SC)

There are immediate problems:

- How do we even measure “the money supply” (is it just cash? what about money in current accounts? and savings accounts? how about electronic money? are “money substitutes” like CDs and demand deposits included? how liquid do these need to be? how about bonds? or “sweeps”? or notes and coins in bank vaults? or traveller’s cheques? or money held in money market funds?)

- What in reality is “velocity” when it’s at home, and how does if differ from people’s estimate of the marginal value of money (hint: the latter is more fundamental). And how can the “velocity” of money being passed hand to hand even be measured without first measuring GDP (isn’t this somewhat circular?).

- If GDP fails to include all business-to-spending, then it looks like the quantity of business-to-spending is ignored. And if it does include it, is that “double counting”? And what about our general understanding that if more money is spent on producing goods rather than consuming them, then the “price level” will tend to go down rather than up?

- And prices themselves are all over the park (if they weren’t, they wouldn’t be doing their job of conveying knowledge), so what precisely, and to three significant figures please, is a price level?

And, crucially, what about changes in the quantity of money, M. In Mises’s example above, the two systems of an evenly rotating economy A and B, differing from one another only in the fact that to each amount of money m in A there corresponds an amount n m in B, n being greater or smaller than 1 …

Is it thinkable that conditions in A can be altered at one stroke in such a way as to make them entirely equivalent to conditions in B?

That this is clearly not possible is the insight that money is not “neutral”; that money itself has a driving force. This point reflects something named after John Law’s one-time collaborator, the Cantillon Effect, best summarised as “when they are handing out free money, it pays to be in the front of the line.”

The main fault of the old quantity theory as well as the mathematical economists' equation of exchange is that they have ignored this fundamental issue [that prices do not all change commensurate with any new quantity of money, i.e, that money is not “neutral.”]. Changes in the supply of money must bring about changes in other data too. The market system before and after the inflow or outflow of a quantity of money is not merely changed in that the cash holdings of the individuals and prices have increased or decreased. There have been effected also changes in the reciprocal exchange ratios between the various commodities and services which, if one wants to resort to metaphors, are more adequately described by the image of price revolution than by the misleading figure of an elevation or a sinking of the "price level." (Ludwig Von Mises, Human Action, Ch. XVII: ‘Direct Exchange,’ s. 4: ‘The Determination of the Purchasing Power of Money’)

So it’s clear that there are two parts to the theory:

- that a change in money tends to change prices; and

- the way change happens matters.

MISES’S UNDERSTANDING OF THE whole doctrine of the Quantity Theory is encapsulated here:

The insight that the exchange ratio between money on the one hand and the vendible commodities and services on the other is determined, in the same way as the mutual exchange ratios between the various vendible goods, by demand and supply was the essence of the quantity theory of money. This theory is essentially an application of the general theory of supply and demand to the special instance of money. Its merit was the endeavour to explain the determination of money's purchasing power by resorting to the same reasoning which is employed for the explanation of all other exchange ratios. Its short-coming was that it resorted to a holistic interpretation. It looked at the total supply of money in the [whole economy] and not at the actions of the individual men and firms.

An outgrowth of this erroneous point of view was the idea that there prevails a proportionality in the changes of the—total—quantity of money and of money prices.

But the older critics failed in their attempts to explode the errors inherent in the quantity theory and to substitute a more satisfactory theory for it. They did not fight what was wrong in the quantity theory; they attacked, on the contrary, its nucleus of truth. They were intent upon denying that there is a causal relation between the movements of prices and those of the quantity of money. This denial led them into a labyrinth of errors, contradictions, and nonsense.

Modern monetary theory [he was writing in 1949] takes up the thread of the traditional quantity theory as far as it starts from the cognition that changes in the purchasing power of money must be dealt with according to the principles applied to all other market phenomena and that there exists a connection between the changes in the demand for and supply of money on the one hand and those of purchasing power on the other. In this sense one may call the modern theory of money an improved variety of the quantity theory. (Ludwig Von Mises, Human Action, Ch. XVII: ‘Direct Exchange,’ s. 4: ‘The Determination of the Purchasing Power of Money’)

Here is the longer discussion, of which that is just a small part:

Mises on the Quantity Theory of Money

(Human Action, excerpt, p 411-416)

The relation between the demand for money and the supply of money, which may be called the money relation, determines the height of purchasing power. Today's money relation, as it is shaped on the ground of yesterday's purchasing power, determines today's purchasing power. He who wants to increase his cash holding restricts his purchases and increases his sales and thus brings about a tendency toward falling prices. He who wants to reduce his cash holding increases his purchases—either for consumption or for production and investment—and restricts his sales; thus he brings about a tendency toward rising prices.

Changes in the supply of money must necessarily alter the disposition of vendible goods as owned by various individuals and firms. The quantity of money available in the whole market system cannot increase or decrease otherwise than by first increasing or decreasing the cash holdings of certain individual members. We may, if we like, assume that every member gets a share of the additional money right at the moment of its inflow into the system, or shares in the reduction of the quantity of money. But whether we assume this or not, the final result of our demonstration will remain the same. This result will be that changes in the structure of prices brought about by changes in the supply of money available in the economic system never affect the prices of the various commodities and services to the same extent and at the same date.

Let us assume that the government issues an additional quantity of paper money. The government plans either to buy commodities and services or to repay debts incurred or to pay interest on such debts. However this may be, the treasury enters the market with an additional demand for goods and services; it is now in a position to buy more goods than it could buy before. The prices of the commodities it buys rise. If the government had expended in its purchases money collected by taxation, the taxpayers would have restricted their purchases and, while the prices of goods bought by the government would have risen, those of other goods would have dropped. But this fall in the prices of the goods the taxpayers used to buy does not occur if the government increases the quantity of money at its disposal without reducing the quantity of money in the hands of the public. The prices of some commodities—viz., of those the government buys—rise immediately, while those of the other commodities remain unaltered for the time being. But the process goes on. Those selling the commodities asked for by the government are now themselves in a position to buy more than they used previously. The prices of the things these people are buying in larger quantities therefore rise too. Thus the boom spreads from one group of commodities and services to other groups until all prices and wage rates have risen. The rise in prices is thus not synchronous for the various commodities and services.

When eventually, in the further course of the increase in the quantity of money, all prices have risen, the rise does not affect the various commodities and services to the same extent. For the process has affected the material position of various individuals to different degrees. While the process is under way, some people enjoy the benefit of higher prices for the goods or services they sell, while the prices of the things they buy have not yet risen or have not risen to the same extent. On the other hand, there are people who are in the unhappy situation of selling commodities and services whose prices have not yet risen or not in the same degree as the prices of the goods they must buy for their daily consumption. For the former the progressive rise in prices is a boon, for the latter a calamity. Besides, the debtors are favoured at the expense of the creditors. When the process once comes to an end, the wealth of various individuals has been affected in different ways and to different degrees. Some are enriched, some impoverished. Conditions are no longer what they were before. The new order of things results in changes in the intensity of demand for various goods. The mutual ratio of the money prices of the vendible goods and services is no longer the same as before. The price structure has changed apart from the fact that all prices in terms of money have risen. The final prices to the establishment of which the market tends after the effects of the increase in the quantity of money have been fully consummated are not equal to the previous final prices multiplied by the same multiplier.

The main fault of the old quantity theory as well as the mathematical economists' equation of exchange is that they have ignored this fundamental issue. Changes in the supply of money must bring about changes in other data too. The market system before and after the inflow or outflow of a quantity of money is not merely changed in that the cash holdings of the individuals and prices have increased or decreased. There have been effected also changes in the reciprocal exchange ratios between the various commodities and services which, if one wants to resort to metaphors, are more adequately described by the image of price revolution than by the misleading figure of an elevation or a sinking of the "price level."

We may at this point disregard the effects brought about by the influence on the content of all deferred payments as stipulated by contracts. We will deal later with them and with the operation of monetary events on consumption and production, investment in capital goods, and accumulation and consumption of capital. But even in setting aside all these things, we must never forget that changes in the quantity of money affect prices in an uneven way. It depends on the data of each particular case at what moment and to what extent the prices of the various commodities and services are affected. In the course of a monetary expansion (inflation) the first reaction is not only that the prices of some of them rise more quickly and more steeply than others. It may also occur that some fall at first as they are for the most part demanded by those groups whose interests are hurt.

Changes in the money relation are not only caused by governments issuing additional paper money. An increase in the production of the precious metals employed as money has the same effects although, of course, other classes of the population may be favoured or hurt by it. Prices also rise in the same way if, without a corresponding reduction in the quantity of money available, the demand for money falls because of a general tendency toward a diminution of cash holdings. The money expended additionally by such a "dishoarding" brings about a tendency toward higher prices in the same way as that flowing from the gold mines or from the printing press. Conversely, prices drop when the supply of money falls (e.g., through a withdrawal of paper money) or the demand for money increases (e.g., through a tendency toward "hoarding," the keeping of greater cash balances). The process is always uneven and by steps, disproportionate and asymmetrical.

It could be and has been objected that the normal production of the gold mines brought to the market may well entail an increase in the quantity of money, but does not increase the income, still less the wealth, of the owners of the mines. These people earn only their "normal" income and thus their spending of it cannot disarrange market conditions and the prevailing tendencies toward the establishment of final prices and the equilibrium of the evenly rotating economy. For them, the annual output of the mines does not mean an increase in riches and does not impel them to offer higher prices. They will continue to live at the standard at which they used to live before. Their spending within these limits will not revolutionize the market. Thus the normal amount of gold production, although certainly increasing the quantity of money available, cannot put into motion the process of depreciation. It is neutral with regard to prices.

As against this reasoning one must first of all observe that within a progressing economy in which population figures are increasing and the division of labour and its corollary, industrial specialization, are perfected, there prevails a tendency toward an increase in the demand for money. Additional people appear on the scene and want to establish cash holdings. The extent of economic self-sufficiency, i.e., of production for the household's own needs, shrinks and people become more dependent upon the market; this will, by and large, impel them to increase their holding of cash. Thus the price-raising tendency emanating from what is called the "normal" gold production encounters a price-cutting tendency emanating from the increased demand for cash holding. However, these two opposite tendencies do not neutralize each other. Both processes take their own course, both result in a disarrangement of existing social conditions, making some people richer, some people poorer. Both affect the prices of various goods at different dates and to a different degree. It is true that the rise in the prices of some commodities caused by one of these processes can finally be compensated by the fall caused by the other process. It may happen that at the end some or many prices come back to their previous height. But this final result is not the outcome of an absence of movements provoked by changes in the money relation. It is rather the outcome of the joint effect of the coincidence of two processes independent of each other, each of which brings about alterations in the market data as well as in the material conditions of various individuals and groups of individuals. The new structure of prices may not differ very much from the previous one. But it is the resultant of two series of changes which have accomplished all inherent social transformations.

The fact that the owners of gold mines rely upon steady yearly proceeds from their gold production does not cancel the newly mined gold's impression upon prices. The owners of the mines take from the market, in exchange for the gold produced, the goods and services required for their mining and the goods needed for their consumption and their investments in other lines of production. If they had not produced this amount of gold, prices would not have been affected by it. It is beside the point that they have anticipated the future yield of the mines and capitalized it and that they have adjusted their standard of living to the expectation of steady proceeds from the mining operations. The effects which the newly mined gold exercises on their expenditure and on that of those people whose cash holdings it enters later step by step begin only at the instant this gold is available in the hands of the mine owners. If, in the expectation of future yields, they had expended money at an earlier date and the expected yield failed to appear, conditions would not differ from other cases in which consumption was financed by credit based on expectations not realized by later events.

Changes in the extent of the desired cash holding of various people neutralize one another only to the extent that they are regularly recurring and mutually connected by a causal reciprocity. Salaried people and wage earners are not paid daily, but at certain pay days for a period of one or several weeks. They do not plan to keep their cash holding within the period between pay days at the same level; the amount of cash in their pockets declines with the approach of the next pay day. On the other hand, the merchants who supply them with the necessities of life increase their cash holdings concomitantly. The two movements condition each other; there is a causal interdependence between them which harmonizes them both with regard to time and to quantitative amount. Neither the dealer nor his customer lets himself be influenced by these recurrent fluctuations. Their plans concerning cash holding as well as their business operations and their spending for consumption respectively have the whole period in view and take it into account as a whole.

It was this phenomenon that led economists to the image of a regular circulation of money and to the neglect of the changes in the individuals' cash holdings. However, we are faced with a concatenation which is limited to a narrow, neatly circumscribed field. Only as far as the increase in the cash holding of one group of people is temporally and quantitatively related to the decrease in the cash holding of another group and as far as these changes are self-liquidating within the course of a period which the members of both groups consider as a whole in planning their cash holding, can the neutralization take place. Beyond this field there is no question of such a neutralization.

The eager student may care to compare this to what Mises wrote on the same subject in 1912 in his Theory of Money and Credit. A good summary here of that what he said then.

NOTES:

1. Copernicus, Monetae cudendae ratio, 1526

2. Excerpt is from Detlev Schlicter’s book Paper Money Collapse, Ch. 3.

No comments:

Post a Comment

We welcome thoughtful disagreement.

But we do (ir)regularly moderate comments -- and we *will* delete any with insulting or abusive language. Or if they're just inane. It’s okay to disagree, but pretend you’re having a drink in the living room with the person you’re disagreeing with. This includes me.

PS: Have the honesty and courage to use your real name. That gives added weight to any opinion.