Guest post by Frank Shostak

The US Federal Reserve can keep stimulating the American economy because inflation is posing little threat, Federal Reserve Bank of Minneapolis President Kocherlakota says. “I am expecting an inflation rate to run below two percent for the next four years, through 2018,” he says. “That means there is more room for monetary policy to be helpful in terms of … boosting demand without running up against generating too much inflation.”

On the face of it, he’s right. The yearly rate of growth of the official consumer price index (CPI) stood at 1.7 percent in August against two percent in July. According to our estimate, the yearly rate of growth of the CPI could close at 1.4 percent by December. By December next year we forecast the yearly rate of growth of 0.6 percent.*

Does Demand Create More Supply?

But why should that be so?

If one could strengthen the economic system simply by means of monetary pumping it would imply that it is possible by means of monetary pumping to create real wealth and generate an everlasting economic prosperity.

This would also mean that world-wide poverty should have been erased a long time ago. After all, most countries today have central banks that possess the skills to create money in large amounts.

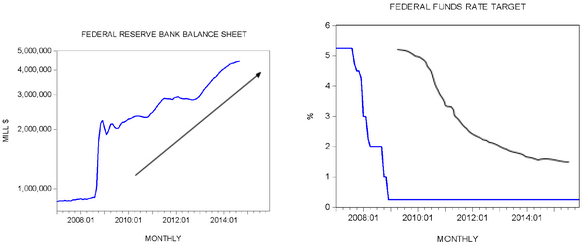

Yet world poverty remains intact. And despite massive monetary pumping since 2008, and the policy interest rate of around zero, Fed policymakers remain unhappy with the so-called economic recovery.

Note that the Fed’s balance sheet, which stood at $0.86 trillion in January 2007 jumped to $4.4 trillion by September this year.

Production Comes Before Demand

We hold that the Minneapolis Fed President is in error.

We suggest that there is no such thing as an independent category called demand.

We observe that before an individual can exercise demand for goods and services, he/she must produce some other useful goods and services themselves. Only once these goods and services are produced can individuals exercise real demand for the goods they desire. This is achieved by exchanging things that were produced for money, which in turn can be exchanged for goods that are desired. Note that money serves here as the medium of exchange — it produces absolutely nothing itself. It simply permits the exchange of something for something.

On the other hand, any policy that results in monetary pumping leads to an exchange of nothing for something. This amounts to a weakening of the pool of real wealth —of the pool of goods and services produced – and hence to reduced prospects for the expansion of this pool.

Artificially Boosted Demand Destroys Wealth

Now, what we must all understand is that the artificial boosting of demand by means of monetary pumping leads not to greater real demand but to the depletion of the pool of real wealth. It amounts to adding more individuals that take from the pool of real wealth without adding anything in return — not an economic growth but an economic impoverishment.

The longer the reckless loose policy of the Fed stays in force, the harder it gets for wealth generators to generate real wealth and to prevent the pool of real wealth from shrinking.

Finally, the fact that the yearly rate of growth of the CPI is declining doesn’t mean that the Fed’s monetary pumping is going to be harmless. Regardless of price inflation, monetary pumping results in an exchange of nothing for something and, thus, impoverishment.

Dr Frank Shostak is the head of Australian research firm Applied Austrian Economics Ltd, and one of the world leaders in the applied Austrian School of Economics. An adjunct scholar at the Mises Institute in the US, Dr Shostak has been an economist and market strategist for MF Global Australia (previously Ord Minnett) since 1986. During 1974 to 1980 he was head of the econometric department at the Standard Bank in Johannesburg South Africa. During 1981 to 1985 was head of an economic consulting firm Econometrix in Johannesburg.

This post first appeared at the Mises Daily.

* But don’t forget the many problems with “forecasts” – Ed.

2 comments:

Well put. One of the reasons why Piketty's book is so wrong, is because he sees this fiat money as capital., but it is, in fact the exact opposite of capital. To create capital, one must create wealth by producing something. True capital reduces poverty. Fiat money merely consumes wealth, thereby exacerbating poverty and increasing inequality.}

Until I saw this clear summary, I had never realised that Austrian/von Mises economics was so vacuous.

"... before an individual can exercise demand for goods and services, he/she must produce some other useful goods and services themselves." This is obviously untrue: I can borrow or be given the money to buy the goods and services, repaying it later from what I will produce later. That is not only how most individuals buy homes and cars, it is also how corporations are funded: shareholders contribute, and banks lend, money to allow capital goods to be acquired to support future production, from which the investors will be repaid in future.

"If one could strengthen the economic system simply by means of monetary pumping it would imply that it is possible by means of monetary pumping to create real wealth and generate an everlasting economic prosperity." But the effects of monetary stimulus depend on the situation: in a liquidity trap, where much of the world (not NZ) finds itself today, creating money does not add to inflation (though nor does it "strengthen the monetary system", whatever that means). It acts, to some extent, to encourage savers to spend some of their existing savings (by giving them a near-zero return on holding money), thus adding to the demand for goods and services that Dr Shostak declares cannot exist. But it only has that effect in a liquidity trap: once we are free of the trap, then monetary expansion just causes inflation, not economic growth. No serious economist claims that monetary expansion can increase economic activity forever, as Dr Shostak's straw argument implies.

The rest is gibberish: "monetary pumping leads to an exchange of nothing for something"; "artificial boosting of demand by means of monetary pumping leads not to greater real demand but to the depletion of the pool of real wealth". In a world where major corporations have unprecedented amounts of cash on their balance sheets which they are not investing in productive assets because they do not see sufficient demand for the resulting output to justify the investment risk, telling governments not to use the few levers that they have to increase demand and put people to work is to advocate economic cruelty.

My thanks to Dr Shostak for making it so clear that I never need to make the effort to investigate Austrian economics, since there is evidently nothing there. There may (some day?) be a genuine libertarian economics, but this is not it.

Post a Comment