As I mentioned the other day, mainstream economists are talking up New Zealand as a “rock star” economy on the basis both of expectations of greater demand from China for our milk products, but also because of greater consumption spending.

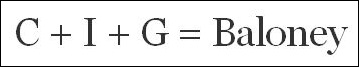

The latter can only figure as “growth” if the way you measure growth is based on consumption rather than production, which is exactly what so-called Gross Domestic Product measures – measuring spending on retail goods or by government (which is all consumption spending) as production, but ignoring most of the production that makes this spending possible.

It’s this sort of nonsense that allows unthinking alleged economists to utter nonsense suggesting consumer spending drives more than two-thirds of the overall economy, and giving vote-buying governments the cover to issue shopping subsidies and central bankers to talk about dropping helicopter-loads of money whenever they see spending fall.

This is not just nonsense, it’s dangerous nonsense.

Mark Skousen is one of the few economists clear-eyed enough to understand this, and for years has been arguing that production figures should measure all production – not just beer sales to consumers, for example, but all the hops, barley, malted barley and yeast production that go into beer, not to mention the packaging, warehousing and transporting of the stuff around the country.

And it looks like Skousen will finally be rewarded, in the US at least, because as he writes …

Starting in spring 2014, the Bureau of Economic Analysis will release a breakthrough new economic statistic on a quarterly basis. It’s called Gross Output, a measure of total sales volume at all stages of production. GO is almost twice the size of GDP, the standard yardstick for measuring final goods and services produced in a year.

This is the first new economic aggregate since Gross Domestic Product (GDP) was introduced over fifty years ago.

It’s about time. Starting with my work The Structure of Production in 1990 [highly recommended, by the way] and Economics on Trial in 1991, I have made the case that we needed a new statistic beyond GDP that measures spending throughout the entire production process, not just final output. GO is a move in that direction – a personal triumph 25 years in the making.

This might sound trivial, but it’s really big news because, while Gross Output is still not perfect, it is “a better indicator of the business cycle, and most consistent with economic growth theory” than so called Gross Domestic Production – which we could more accurately call Net Domestic Consumption. Or in Skousen’s words:

GO is a measure of the “make” economy, while GDP represents the “use” economy… I believe that Gross Output fills in a big piece of the macroeconomic puzzle. It establishes the proper balance between production and consumption, between the “make” and the “use” economy, and it is more consistent with growth theory.

Most importantly, measuring the “make” economy tells us much more about what happens when things go wrong – and tells us much earlier when they might be heading that way. In other words, it offers more enlightenment for those who try to avoid economic disasters, and fewer excuses for those who cause and prolong them.

In short, by focusing only on final output, GDP underestimates the money spent and economic activity generated at earlier stages in the production process. It’s as though the manufacturers and shippers and designers aren’t fully acknowledged in their contribution to overall growth or decline.

Gross Output exposes these misconceptions. In my own research, I’ve discovered many benefits of GO statistics. First, Gross Output provides a more accurate picture of what drives the economy. Using GO as a more comprehensive measure of economic activity, spending by consumers turns out to represent around 40% of total yearly sales, not 70% as commonly reported. Spending by business (private investment plus intermediate inputs) is substantially bigger, representing over 50% of economic activity. That’s more consistent with economic growth theory, which emphasizes productive saving and investment in technology on the producer side as the drivers of economic growth. Consumer spending is largely the effect, not the cause, of prosperity.

Second, GO is significantly more sensitive to the business cycle. During the 2008-09 Great Recession, nominal GDP fell only 2% (due largely to countercyclical increases in government), but GO collapsed by over 7%, and intermediate inputs by 10%. Since 2009, nominal GDP has increased 3-4% a year, but GO has climbed more than 5% a year. GO acts like the end of a waving fan. (See chart at right.) …

In my own research [says Skousen], I find it interesting that GO and GDE are far more volatile than GDP during the business cycle. As noted in the chart above, sales/revenues rise faster than GDP during an expansion, and collapse during a contraction (wholesale trade fell 20% in 2009; retail trade dropped over 7%).

Economists need to explore the meaning of this cyclical behaviour in order to make accurate forecasts and policy recommendations…

In conclusion, GO or GDE should be the starting point for measuring aggregate spending in the economy, as it measures both the “make” economy (intermediate production), and the “use” economy (final output). It complements GDP and can easily be incorporated in standard national income accounting and macroeconomic analysis.

Let’s hope some forward-thinking soul in the NZ Treasury or elsewhere takes up the initiative here.

READ: Beyond GDP: get ready for a new way to measure the economy – Mark Skousen, COBDEN CENTRE

RELATED READING:

- Schiff explains the GDP delusion – NOT PC

- Consumers don't drive the economy, stupid – NOT PC

- Sustaining the moochers – NOT PC

- Your basic 2025 no-brainer: Govt spending is unsustainable – NOT PC

- Recession & Recovery: Six Fundamental Errors of the Current Orthodoxy – Robert Higgs

- What is up with the GDP? – Frank Shostak

- Beyond GDP: A Breakthrough in National Income Accounting [pdf] – Mark Skousen

- Today’s Gross Product is Nett Product [pdf] – George Reisman

No comments:

Post a Comment