"Just when you thought that the Donald had already won the derby for economic crackpottery, he comes up with another even more fakakta entry. This one spilled forth when asked whether the President should have a say in monetary policy:".... It should be done,” Trump said....”I don’t think he should do exactly what we say. But certainly we’re — I’m a smart voice and should be listened to.”"Well, actually, it was only a matter of time until we got a domineering dufus in the Oval Office who has no compunction about loudly displaying his barking economic ignorance. To our knowledge there has never been an economist—-left, right, or centre—–and possessing intellectual faculties—brilliant, feeble or in-between—- who has claimed that the 'lowest rate in the world' has anything to do with anything when it comes to monetary policy.

Asked how low he would like to see interest rates go, Trump made it clear he wants the new Fed chief to be aggressive. Rates should be “1% and maybe lower than that,” Trump said. “We should have the lowest rate in the world.”

"The Donald’s quip here is just sui generis humbug—a word salad, if you will, on a very crucial matter that makes Kamala Harris sound like a deep thinker. After all, who in their right mind would think that having a lower rate then the likes of Zimbabwe, Venezuela (or the Wiemar Republic for that matter) or dozens of other inflaters that dot the world economy even today provides any kind of monetary standard?

..."Interest rates are the price of money and debt and provide the benchmark for the valuation of all financial assets and real estate. They are, accordingly, the most important price in the entire capitalist economy and they should therefore be set by the free market, not the FOMC, the POTUS or any other arm or agency of the state.

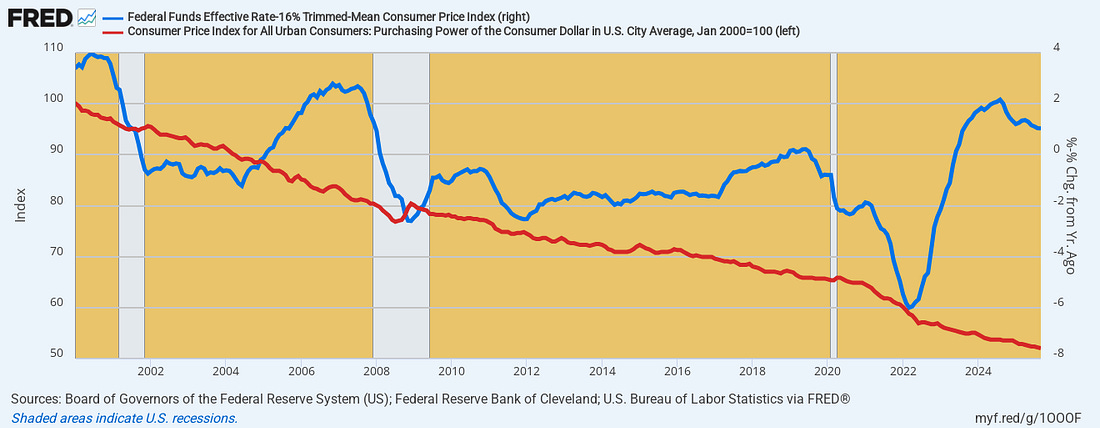

"However, once the government apparatchiks who comprise the FOMC (Federal Open Market Committee) seized the power to set interest rates decades ago it was foreordained that some unhinged know-it-all would end up in the Oval Office claiming a piece of the action. ..."[W]here in the hell does the Donald think inflation comes from—-failure of the Peruvian anchovies schools ... ? The Hunt brothers cornering the silver market ...? OPEC meetings ...? The beef processors cartel ...?(blue line, below) has been below the zero bound 75% of the time ... [meaning that s]hort-term money for gambling and speculation on Wall Street and main street alike has been free after inflation for the entirety of this century to date.

"The fact is, the guy is 79 years old and has been pontificating on how to fuel prosperity and remedy inflation and other economic ills for decades, and most especially since he came down the escalator in June 2015. Yet has it ever once occurred to him that the easy money and ever lower interest rates at the central bank that he has ceaselessly advocated is actually the one and only cause of 'inflation,' and that’s the case with respect to both goods and services and financial asset prices, too?

"As it has happened, since the turn of the century the real Fed funds rate on overnight money

"So is there any mystery as to why the purchasing power of the consumer’s dollar earned or saved in the year 2000 has already lost 50% of it value? ... [Yet] the Donald has endlessly denounced [those responsible] for not running the printing presses even faster and hotter."~ David Stockman from his post 'On The Blithering Economic Crackpottery Of Donald J. Trump'

▼

No comments:

Post a Comment

We welcome thoughtful disagreement.

But we do (ir)regularly moderate comments -- and we *will* delete any with insulting or abusive language. Or if they're just inane. It’s okay to disagree, but pretend you’re having a drink in the living room with the person you’re disagreeing with. This includes me.

PS: Have the honesty and courage to use your real name. That gives added weight to any opinion.